Mr.Shift

There are a lot of things to cover in the lead up to this purchase. On the surface it seems that purchasing a property just involves getting finance approval and picking the property you like to purchase. However, for a property investor with a long-term vision looking to build wealth through a portfolio, there are a lot of factors involved which need to be taken into close consideration.

If you’re going to build a skyscraper building, the most important thing you need to do is to build the foundations. In property investing, the first move you make plays an enormous role in setting the foundations of your future property portfolio (e.g. factors include loan type, which financial institution, purchase price/budget, deposit amount, which area to buy in, members of your team, etc.)

This relates to what I have mentioned in previous blog posts of having the long term vision and plan and ensuring that your short-term goals are in alignment to achieving the long-term vision.

Just like the engineering of a car involves all the intricate parts calculated to precision for it to operate smoothly as intended, then so too is the system you build for yourself.

Now that I have purchased my property, I just have to trust the process and stay committed to my vision by following the system.

Overview of my goal

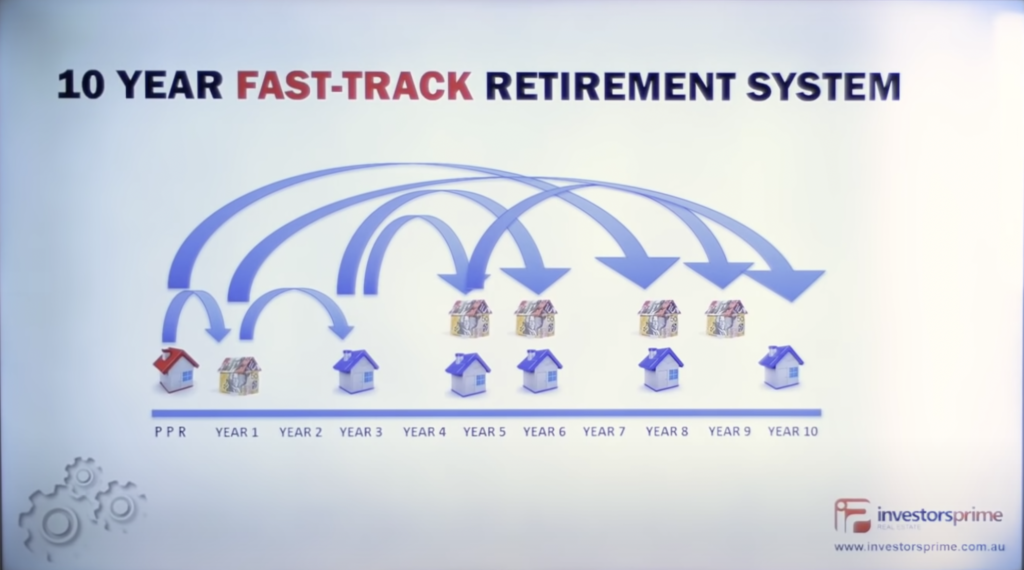

Overall, the goal I have set is to purchase 10 properties in 10 years. Then after the 10 years, I depending on the situation, I can decide how to move forward from there; one option would be to sell 6 properties and fully pay off 4 and enjoy the passive income from the remaining properties.

I can’t say for sure exactly what will happen in 10 years time and what my decision-making process will be then, but what is important that I have a vision and goal to strive for and orient my short term goals and actions towards.

Below is a diagram showing a sample blueprint of how this can be achieved.

This was taken from Konrad Bobilak’s youtube video:

https://www.youtube.com/watch?v=vex-oFcq-EQ

Also as a side note: Konrad Bobilak is the author of “Australian Property Finance Made Simple” which is by far the best resource on Australian real estate I have come across.

