US taxes

When investing, we will most likely include investing in the US stock market. This means we will need to pay tax to the US government for our American investments.

There’s a problem here, however… Here’s an example; say we’re invested in Apple. Now Apple pays their fair share in taxes when they make their profits, then their net profits are then distributed as dividends. Well, since Apple has already paid the tax on profit, it’s only fair that we receive the full amount of our dividends, right?

Well, the US government would still love to tax you again! This is called double taxation.

Luckily, however, the W8-ben form is here to save the day! It’s a form you pay which stops double taxation so you don’t pay the full tax amount twice in both countries.

What is the W8ben form?

The W8-ben form is a legal document by the IRS (which is the US government tax agency) which allows foreign investors like you and me to claim benefits on the tax treaty between America and Australia. (Australia/US Double Tax Agreement (DTA))

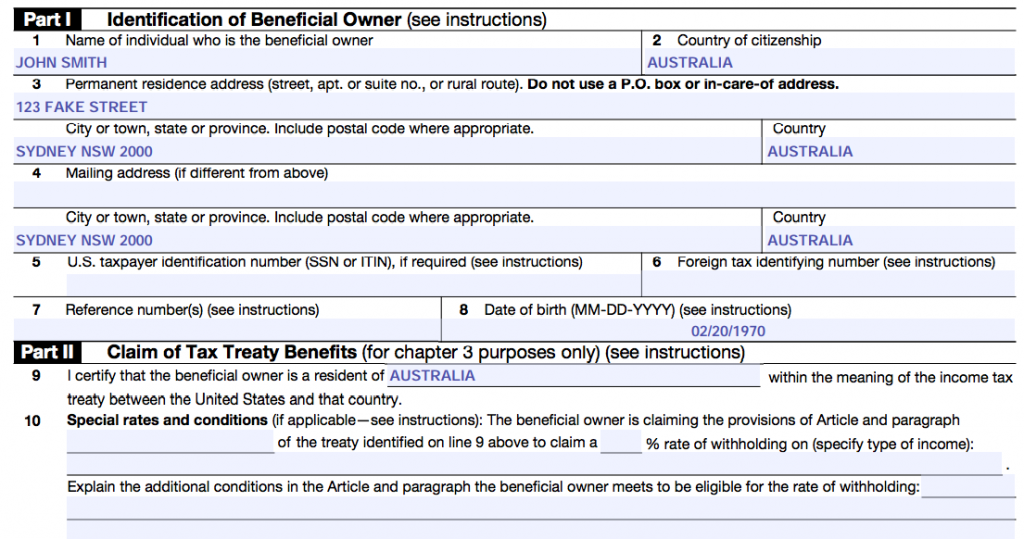

For every investment you have with US origins, you’ll have to fill out the W8-ben form so you get to enjoy the benefits of the tax treaty, which can be seen below (taken from Commsec).

· So for dividends, you will only get a 15% tax instead of 30%.

· For sales proceeds, you will not get taxed at all.

Filling out the W8ben form

Note:

· Section 6 – You are not legally obliged to provide your Tax File Number (TFN). You can leave this as blank.

· Section 9 – Must fill in ‘Australia’ in this section to claim the tax treaty benefits. This is crucial. This is something I missed the first time completing this form, since the CommSec guide seemed to miss this important part of the form, and I realised I was not getting the tax treaty benefits since I left this blank.

Where do I submit my W8ben form?

You submit your W8ben form to the brokerage firm where you bought your shares/ETFs from. So for example, I purchased Vanguard’s ETF “VTS” which is an ETF which tracks the Total US Market. Since it is a US domiciled share, it requires a W8ben form to receive the tax treaty benefits.

Share Registries

An organisation called a share registry works on behalf of the company which you bought the share from to:

· Record any changes in share ownership

· Issue shareholding statements

· Manage dividend payments – you can set up a dividend reinvestment plan through your share registry

There are a different number of share registries out there, such as Computershare and Linkmarket. Different companies will go with different share registries – but its all basically the same thing. You need to create an account with the share registry your investment company chooses – for example, I will need to create a Computershare account, as this is the share registry chosen by Vanguard.

This may mean you may need to create an account with multiple share registries if your investments use different ones. For example, I know my Vanguard uses Computershare, but another investment like Apple may use Linkmarket.

Share registries are also where you are able to update your securityholder information.

Check to see if your W8ben form is actually active

Once you have submitted your form and allowed adequate time to pass, you can easily check to see if your W8ben form is active that you are not incurring the large 30% tax on your earnings. You can check this in your share registry by looking at your latest statement for your US domiciled ETF or share. This can be done by simply making sure that your (Witholding Tax / Gross Amount Dividends) = 15%, and not 30%.