In online forums and groups, I (Mrs Shift) see a lot of people ask which Superfund they should go with, however, a lot of the responses generally don’t address fees on a level-playing field.

So I thought I’d put this post together to help people understand how to better look out for the right superfund if they want minimal fees and good returns. This is not a comprehensive guide, as I’m aware some people like to consider ethical and sustainable investments as well as insurance options – but the focus of this post is based on what Mr Shift and I find important.

Lower fees

Aside from self-managed superfunds, the two main types of superfunds out there are Retail and Industry superfunds. Retail superfunds (e.g. CBA, AMP, ANZ, and other banks / large financial institutions) generally have higher fees than Industry superfunds (e.g. REST, HostPlus, UniSuper AustralianSuper). This is because retail superfund profits go to shareholders + members, whilst Industry superfund profits go to members.

So to look for the lowest fees, look at industry superfunds to start with.

The main fees you need to look at are the admin fee (basically like an account keeping fee), investment fees (people actually do work to get you the returns that you do, and this costs time, and hence, money – see the next point for more info on this), indirect costs (expenses incurred in managing your investments), and buy / sell spread (costs associated with buying new units when super contributions are made, as well as costs associated with selling units when switching investment options / moving super).

Better returns

Superfunds use the funds in your account to invest and create better returns on your money rather than it just sit there pretty and lose value to inflation. The higher risk the investment strategy you select, the potentially better returns you can expect.

So when your account was opened with a Superfund, it probably would’ve went into the Superfund’s default strategy. Most the time these will have a mix of different investment types, and will generally be a quite balanced strategy, with ~medium risk and ~medium returns.

If you’re a young person reading this, you shouldn’t settle for a medium risk / medium return strategy. You should choose a higher risk investment strategy for better returns, and then when you’re closer to retirement, switch to a lower risk investment strategy. However, be aware that higher risk investment strategies also generally results in more fees.

From what I’ve read over the last couple of months, I think the general consensus is that Australian Super has really great returns, however, these better returns do involve selecting an investment option with what I assume would be higher fees (not very high fees, but relatively higher than what we pay in fees… Keep reading and I’ll get to that). Also, past performance is not necessarily an indicator for future returns. So just because Australian Super has had great returns in the past, that doesn’t mean they will continue doing so in the future.

Also note: Sometimes when people say ‘I was with X and now I’m with Y and I have better returns’ but don’t say which investment option they were with – take it with a grain of salt. Because they might be comparing apples with oranges.

LOWEST fees + (potentially) BEST returns

If you’ve read the Barefoot Investor, you’ll have heard this before: Warren Buffet, one of the world’s greatest investors, made a million dollar bet that low-cost index funds would outperform investments that are selected to ‘beat the market’ over a ten year period. Buffet won this bet by passively investing in index funds, outperforming the most savvy active investors and their cherry-picked investments (Google this if you want more details). Also, if you want to read more about ‘beating the market’ vs passive investing, Mr Shift explains it well here in this blog: https://shiftinperspective.net/2020/07/07/beginners-guide-1-getting-started-with-investing/

So what does this have to do with Super? Some superfunds offer low-fee index investment options, such as HostPlus and REST. HostPlus is what the Barefoot Investor has presented as a good option in his book. But not just HostPlus as a superfund in general, but specifically Hostplus’ Indexed Balanced investment option. Since the time of Barefoot writing his book, REST Super has released a similar investment option Balanced – Index with zero fees (Barefoot addresses this in a blog post in his website: https://www.barefootinvestor.com/articles/a-super-fund-option-with-zero-fees). Now you will still pay the admin fee for REST, but all in all, it’s still all very low, especially now that REST has even lowered their admin fee: https://rest.com.au/why-rest/about-rest/news/administration-fee-structure as of November 2020 (note: this is relative to your account balance, but as you approach higher balances you’ll really see minimal fees with REST).