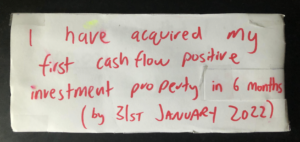

6 months ago I made a commitment to my goal and stuck it up next to my bed where I would see it everyday. 6 months later, settlement for my first cash flow positive IP is set for late January and just in time for my goal 🙂

Deal Details

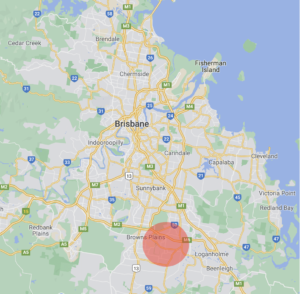

South Brisbane

Purchase Price: $470,000

Specs: 4 bedroom / 2 bathroom / 2 garage spaces

Land: 500m^2

Settlement: Late January

Overall, I am quite happy with this deal. It was a below market value purchase and the house was in a decent location in relation to its proximity to shops, schools, amenities, etc. It also fit my budget and criteria of having min. 2 bathrooms and a 500m^2 lot.

Also, I spoke with my property manager and he said that he knows that a house on the same street was receiving offers of $580k+! Although the house down the road was presented a lot nicer, it is comparable in its specifications of land size and property type (4/2/2) and property age. I’ve also seen other comparables already selling at the $530k+ mark.

One caveat about my property however is that it is in need of TLC, and it is the reason why I was able to purchase at such a low price (in relation to recent market comparables). Luckily the TLC are just small things, like carpet and walls needing cleaning (or worst case, replacing/painting). However at the end of the day, this was great purchase and I believe I am going to already have a decent amount of equity in the property when the deal is done which will contribute for my next purchase.

Loan Details

Loan Details:

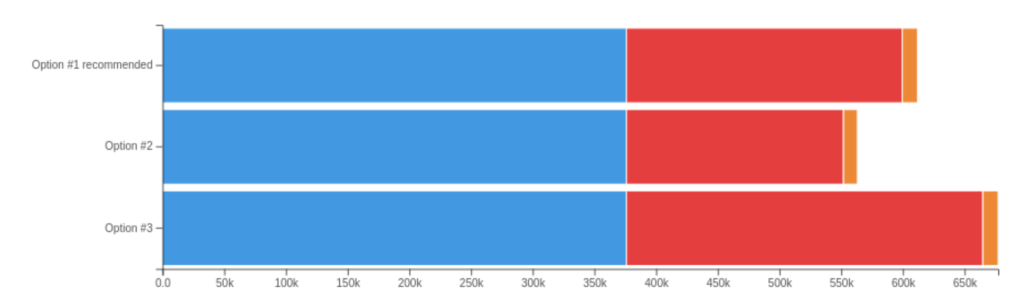

CBA – I went with CBA for this purchase.

o Option #1 – CBA

o Option #2 – AMP

o Option #3 – NAB

At first glance, Option #2 which is AMP seems to be the best option, as its competitive interest rate will have a significant impact over the life of the loan. We see an overall saving of over $50,000 if I went with this option! So why did I decide to go with CBA?…

Recall that from my PropertyPost#4 on Mortgage Brokers that:

“The primary purpose of a mortgage broker is to match the borrower’s unique requirements to a specific lender and loan product”

Konrad Bobilak, Australia Property Finance

The key words here are the borrower’s unique requirements. I have a long term goal and vision in my mind of building my property portfolio and intend for a quick equity release once its built up in this first purchase so I can move onto the next. After speaking with my mortgage broker, they concluded that although Option #2 is the cheapeset, it may be more difficult for me to pull out equity for the next property. Therefore, for my circumstance, CBA is the best option here.

– 2.84% p.a. Interest (I paid $395 up front for a rate lock; meaning if the rate increases any time between now and settlement then I would still keep this interest rate. Update: as of now, the rate has increased by 0.1% and if my math checks our correctly, this decision has saved me ~$400 over 2 years!)

– Interest Only Loan – Personal decision based on wanting to cashflow positive. Also, interest paid on a loan is tax deductible so would like to use my additional cash to either service non-tax deductible loans or to invest.

– 100% Fixed, No Offset Account – I had initially considered this, however I’ve decided to put my money in the stock market instead. (Reasoning is related to the point of wanting to maximise tax-deductible loan, as well as my speculation of getting better returns in the market through this way). Another reason i went with 100% fixed is because i am speculating that the interest rates will be rising now and fixing this low rate now would be beneficial.

