We use these monthly updates as a tool to keep us accountable on our journey.

Welcome to the first ever monthly journey update! In this post we’ll be covering Mrs.Shift’s exciting first property purchase! We will be talking about details of the purchase, the mortgage and the way we’ve decided to structure the loan to set us up for our next step in our property investing journey. For Mr Shift’s update, we will be covering his current financial situation to help gauge an idea of possible next steps/timeline for also purchasing his first IP. So without further ado, let’s get to it.

Mrs. Shift

After 12 months of cracking down on goals, I’ve been able to purchase my first very own PPOR/IP! The reason we classify it as both is because:

– This property is in Sydney, our home city. Whilst I’ll be living in it alone for now, it’ll be such a great place for us to live when we get married.

– Depending on our future circumstances, we do hope to convert it into an investment property.

Being the first property part of our portfolio, starting as a PPOR and also being a future IP, there were soooo many boxes I was trying to tick in one go, especially because we also wanted it to be in our hometown Sydney. Any property after this first one, it won’t matter where it is anymore as we will always have a place to call our own in our hometown.

Given the current state of Sydney property pricing, I couldn’t reasonably expect to afford a house given my current circumstances. And so for this property, my intention was to look for a two bedroom apartment. Whilst apartments don’t experience as much capital growth as houses, I tried to factor in a lot of location and feature requirements to hopefully ensure decent capital growth (for an apartment, at least) and good rental yield.

Noting the shift due to pandemic, restriction on inbound tourism and entry of inernational students has caused a lower demand in units, making now a good time to buy. Unit pricing is not surging right now (unlike Sydney houses) and as such they are stable (shoebox high rises aside) and can only now go up given a long investment window.

In terms of apartment age, I didn’t want to purchase anything too new as

a) there are several examples of developers cutting corners and doing shoddy builds (such as Opal Towers in Sydney Olympic Park and Mascot Towers near Sydney airport)

b) there are also many examples of apartments being overpriced during the off the plan stages, and then oversaturating the market causing them to experience capital losses (such as in Strathfield and Parramatta CBD )

But I also didn’t want it to be so old that I would dislike the look of it every time I look at it haha. But brick was definitely a must.

About the property:

I was able to purchase a 122sqm (98sqm internal) 2-2-1 full brick apartment built in 2005. For the apartment I got, I do like the relatively modern full brick exterior aesthetics. There are certain things on the interior I’ll likely work on in future (e.g. changing the carpet to floorboards).

Aside from the aesthetics, here are other actual important factors about the apartment that we were aiming for…

Location:

I wanted a location that suited my lifestyle, but would have really great future potential as an investment property. The property itself is in Northmead, a suburb situated in the Parramatta LGA bordered by the suburbs of Westmead, North Parramatta, North Rocks, Baulkham Hills, Winston Hills, and Constitution Hill. It is situated in the pocket of Northmead closest to Westmead which has many benefits.

– Close proximity to Westmead Hospital and Parramatta CBD, meaning we should have a healthy outlook on tenancy in future. On the point about the hospital especially, this is a stable industry ensuring consistent job prospects in the area.