So how are HostPlus and REST able to do such low or zero investment fees? Because there’s little to no work to be done to invest in low cost indexes! Less middle man working to make you money = lower fees. Again, all explained in Mr Shift’s blog post from July last year.

Please do note that this is not for everyone. If you prefer having a fund manager select investments for you in a high growth option, then definitely go for it. Personally, I prefer the idea of passive investing and minimal fees. It’s difficult to time or beat the market, and past performance doesn’t guarantee great returns. There isn’t much you can do to control how your Super may turn out, but one thing you can control is keeping fees down. A 0.75% difference in fees can result in $215,482 difference in Super at retirement! (https://www.canstar.com.au/superannuation/fees-explained/)

So how much do we pay in fees?

Having started my first job in retail at Dick Smith Electronics during high school, I was already a member with REST (Retail Employees Superannuation Trust). But I was invested in their Core Strategy which had mid-range fees and a medium level of risk and return. I’ve since shifted over to their Balanced – Indexed investment option. Meanwhile, Mr Shift was with a retail Superfund (ANZ I think?) and has since moved his super over to HostPlus and is invested in their Indexed Balanced investment option.

Admin Fees | Investment Fees | Other Fees | |

REST | $1.50 per week + 0.12% pa capped at $300 pa (as of November 2020) | Balanced – Indexed: 0% | 0% ICR (indirect cost ratio) + 0.08% buy spread + 0% sell spread |

Hostplus | $1.50 per week ($78 per year) | Indexed Balanced: 0.02% | 0.04% ICR (where the ICR is composed of 0.03% transaction cost + 0.01% operational cost) |

