The interest rates are rising!!

AHHHHH!!!!

Don’t buy property now… just wait!!

AHH!

Yes I’ve heard all the news about interest rates shooting up and people are all skitzed out. The fear may be warranted for people looking for to purchase expensive owner occupiers (especially cos they’re going to be on a P+I loan), but I do not believe investors should automatically just jump in the same boat as well.

So I’d like to break down why I am deciding to continue with my foot on the throttle and purchase my second investment property despite the noise. To be able to paint a clearer picture we need to, like with all investments, turn to the fundamentals and look at the numbers.

Investment Property #1 - Finances

Before we dive into my finances for Brisbane I’d like to touch on what I talked about in ‘Property Post #12 – the financial roadmap pt.2’.

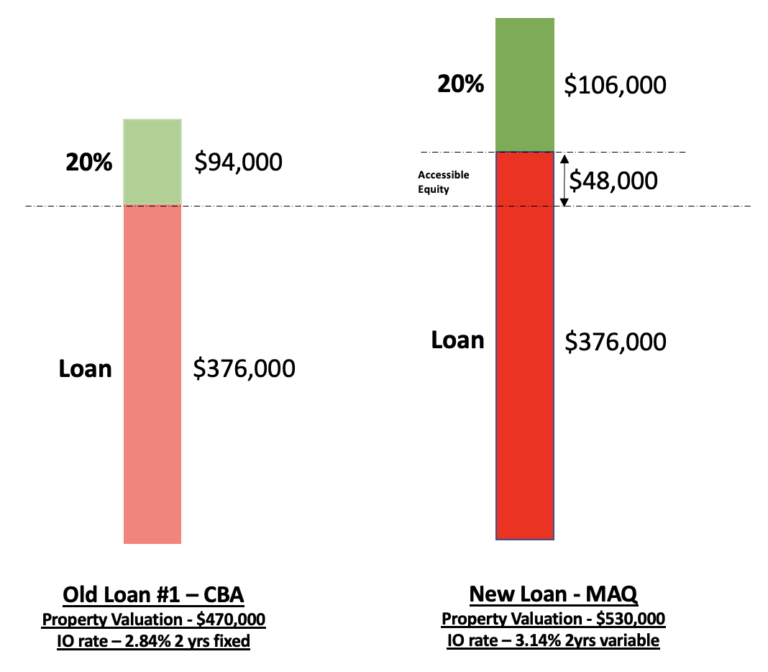

Here’s what my refinance from CBA (original loan) to Macquarie (New loan) looked like:

So above we can see that my interest rate did bump up when moving loans. However, this refinance was necessary as I need to draw equity for my next purchase.

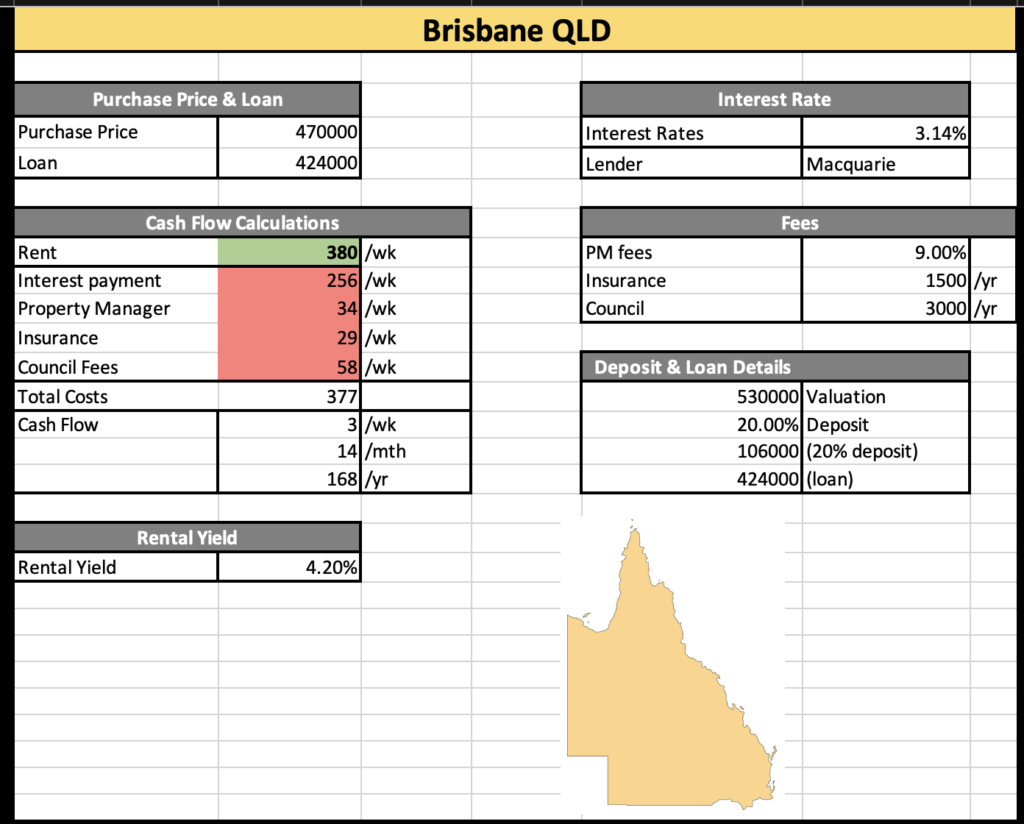

But we’ll punch in the numbers paint a better picture to see how this refinance affects my financial health and cash flow:

These are great results! Great because as of now, I’m still sitting on positive cash flow… just. I’m making $3/week. I believe this is the price of a McDonalds cheeseburger so you can say I am being paid 52 cheeseburgers a year to hold onto this appreciating asset (while being given some equity to use a deposit for my next purchase since this is the refinance loan)… not a bad deal in my eyes!

Ok… so if I’m just hovering just above the line in terms of cash flow then what does this mean if there’s a slight bump up in interest rates…? I’ll go negative cashflow right?

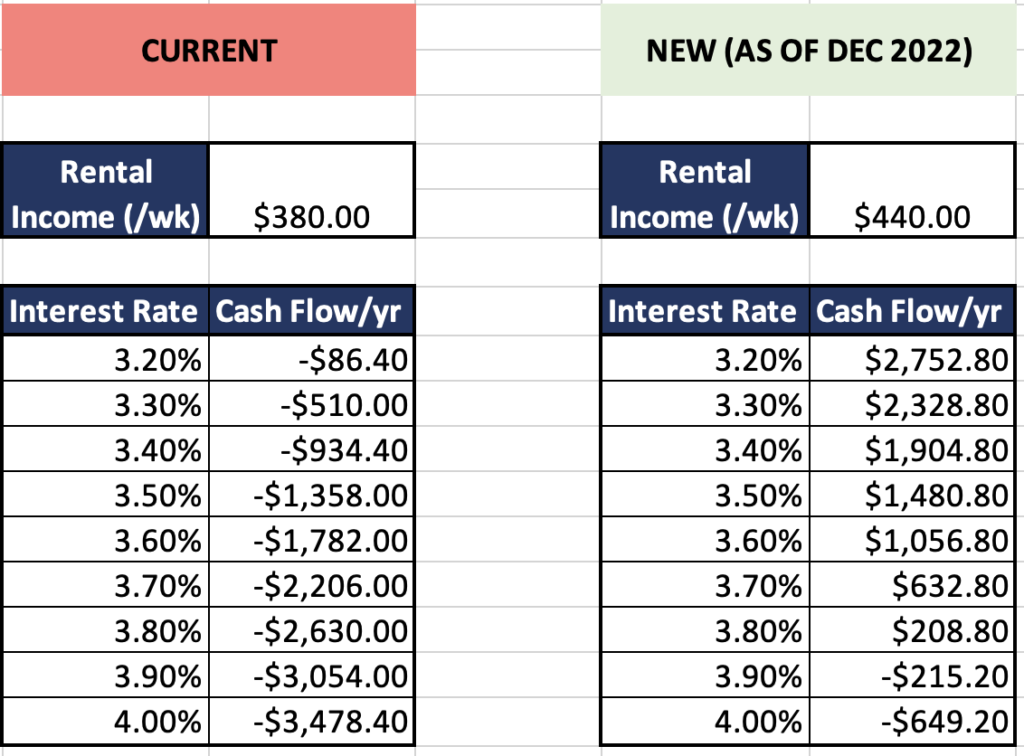

For the time being, yes. But at the same time my tenants are paying below market value for rent. I had a rental appraisal of $440 at the end of last year, and I am conservatively estimating for calculation purposes that they are around $440 still (despite the rise in rents this year).

So let’s see what picture the numbers paint for my financial health for my current $380/wk rent and my new $440/wk rent (when lease renewed at end of the year) with respect to rising interest rates…

Additionally for further consolation, rents typically increase also when interest rates increase because the landlords raise the rents to help cover the extra expense. So should interest rates go back up to 4%+ I can rest assured know that I will remain positive in cashflow. (Even in worst case scenario a couple hundred bucks out my pocket won’t even be too bad).