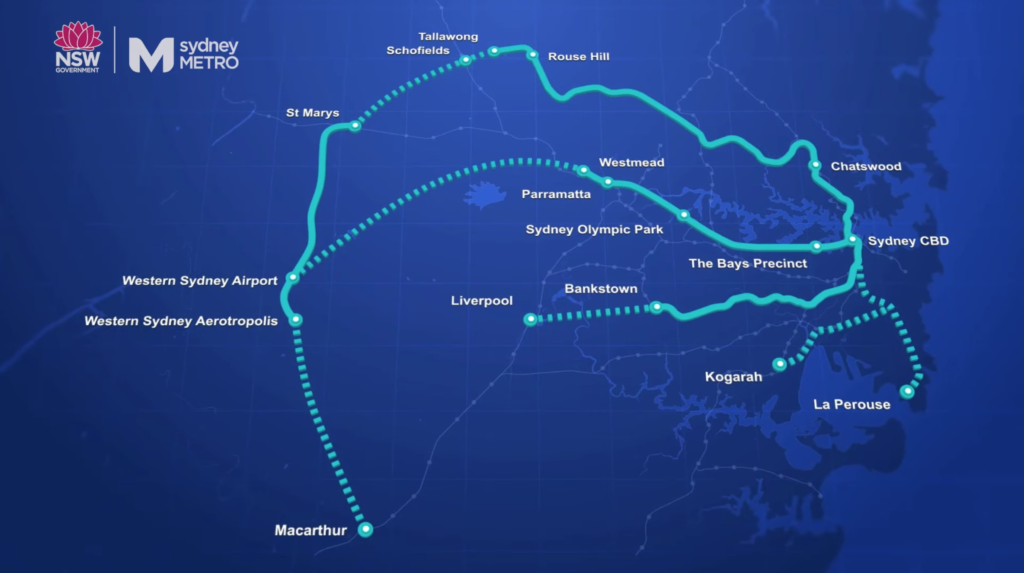

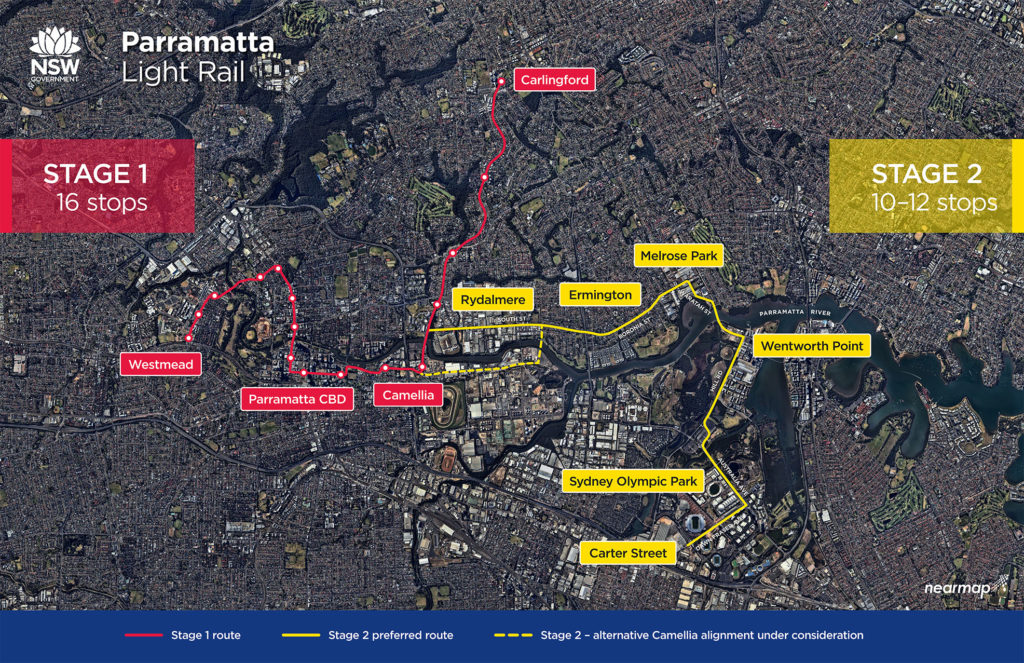

– With regards to public transport, the property is relatively close to Westmead Station. It is also relatively close to the upcoming Westmead Metro Station (part of the new upcoming Western Metro line), connecting towards the city on the south side of the Parramatta river and offering a higher speed option into the Sydney CBD (compared to the current Western train line). There are also proposals to extend the Western Metro towards the new airport train line in the west. Finally, it is also walking distance to the new tramline travelling from Westmead to Carlingford via Parramatta.

– Quiet street. This wasn’t initially on the list of requirements, but it was a ‘nice to have.’ Feeling really lucky to have scored an apartment on a quiet street as opposed to a main road, for which most apartment buildings are. That being said, it’s not far off from the main road either – so it’s in a great position balancing access to main roads and quietness.