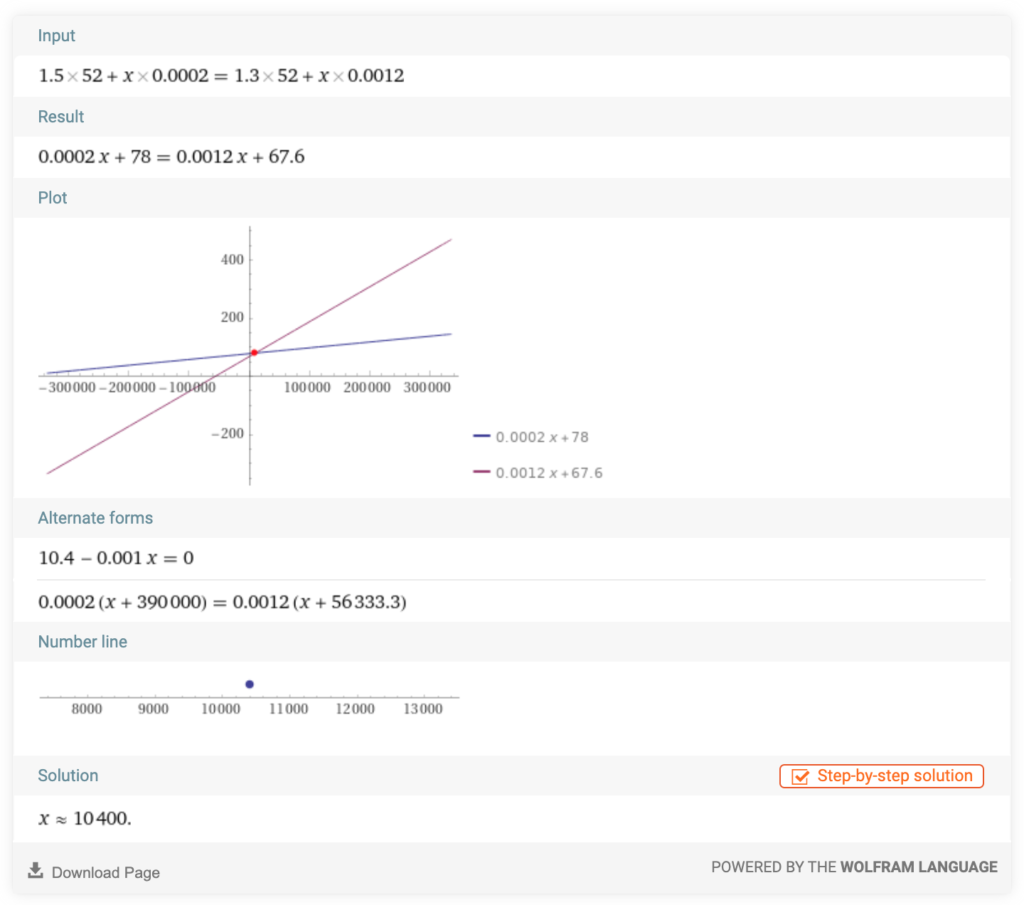

Below is a comparison of the admin + investment fees between REST and Hostplus.

For simplicity’s sake we’re focusing on the admin and investment sees. As such, the calculation excludes:

- ICR / buy and sell spread fees – as these depend on contributions and other other transaction costs. For REST, the buy/sell spreads represent the estimated transaction costs, including brokerage fees and stamp duty, incurred when buying or selling underlying assets in relation to investment options. The spread charged is an additional cost to you when you contribute or withdraw from your account, if you switch between investment options or any other transaction is processed in your account balance (for example deduction of fees or insurance costs).

- Insurance fees – these are slightly different between the two. (And if you’re wondering, yes, we do pay for Income Protection, Death and TPD Insurances within our Super).

REST is the one that has a steeper gradient, and as such, it is cheaper than Hostplus until an account balance of $10,400 to which it continues to exceed after that. However, with REST, the total fees will never exceed the maximum admin fee of $378 per year… and I think that’d be at the stage when you reach a balance of $258,677. In comparison, you won’t even reach fees of $378 pa with Hostplus until you reach an account balance of $1,500,000!

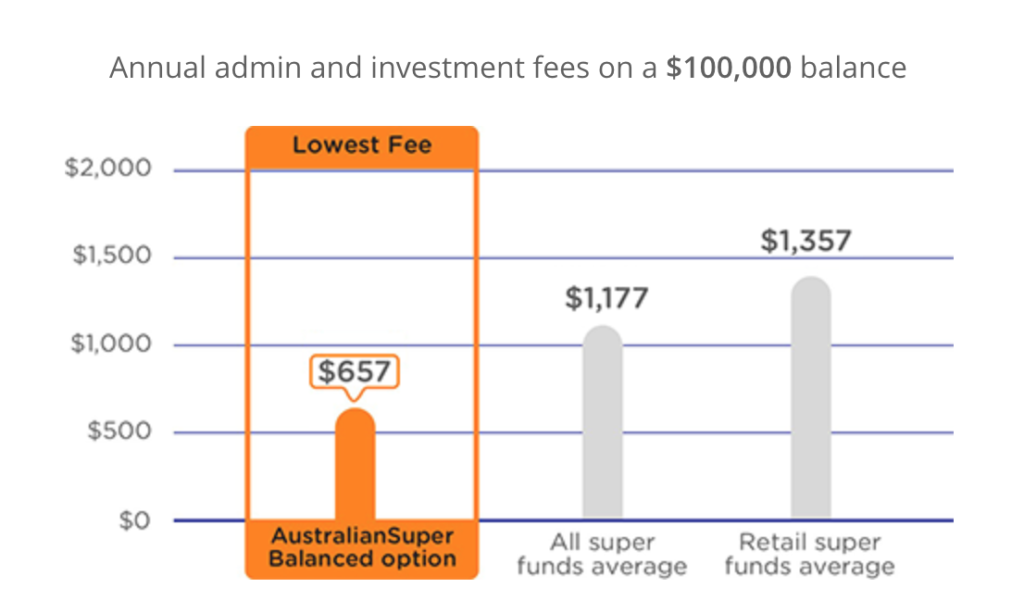

You might be wondering why I pay so much in fees when I probably won’t ever reach a balance of $1.5 million in my Super – I’ll get to that in the next two sections. And mind you, I make it sound like $378 with REST is a lot, but really it’s not. With a balance above $100k, you could easily be paying over $1000 in admin and investment fees with non-indexed investment options. Here’s a comparison chart from Australian Super for a $100k balance for one of their medium risk investment options against super fund averages:

That’s already almost double REST’s cap!

