When I used to hear of rich people having extremely large property portfolios numbering up in the tens or hundreds, I really did not understand how this was possible, because I thought this meant that they owned all these properties outright.

As I got more and more educated and understood that they only controlled the assets, my perspective on the rich changed and I was better able to understand how they were able to do this; “the rich control assets, the poor own assets”. This blog post will aim to cover the trust structure, and why it is something you need to think about at the beginning of your property investing journey. Note that I’ll only lay out the information from my limited understanding at this current point in time, as trusts are a difficult topic and I acknowledge there are a truckload more things I may be missing.

What are trusts?

“A trust is a structure where a trustee carries out the business on behalf of the trust’s members (or beneficiaries).” – WA gov.

The main type of trust is the family discretionary trust, which holds onto the family assets, and utilise the family members as beneficiaries.

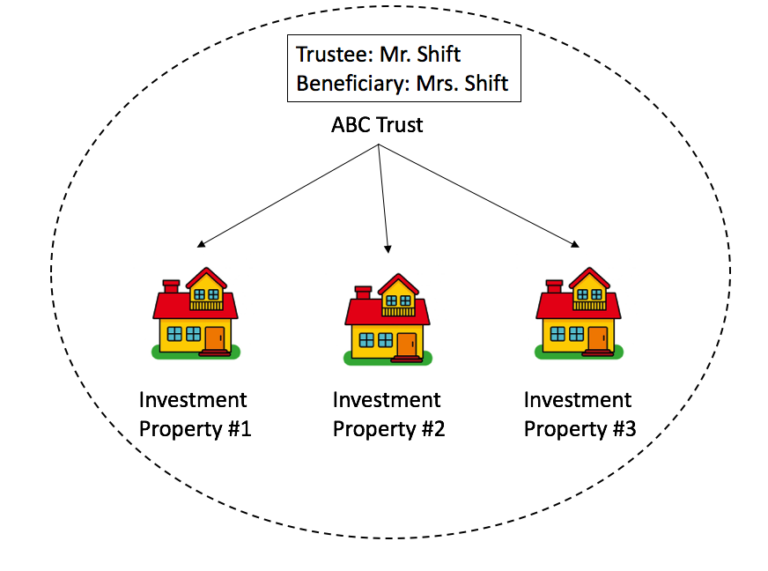

So for example if we were to start our own trust:

· Mr. Shift is appointed as the trustee

· Mrs. Shift is a trust member (aka beneficiary)

Asset protection of trusts

The main reason why people would go for trusts is for asset protection.

“if the beneficiary becomes bankrupt or is sued personally, assets held in the discretionary trust are protected against those claims because they do not form part of the beneficiary’s property or assets.”- smeba.com.au

If either of us get sued, then our one IP in the trust will not be able to be touched.

Aditionally, here’s another illustration which can help demonstrate how the asset protection of trusts can help us:

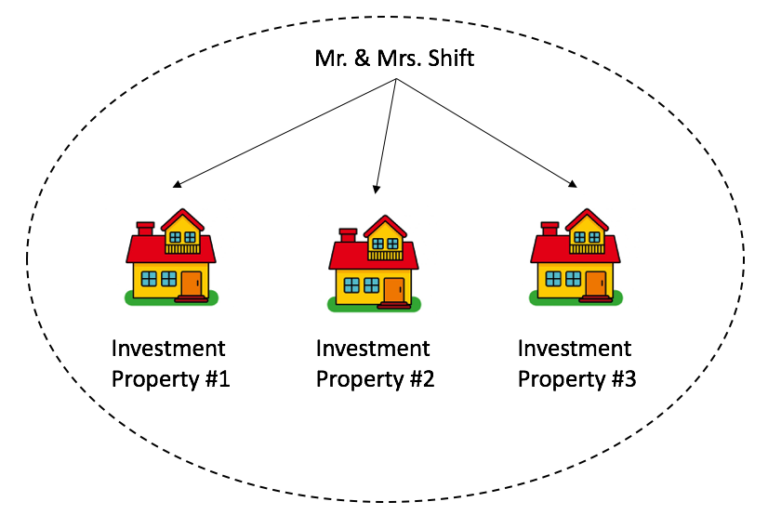

Scenario #1 – Holding Assets in our own name

If we decide to hold the assets in our own name, then:

· In the (unlikely) chance we get sued, then the person suing will be able to come after our assets

· If one investment property, say Investment property #3 comes under financial trouble and we are unable to make our repayments or whatever, then the creditors can come after our other investment properties.