– Good schools in the area. Not applicable to Mr Shift and myself in terms of our lifestyle (yet), but it is applicable to the desirability of Northmead as a suburb in encouraging capital growth. The unit is within 10 minutes drive of selective schools James Ruse Agricultural High School, Baulkham Hills High, and Girraween High School, as well as highly coveted private independent school The Kings School in North Parramatta. In terms of Catholic schools, it is also in closer proximity to high ranking Parramatta Marist High School (Catholic school HSC rank 6 in 2020, highest ranking amongst Western Sydney Catholic schools) and Our Lady of Mercy College, Parramatta (Catholic school HSC rank 17 in 2020). Source: https://bettereducation.com.au/results/HscCatholicSchoolResults.aspx

– Decent walkability score of 56/100 (source: https://www.walkscore.com). Aside from good vicinity to public transport as highlighted previously, it is close to local restaurants (Pancakes on the Rocks!), coffee shops, fast food, and some small supermarkets. Bonus: it’s also very close to a Bunnings and an Officeworks.

– In terms of lifestyle, Northmead itself is close to all of my circles and commitments – family, friends, frisbee, and food 🙂

You might be wondering why I didn’t just buy in Westmead if most of the location benefits I’ve listed so far are about or also apply to Westmead. Even Westmead scores a 71 average walkability score across the suburb in comparison to my unit’s score of 56. But looking at the financial numbers:

- Currently, Westmead’s unit 12 month capital growth is -4.68%, unit average capital growth is 4.04%, and unit gross rental yield sits at 3.88%. In comparison, Northmead units have a higher unit 12 month capital growth being 3.76%, unit average capital growth of 4.82%, although slightly lower unit gross rental yield of 3.51%

- DSR data shows that Westmead units score 51/100 in terms of supply and demand, and Northmead scores 58/100.

- Westmead units average 64.4 days on the market, whilst Northmead units average 38.2 days on the market.

- Sources:

We are banking on various factors, namely public transport projects and Parramatta CBD development for an increase in both capital growth and rental yield. Being just north of high-government funding areas of Parramatta / Westmead, but also south of the highly desirable Hills District, I believe a rippling effect should encourage increased capital growth in Northmead.

Features

– Street frontage. Whilst most apartments feature a common lobby and stair/lift well with all the apartments entryways down the corridors, my complex is situated on fairly sizeable block with most of the ground floor apartments (like mine) having a small patio out the front with street frontage. This is great in terms of lifestyle, practicality, and privacy.

– Lack of elevator. You might be wondering why I’m mentioning elevators when I just explained that I’m situated on the ground floor and my front door facing the street haha. Reason I mention it, or rather, mention the lack-thereof, is because less Strata fees. Elevators are a money sink, especially when special Strata levies are required for maintenance or replacement of elevators. When I was looking for apartments, I was looking to avoid any complex with an elevator and a pool to avoid unnecessary expensive Strata costs. My Strata fees are just over $800 pq. Small enough to not break the bank, and large enough to have a healthy sinking fund (as I’ve seen within the Strata report).

– Low rise apartment. None of Northmead’s blocks of land are currently zoned for high rises, but surrounding suburbs Westmead and Parramatta do have newly built high rises. This means that those suburbs have huge amounts of supply, and buyers of those new units have also experienced significant capital losses.