Note: I’d like to mention that my approach is suited to me. It depends on your risk tolerance as well – so for e.g., I’m looking to buy another property soon so it may be a bit of a riskier move from my part if I were to park my money in something like the stock market where volatility is not uncommon (so there might be a dip in the market by the time I decide to buy which is worst case scenario). Or maybe P&I repayments may suit you (which holds its own set of benefits), as some of the people I look up to who have several properties go with this approach.

So ultimately what I decide is right for me based on my risk tolerance might not be right for you.

Buyer’s Agent

For more details on Buyers Agents, please refer to PropertyPost#9 in my blog.

To summarise my experience, I’ve come to learn and understand the advantages and limitations with the buyer’s agent I had decided to go with.

The buyer’s agent I went with was known for his ability to acquire below market value off-market distressed properties. This seemed to be too good to be true at first, but I can say that this buyer’s agent was definitely the real deal and delivered with what he was known for.

One disadvantage with this was that you are only limited to properties which pop up which are off-market distressed properties. So if I wanted to narrow the search down to a particular area, this won’t really be possible as there’s no guarantee you can get an off market below market value property there. I think if I went with another BA, I would have got value through being able to collaborate with the BA and have a bit more influence on the search. It would have been a very good learning experience to hear their professional opinions of the pros and cons of properties and their approach to things.

However, in conclusion I would say that I am happy with the BA I had decided to go with. The main reason being the value they provided in the current market conditions. It was not uncommon to see properties sell for $50-80k+ above the asking price! So for me to get something which is under market value in this current environment is definitely extremely valuable.

Property Manager

As I mentioned at the start, the property I have purchased is in need of TLC. I have seen images of the property before the tenant had moved in and it did look very clean. So the tenant has definitely ‘left their mark’ on this property with how they’ve treated it.

I would suspect that the property is in the state that it is in because of poor property management. I think this could have been avoided by a good property manager by:

– Tenant selection – choosing the best candidate and not just anyone to be a tenant for the property

– Managing – maybe there was a poor job on behalf of the property manager on ensuring the tenant doesn’t trash the property.

– Non-local manager – I believe the existing PM was located an hour away. Not entirely sure if locality plays a big role in this but I would prefer a local PM.

So I’ve decided to go for a PM who I can trust and who has an enormous amount of recommendations on PropertyChat.

I’ve also thought about the cost of fees – the real estate agent recommended their PM with 6.6% fee however the one I want is 8.8% fee (fee is a percentage of the rent collected), so to put it in perspective a 2.2% difference in fees for a $375/wk rent would be approximately $400. While I’m all for bargains and saving money, I think the opportunity cost for a good PM far outweigh the $400 saving. It makes me think, if the previous owner went with a higher quality PM, would the property be in this current state?

Anyway, we’ll see how I go with this. I’d like to liaise with my chosen PM down the track on how to sort this out; should we get a new tenant? Renovation costs – does the tenant pay for this out of their bond if I end their tenancy at lease end? Not sure how it will go down but it would be good to hear their opinion on things .

Previous Deals

This is the 4th deal which was brought to me by my BA – there were 3 before it which I wasn’t entirely happy with [at the time] and said no to.

The reason I say ‘at the time’ is because I realise that some deals, particularly the first, was something I should have went for. However this is just the nature of things, when you embark on something new you do end up making mistakes.

Deal #1 – $450k property (4/2/2, 500m^2, excellent location) which required $10-15k of rennovations, currently untenanted. I rejected because I did not have $10-15k upfront for rennovations (new carpet + paint). I thought I should just wait instead and hopefully a better deal should come along (but in hindsight, this was probably one of the best deals offered). Anyway, one flaw I had here is saying “I can’t afford the $10-15k renos” instead of asking “How can I afford it?”. One possibility I could have done is that maybe I should’ve spoke with my broker to see if I can borrow say $470k for a $450k property and have the $20k to spend on rennos… A big part of real estate investing is about creative financing with deals, and I am upset that I closed the door before even thinking about this question. Also, fear was a big contributing factor in my decision – since this was interstate I would have no control over the contractors completing the renos. But to be a successful investor/entrepreneur you would need to be able to solve problems through people/relationships. If I had established a good relationship with a Property Manager early on, maybe they could have helped with this process.

Deal #2 – $415k property (4/2/2 500m^2). This was in Ipswich which, from previous studies I’ve done, was somewhere I was not interested in at all.