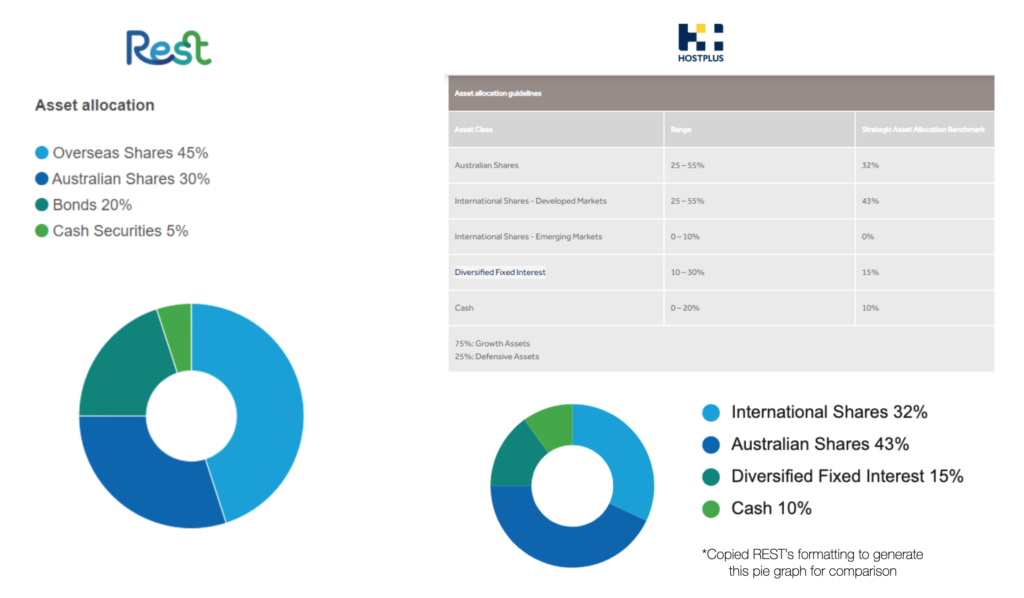

Investment structures within our Super

- REST: Overseas indexed shares 45%, Australian indexed shares 30%, Bonds 20%, Cash 5%

- Hostplus: Australian indexed shares 32%, International indexed shares 43%, Diversified fixed interest 15%, Cash 10%