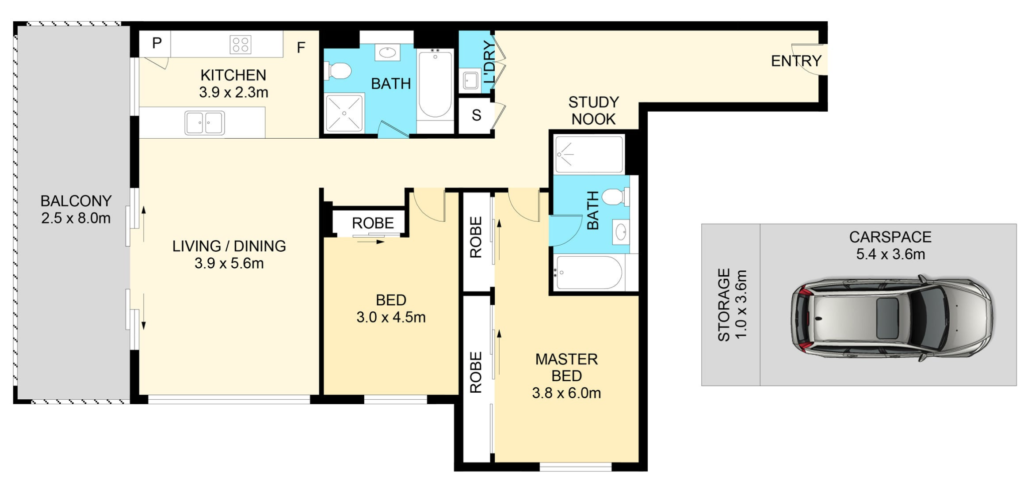

– Door to an open floor plan. Many shoebox apartments suffer from poor floor plans due to limited space. Whilst I won’t share my actual floor plan, on the left is an example of a good floor plan similar to mine where you walk into an open space. And on the right is a floor plan with so much wasted space (the long hallway / corridor) which is wasted money on sqm of unusable living space.

Ideal floor plan

Poor floor plan

– Full lock garage. Uncommon in newer apartments, my apartment features a 24sqm full lock garage as opposed to just a car space and a cage. This is great for storage and security.

– An actual laundry room. Laundry rooms are also uncommon in most newer apartments, which tend to favour laundry ‘closets’ to save space and basically become part of modern apartment shoebox living. I mean, this isn’t a huge deal, but as we want to scale this as a property that will be effective for a potential longterm living situation, a laundry room provides additional indoor storage.

– Two bathrooms. Most but not all apartments in this area have two bathrooms, and I’m glad that the one I purchased does have two. Again, as an effective longterm living situation, appealing to renters, and enabling greater sellability in future, it is beneficial to have more than one bathroom.

When Mr Shift and I get married, we can be confident that this apartment will meet most needs of a young family if we are still here. All these factors of location and features are not only great for lifestyle as a PPOR, but will likely result in great rental yield and capital growth in future as an IP.

Setbacks prior to purchase

I’ll admit – I wasn’t able to get the greatest deal for my mortgage. The main thing to note is that I didn’t have a lot of choice, as I was only 1.5 – 2 months into my new job at the time of going for full approval. More on that later, but here’s the full background:

I began engaging with a mortgage broker in Dec 2020 / Jan 2021. At the time, I had a novated lease with my now former employer. My repayments were approximately $600 pre-tax and $455 post-tax, deducted directly from my salary each month. In terms of pay, back then I was on sub $75k base salary.

Due to the nature of how novated leases work (the fact that they are not only a repayment of the loan of the car, but they are also package in your normal car expenses – rego, insurance, fuel, maintenance, tyres, and the services provided by the leasing company to do all of this. But most banks / lenders can’t take this into account properly, and so it looks like one big giant LOAN repayment, as opposed to a loan + expenses. This hit my borrowing capacity hard.

Thankfully, my mortgage broker partnered me with another mortgage broker part of another company. Mortgage brokers have different lenders they are partnered with, and so I’m quite grateful to my original mortgage broker to have provided me assistance in my best interest. My new mortgage broker had access to a lender, Virgin Money, that was able to take into account my novated lease for what it was: both a loan, and expenses. This helped increase my borrowing capacity. Paired with my deposit at the time, I was limited to 480 – 500k as my budget for purchasing a property.