Deal #3 – $470k property (4/2/2 500m^2). This was in a new development area, which I was iffy about since there was going to be 1500 new houses to be built in the same suburb. So I was unsure if the new supply would affect the price of this property. Additionally, although it was in excellent condition (5 year old property), I was unsure if buying something so new was a good idea. I spoke to a property investor I look up to (who I met from PropertyChat) for his opinion, and he told me: if you’re looking to buy a property, are you buying it for the land (appreciating asset), or are you buying it for the house (depreciating asset)? For a new-ish property, a big part of your purchase is towards the house (depreciating asset) since it is still relatively new. Also historically, established properties have performed better in capital growth. This was an excellent perspective, and although it was a good deal, he told me to put a bit more focus on buying an asset which ticks the boxes rather than something below market value.

Observations and Learnings

There are a lot of things you definitely cannot truly learn unless walking the walk. I had spent a couple hundred hours learning through listening to podcasts, joining seminars, webinars, online meetups on PropertyChat, reading forums, reading books, meeting investors from forums and chatting having a chat, finding investors to ask for advice, etc. I had thought that I had known a decent amount already before diving in, but I was dead wrong lol. The learnings I got from walking the walk ranged from personal factors such as my EQ (emotional intelligence – which is an enormous factor in the investment game) – to simpler things like the correct way of market analysis, which I cover below.

1. Going in the wrong direction – I’d say I had spent somewhere between 200-300 hours of study before pulling the trigger. I would say at least 50% of these hours did not directly contribute towards the goal – usually as a result of me studying something the ‘wrong’ thing or going in the completely wrong direction. For e.g. going like 30+ hours in the direction of thinking the property investment game can be simplified to merely numbers and data (since I come from an engineering background) – so I spent a while acquiring property data, then beginning to analyse it. This is just one of many examples where I spent a lot of time on the wrong approach, however I believe to be successful, you need to learn how to navigate through unfamiliar territory persistently until you reach clarity. I don’t regret those ‘lost hours’, for there was still things of value which I learnt not only about property investing, but also myself, which I would have not learnt if I did not go in the wrong direction. One take away is that I can’t always rely on the books or courses or even someone else to tell me how to do things. Failing and going in the wrong direction is part of reaching goals and embarking on the journey and that’s the only way you can truly learn.

2. For instance, regarding deal #1 above, I can attribute my failure to act and think of a better solution to my emotions at the time… As I was given the deal I had a heightened sense of anxiety since it was the first offer brought to the table and this clouded some of my thoughts and the way I would normally think. I had answers and solutions within me the whole time, but I was too blinded by my emotions to see it. The reason I bring this up is that with my understanding now of how I can falter in some ways under the pressure of big decisions, I can have more awareness of it the next time a big decision is brought to my plate. I think an improvement for next time would be to practice meditation when making big decisions to return to a state of awareness and to help me become a little less reactive and to help me think with more clarity.

3. Understanding how to do market analysis properly – I had previously analysed properties using the ‘buy’ search criteria on RealEstate.com. However, we see that with such a crazy market, houses are selling for $50-80k above the asking price!! Therefore, using the ‘sold’ criteria gave a much better indication of what was going on in the market. Additionally, I learnt that in this crazy market, looking at sale prices from even 2-3 months ago can be regarded as already outdated. The market is moving my $50-100k every 3-6 months in my estimation, so looking at the most recent sales from the month is the most accurate way of getting an idea of how the market is moving.

4. Beggars can’t be choosers – In the current environment the market is batsh!t crazy. As mentioned, it is not uncommon to see properties sell for $50-80k above the asking price. In the beginning of my journey, I had created blog posts on the suburb checklist and property checklists for analysing the properties/suburbs which would most likely be the best asset to purchase. However, to obtain a property which ‘ticks all the boxes’ would most likely involve you battling with batsh@t crazy first home buyers willing to spend $50-80k above market value. So i guess my main learning here is that I needed to adapt and shift my criteria for what a ‘good’ property or deal would entail with consideration of how hot the market is. In my case, while the property I purchased did not ‘tick all the boxes’ that I would have liked if it were an ideal scenario, I needed to know and understand what is the best that I can do in this current environment. It is all about balance/