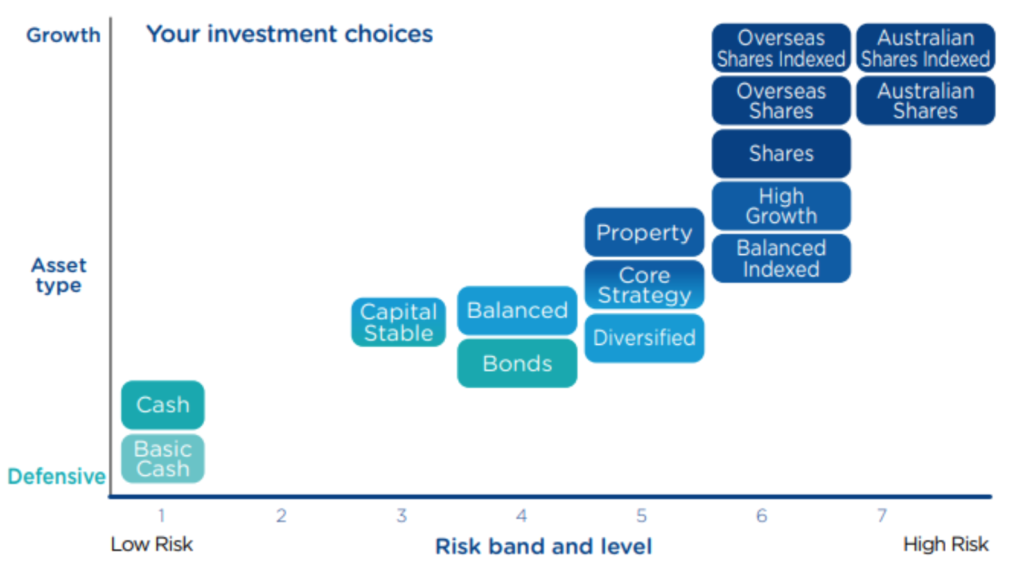

All in all, the investment structures are quite similar, as both have 75% growth assets and 25% defensive assets. However, possibly REST has slightly higher growth within their defensive assets in the form of bonds / diversified fixed interest as opposed to the higher allocation of cash in Hostplus’ structure. Here’s an idea of the risk vs growth level of different investments:

*This graph is from REST’s website. Please note that Hostplus’ diversified fixed interest =/= REST’s Diversified in this chart, which is a mixed investment option offered by REST. Rather, when Hostplus refers to diversified fixed interest, it’s basically bonds.

So as you can see in the chart, it is possible that REST has potentially greater growth potential in comparison to Hostplus due to the lower amount of cash allocation. Also, the higher allocation of overseas shares indexed is the around the same level of high growth as Australian shares indexed, with a slightly lower risk.

Why we aren’t invested in the same Superfund

We find it ‘prudent’ to park our money in two different superfunds for ‘diversity’ because I pay slightly more in fees compared to Mr Shift, but I also may benefit from slightly greater returns. But there is another reason….

More importantly – they’re actually slightly different products. Hostplus uses IFM and a few other investment managers to manage their options and they actually hold the underlying investments.

REST uses Macquarie (who utilises derivatives) to approximate an indexed-like return without owning the underlying investments. Assumingly, this is how they can get their investment fee to 0% – but it introduces risks uniquely related to derivatives.

I’ve come to understand that Macquarie aims to emulate the index, or really, to outperform the index, with the returns going to another subsidiary of Macquarie – this is how the fees are 0%. If they do not outperform, the use of derivatives (a swap) to compensate to the value of the true index (the compensation coming from that other Macquarie subsidiary).

“The Underlying Fund also enters into a swap agreement with Macquarie Financial Holdings Pty Limited (Swap Counterparty). If the Underlying Investments outperform the Index, the Swap Counterparty receives this outperformance. If the Underlying Investments underperform the Index, the Swap Counterparty compensates the Underlying Fund to the extent of the underperformance. These arrangements enable the Underlying Fund to provide True Indexing regardless of the performance of the Underlying Investments.” – http://static.macquarie.com/dafiles/Internet/mgl/au/mfg/docs/platform-pds/macquarie-true-index-linked-australian-shares-fund-pds-pf.pdf?v=5

Basically, they’re betting on themselves to make money, otherwise they’ll compensate the difference if not. So either way REST (Macquarie) are giving you the returns of the indexed shares.

So all up, whilst I find that REST’s growth could be slightly higher than Hostplus when comparing their asset allocation + their fees are quite competitive, however, as explained above there could be more risks associated due to the nature of the investments with REST. So hence we utilise two different superfunds to diversify and also reduce said ‘risks’

Final note

I don’t know everything there is to know about Super, so I may have missed something, or maybe I missed many things. But I still hope this post helps. As mentioned from the start, this post explains what we personally find important for us, so do think about what’s important to you. Possibly seek financial advice that may be better tailored to your situation. Income Protection, Death and TPD Insurances are another important consideration when choosing your Superfund, and personally we do pay for these in our individual superfunds. The fees are slightly different and will have an effect on the fees we shared above, but we’ve excluded them in our calculations to simplify things.