Late January 2021, I came across an interesting government job ad on LinkedIn. I wasn’t really looking, but after reading the job description I thought, ‘why not?’ The following month I was invited to an interview, and lo and behold, it took the government until end of April to offer me the role (so much bureaucracy and red tape, am I right?) I am now on a $99k base salary ($97k before the start of the new financial year). I had already received pre-approval from Virgin Money earlier that same month, but I was worried at the time that they won’t lend to me now that I’ve got a new job coming up and will be on probation for the next 6 months.

Thankfully, the lender confirmed that they will still be able to lend to me once I had my first payslip, in which I wasn’t expecting until mid-June.

Details of the purchase

Come end of June, the apartment I described above came on the market. I placed an offer of the asking price of $530k about two weeks after it was listed. In terms of why I offered the asking price, it was because it already had an offer by another buyer for about $525k. Also, a similar unit to mine in the same complex sold earlier this year for $15k more than my unit’s asking price! Given that, and everything I listed above about this property, I do believe it to be well worth the asking price of $530k.

The lender I had pre-approval with, Virgin Money, does not have the most competitive rates / fees on the market unfortunately. Obviously, I had originally gone with them due to having a novated lease before (which I ended up paying off when I got the new job anyway). So now I had the option to either try going with a new lender, or stick to Virgin Money. To minimise the risk of rejection due to still being on probation and to also be able to act swiftly, my mortgage broker agreed that it’s best I stick with the current lender given my circumstances and just refinance in 2 years time.

Structure of the loan

I have decided to go with just a bit over a 10% deposit of $63k, and cop LMI of approximately $8.2k capitalised on the loan. The loan itself is a split loan of $408.2k 2 years fixed at 2.53% and $68k variable 3.14% with offset account.

The reason I’ve structured my loan this way is to keep my funds as liquid as possible for the next property, and to be able to still pay down my loan a bit faster. Given that my timeframe for my next property is in the next 1-2 years, I’ve set my variable loan to an amount I can reasonably save towards in that timeframe given my current circumstances.

I’ll have approximately $20k remaining cash to put into my offset account for now. Moving forward, I plan to direct my salary into the offset account and apply for a new credit card (I cancelled my previous ones leading up to pre-approval originally). I’ll use this credit card for all expenses, and pay it back just before the interest-free period ends (55 days). This way I can maximise the offset account savings on interest as much as possible and pay down my loan faster until such time I’m ready for the next property.

First Home Buyer schemes I took advantage of:

- First Home Buyer Assistance Scheme – stamp duty waiver

- Saved approximately $19k upfront

- First Home Super Saver Scheme – the ability to save a deposit faster with the concessional tax treatment of superannuation.

- During the period where I was saving for a deposit, I made additional contributions totalling $16,750 of pre-tax money to my Super. Within Super, this would be taxed at 15% leaving me with $14,237.50

- My determination was $14,508.50, comprising of $14,237.50 of eligible concessional contributions, $0.00 of eligible non-concessional contributions, and $271.00 of associated earnings, which was worked out based on the above eligible concessional and non-concessional contributions.

- For my request release, my withholding tax rate is 4.5% so I believe I will be receiving $13,855.62 in my bank account. In comparison, had I not contributed to Super, my $16,750 of pre-tax money would’ve resulted in $10,971.25 after taxes (34.5%). Therefore I was able to save / make an additional $2,884.37 through utilising FHSSS