5. Success is when preparation meets opportunity – Regarding the point above, we can see how quickly the market moves. Sitting on the sidelines for just a couple months can result in an enormous opportunity cost. I think this is something seasoned entrepreneurs and investors are really aware of, and they ensure that they are always properly equipped to pull the trigger. I know in my case that i might have potentially been able to pull the trigger a bit quicker (say 1-2 months earlier), but due to my procrastination and lack of urgency, then there was penalty/opportunity cost incurred on my behalf because of it. So the take home lesson is that to be a successful entrepreneur/investor, you will need to be able to act quickly and make big decisions quickly. Note: this isn’t to say to just make rash decisions on the fly; doing your due diligence is a non-negotiable must. But maybe I could have been wiser in how i spent my time and goal timeline for my due diligence.

6. Always trust the process – I was a bit disheartened after saying no to the first 3 properties. Emotions came up thinking that I had made the wrong decision by deciding to dive into property and it would’ve been much safer to stick to stock market investing. This is just me wanting to stay in the familiar and stay in my comfort zone. It’s funny to see how our mind plays tricks on us when are emotions are heightened. This is something which is dangerous and I need to be aware of – to trust the plan I have made for myself and trust the process.

Future steps

As I mentioned in the beginning, my property was a good below-market-value deal. On top of that, the market has moved significantly since I pulled the trigger.

I would estimate that I would have at least 70k equity in the property by the end of the month, which is enough to pull the trigger if I were to purchase a similarly priced property but on a lower 12% deposit.

I spoke to my broker and they mentioned it would be advisable to wait the 90 days before property revaluation to find out how much equity is sitting in the property.

However, as I mentioned it appears to me that the property can move by up to $50-100k in 3-6 months. So if I were to pull the trigger this year, it looks like the best option is for me to do it sooner rather than later. Investing in general, whether it be for stocks of for property, is about buying time in the market. So getting in when you can is the best way to go. (This idea has been covered in my blog posts relating to stock investing)

This brings me to the drawing board now. I want to buy a property ASAP but what the mortgage broker advised me (90 day wait) was most likely the conventional way to go… from what I learnt – what I need to do is to not give up yet and accept what is infront of me and instead ask myself how can I buy ASAP?

I went to the drawing board and thought of a few options. But the one which I finally concluded was probably the best was:

– I get a guarantor loan for a 20% downpayment for my next property. Then come the end of the 90 days mentioned by my mortgage broker, I then use the equity to ‘pay’ the 20% deposit off and release my parents’ PPOR from the guarantor loan (? not sure if I will be able to do this haha, will need to seek mortgage broker advice). So in doing this method, I would essentially allow myself to enter the market 2-3 months earlier than originally planned for.

I brainstormed another option (which I don’t think was that great but I was thinking about it for a few hours) was:

– Setting up a family trust, using parent’s equity to purchase a new IP, setting myself up as the trustee to have control over the asset, then paying back my parents in the 90 days time.

I am not too sure of the feasibility of this option, but if I were to pursue it I would speak to both my mortgage broker and a solicitor on if it’s possible at all.

Update 19/01/2022 – I spoke with my broker and guarantor loan is unfeasible because my borrowing will be the limiting factor. Also after further research, the trust option won’t be a good idea.

Ok, so my future steps are to just get ready for the next purchase and just wait the 90 days for my property to be reevaluated.

Regarding where to purchase next, I am considering different states to purchase in now. This is because although the whole of Australia is a hot market right now, I have seen how crazy the Brisbane market is – so maybe other states aren’t this crazy??? So my next steps will be to look into it because there may be better opportunities elsewhere when i am potentially able to pull the trigger in 4-6 months time for a new IP.

Conclusion

There are a lot of things which I have left unmentioned as there is too much to cover in one blog post. However, I have aimed to provide an overview of my main key learnings and takeaways from my first property purchase.

I have learnt an enormous amount of things on this journey, not only about property but also about myself. I am confident that if I keep going on this path of building up portfolio and financial foundations that this can lead me to becoming the man who is capable of achieving financial independence himself and his future family.

Till next time, thanks for reading!