Scenario #2 – Holding Assets in one trust

· In the (unlikely) chance we get sued, then the person suing will NOT be able to come for our assets

· If one investment property, say Investment property #3 comes under financial trouble and we are unable to make our repayments or whatever, then the creditors can come after our other investment properties, since they are all IN THE SAME TRUST. Another way to think about it is looking at it as a bubble, whatever is in the bubble can be seen by the people in it, so a creditor is included in the bubble since they have some relation to the investment property. However, if you hit someone’s car and they sue you, then they can’t touch anything in the bubble since they’re not part of it.

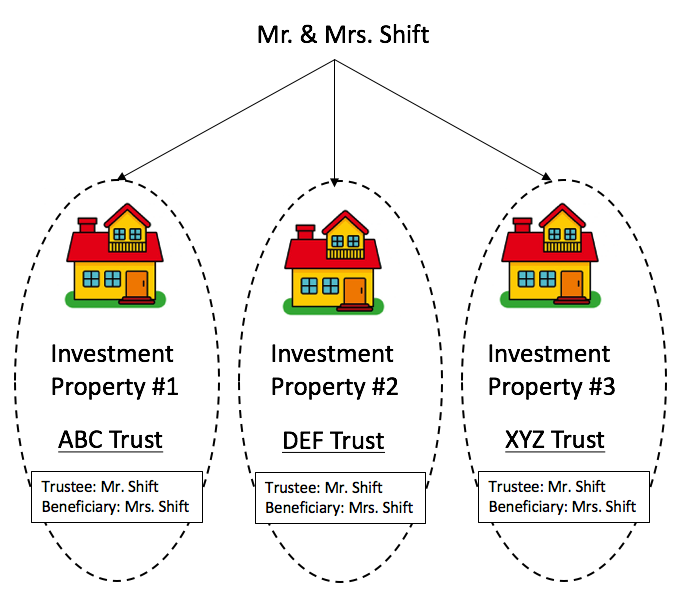

Scenario #3 – Holding Assets in multiple trusts

· In the (unlikely) chance we get sued, then the person suing will NOT be able to come for our assets

· If one investment property, say Investment property #3 comes under financial trouble, the n the creditor will NOT be able to come after IP#2 and IP#1 since they are in separate trusts, or ‘separate bubbles’

Tax advantages of trusts

“The trustee is responsible for managing the trust’s tax affairs, including registering the trust in the tax system, lodging trust tax returns and paying some tax liabilities.” – ATO

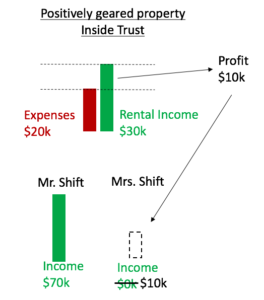

So, in a trust you are able to distribute the net income (whether it be profit or a loss) amongst the benificiaries. A sample scenario where this may be of benefit to us is when we start a family. Mrs. Shift will be taking time off work to spend time with the baby, meaning her income will be $0. If we decide to purchase an investment property around that time, then an ideal scenario would be:

So the profit would be pure profit and will not be taxed since Mrs. Shift would be under the taxable income threshold. This is assuming a situation with a positively geared property.

So what if the property is negatively geared?

“Any negative gearing loss generated by a property owned by a trust is usually trapped in the trust, unless the trust has other income to offset the loss.” – yourinvestmentpropertymag.com

One of the biggest cons of the trust is that you can only offset negative gearing losses against incomes generated in the trust, you can’t offset it against your personal income (which is outside the trust). Negative gearing is one of the most powerful tax benefit tools we have as property investors in Australia, so having a negatively geared property in a trust can mean a big hit on your potential tax deduction savings.

Conclusion

Currently at our stage in life, it looks as though we aren’t in a position where a trust is essential or will be of too much benefit to us. One reason is because we are unlikely to be sued in our professions with our office jobs.

Whether or not you need trusts now, it is important for you to understand them and see where it may fit in your investment strategy. This is because it can be very expensive to set up later down the track when you already have multiple IPs, since you would have to pay the stamp duty again to get your IP in the trust name.

Currently, we are thinking that a trust may not be so beneficial for us right now, but may be something to think about when starting a family becomes closer in our timeline.

Thanks for reading and till next time, peace.