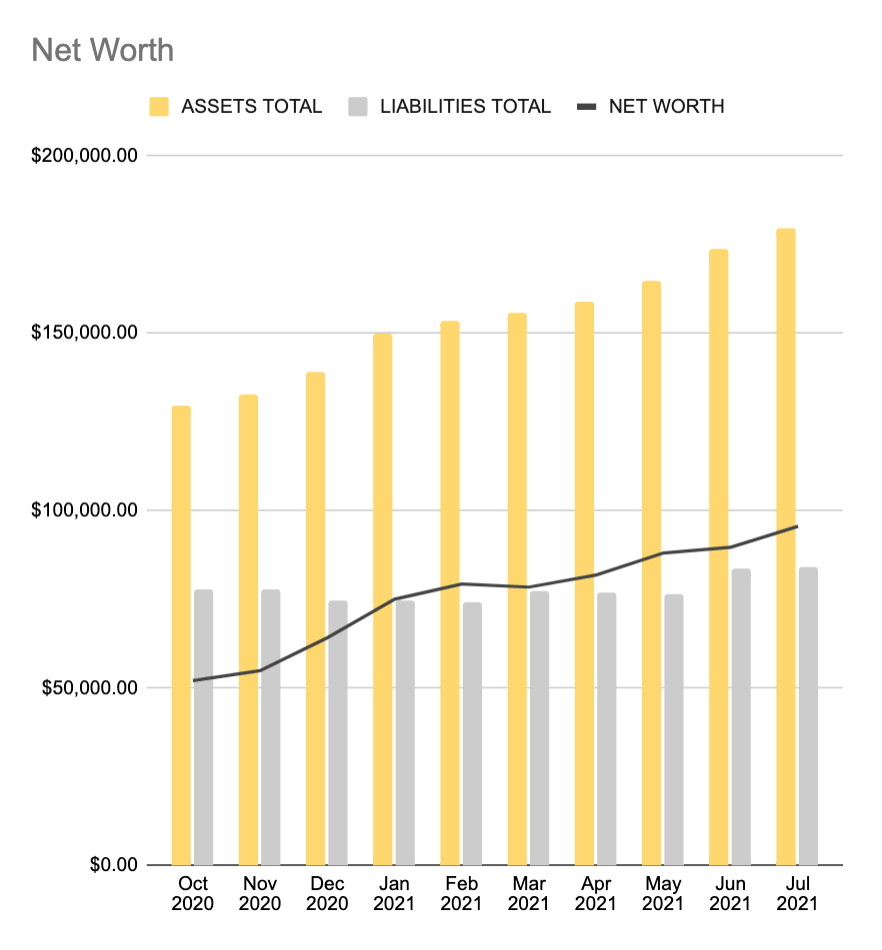

Networth Update

Potentially in future posts I may post a breakdown of the assets and liabilities, but the greatest debt in this current graph is my HECS-HELP (undergrad) and FEE-HELP (post-grad).

I have yet to include my new property’s worth + mortgage debt until next month when settlement date is.

Mr. Shift

Introduction

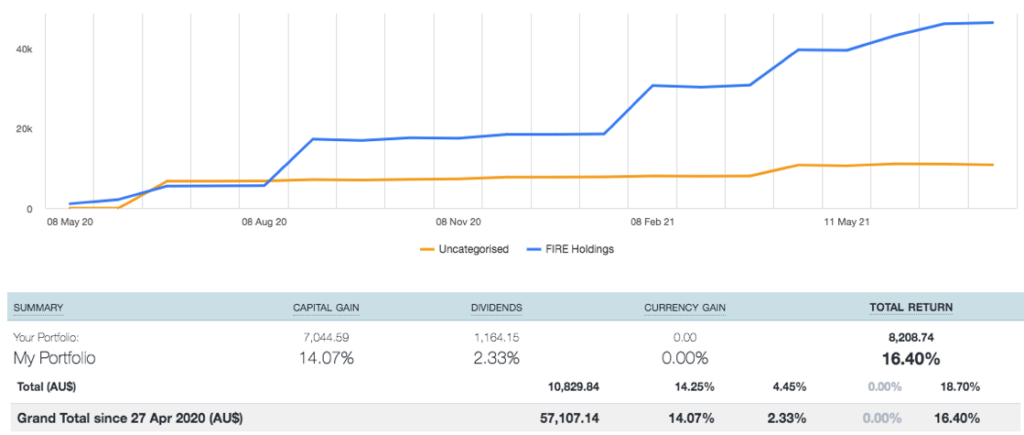

For the past year and a half, I’ve been investing in ETFS. Luckily for me, I began investing during the beginning of the market downturn and was able to score some decent overall returns.

So initially, I had no intention of getting into the property market. However, since Mrs. Shift decided to get into the property market, I decided to study the property investing game as much as I could so I would hopefully be able to provide some valuable inputs for Mrs. Shift in her investing journey. However, I accidentally got bitten by the property bug in the process of studying it, and now I’d like to join in on the action too! I’d like to preface this by saying that the reasons behind my decision to try out property investing is not based on FOMO or anything of that nature, since going down this path would most likely lead to the selling of a significant amount of my ETFs which I really don’t want to do. I’ve detailed my main reasons for entering property investing in my blog post .

How much can I spend?

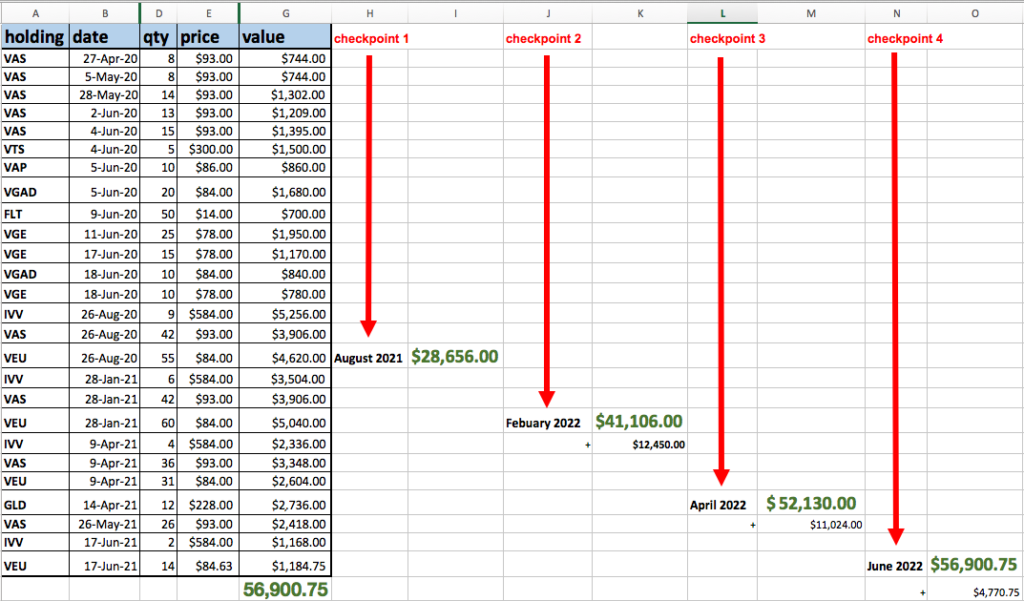

Anyway to get back to my update, what i need to do is to firstly figure out my fire power (e.g. how much money i’d be able to put down on a deposit/other costs associated with buying a place). This includes the option of selling my ETFs.

A problem I’ve had though is:

If you’ve held the investment for more than 12 months, you’re only taxed on half of the capital gain. This is known as the capital gains tax (CGT) discount.

I’d prefer to capitalise on this tax benefit as much as possible and not sell anything

The checkpoint date (and corresponding $dollar amount) indicates the value of the stock which is > 1 year old. I.e., in August I’d be able to pull out 28k, in Feb I can pull out 41k, etc…

Note that I’ve decided to play it conservative with these estimations and have not factored in a theoretical 7%p.a gain for the future values.

Here’s another estimate I made of how much money I’d have in total, assuming a savings rate of $2800/month:

Hmm… so it does appear like February would be the <first> optimal checkpoint for me to buy a place.

Property price and other costs

The type of place I’d prefer to buy would be around the 350k mark(for now). I’ve not done any research of potential areas where I want to buy yet. But the main reason I’d like it to be around this number is for two reasons:

1) Higher rental yields

2) I’d prefer it to be a cheaper property so my serviceability for the next won’t be too heavily compromised.

I’d like to make a note that this is just my frame of thought now and my path forward may change when I get more educated and gain new perspectives.

Anyway, for a 350k property, these are the hypothetical numbers in closing out the deal:

Coincidentally, $63500 is around the same amount I’ve forecasted for me to have in February next year! Let’s see if the stars align… hahaha.

Moving Forward

My future steps now are:

· Start looking at possible properties I’d like to purchase

· Get an estimate of my borrowing capacity

o See if I can get 95% LVR if PPOR initially, how feasible will this move be as a stepping stone (i.e. any negative implications for future investments?)

· Come up with a possible plan depending on different scenarios. This will come after I’ve figured out some potential places I’d like to invest in. For e.g.

o If I go plan A investment loan, then my financing will look like…

o If i go plan B PPOR, then my financing will look like… and so on

· Once I have an area and budget in mind, and my future forecast of how everything is going to work, then I’ll need towork out, to the best of my ability, what I think would be the MOST OPTIMAL way of structuring my loan. My plan is to give this high level overview to the mortgage broker and see if their low level details on loan structuring matches my original ‘most optimal’ plan that I can think of.

o I’ll also prefer if I became really educated before I even begin speaking to mortgage brokers so I’d be able to ask the right questions and will hopefully be able to collaborate and share thoughts with them. This will also accelerate my learning.

· As part of my education, finish off the book: Australian property finance made simple by Konrad Bobilak.

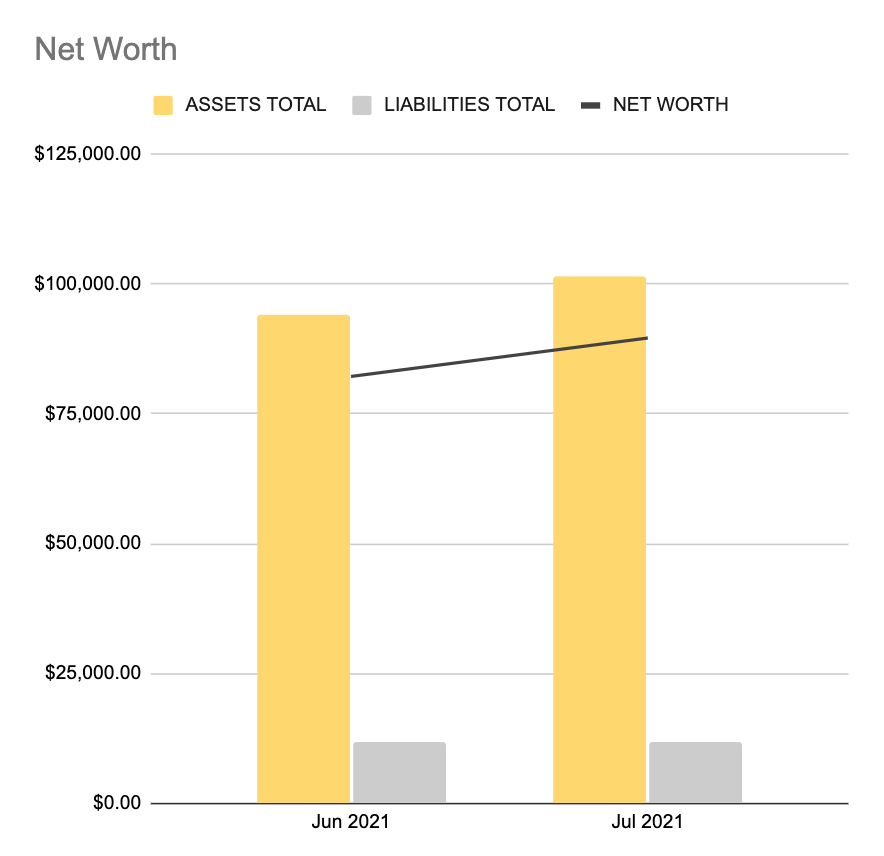

Mrs Shift got me into tracking my assets and liabilities just this month, so my graph is looking a little bare next to hers. My liabilities are purely what’s left of my HECS-HELP debt for my undergraduate degree.