Investment Property #2 - Finances

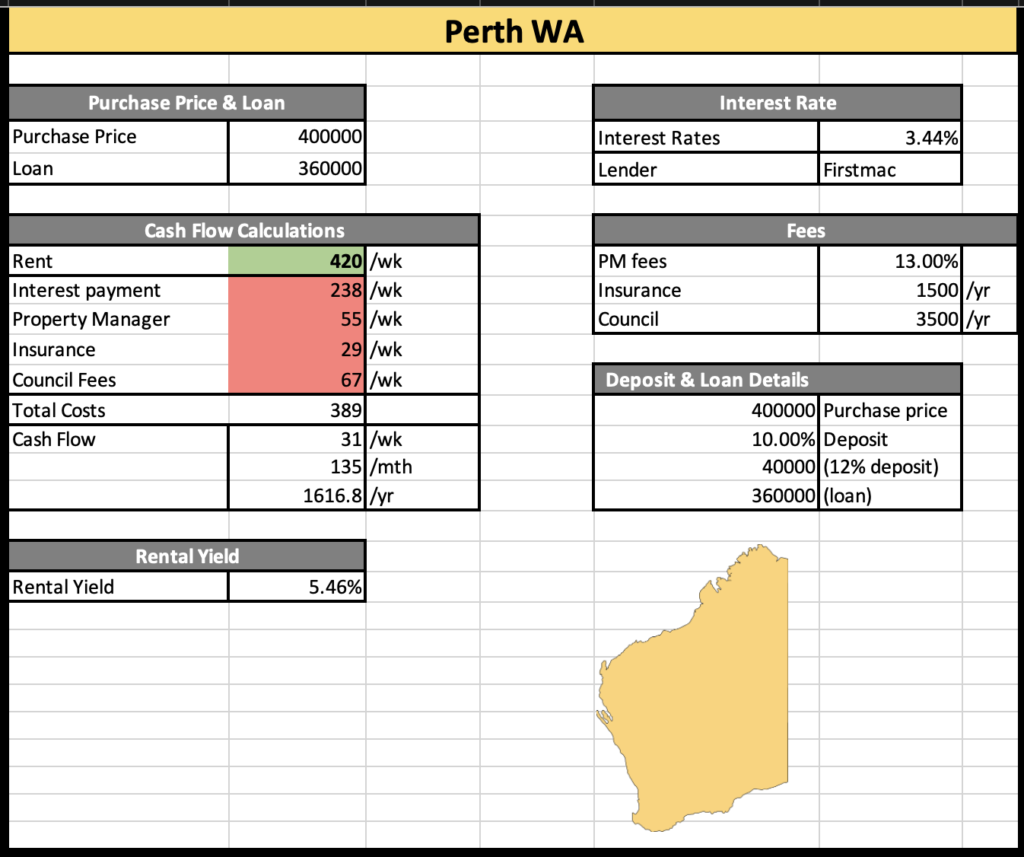

Below is my cashflow estimation for my Perth purchase. These are some of the assumptions I’ve made

· $400k purchase price, $420/wk rent

· ~5.5% yield – this is the average amongst all suburbs in my target areas

· 3.44% interest rate with Firstmac

· Much more expensive fees in WA

Not a bad outcome to be on $1618/yr cash flow!

Rising Interest Rates

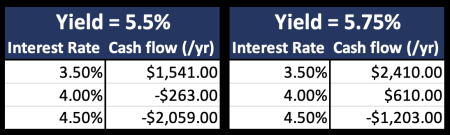

Below I’ve undertaken an analysis on what my cash flow will look like with respect to rising interest rates for the two scenarios:

1. 5.5% rental yield

2. 5.75% rental yield

Obviously getting a higher yielding asset is ideal from the cash flow POV (maybe not necessarily from the capital gains POV). But it’s nice to just get an idea of how cashflow differs between these yields (which are typical in my target areas).

Also, it is worth mentioning again that these calculations above only paint the picture with the assumption that your rents remain at the price that they are during the interest rate increase. Typically interest rates will increase only marginally and rents rise as well to cover the costs so I am quite confident that maintaining a positive cashflow position on 5.5% yields is quite doable in any environment.

Conclusion

I’d like to admit that even with my Brisbane property I had a rough idea that I was positive cash flow but I didn’t really take the time to sit and look at the numbers. Also this is actually the first time I’ve taken a long hard look at the numbers for both purchases (which is very slack from my behalf). Coming into this WA purchase I just assumed I’d be hovering between -$1000 to $1000 cashflow without really doing a thorough investigation. (also very slack on my behalf, as it doesn’t take too long to actually sit down and punch some numbers). Anyway, we did it boys! Haha.

I can say now that moving forward I am a lot more confident in my decision to purchase my second investment property despite the noise. This is because the numbers have shown that I should be able to maintain a positive cashflow position given any environment.

To end I’d like to reiterate once again paraphrase a quote from Konrad Bobilak which goes:

“Property is 80% about creative debt structuring and 20% about the property.”

This is not to say that the property is not important. It’s very important – well-chosen properties go hand in hand with the equation. However, understanding the numbers with relation to your finance, and also with your purchase (like yields, subdivision potential vs yields, etc.) are much more important as these are your ‘chess’ moves to move forward towards your financial freedom goal.

I focus first on my finances to assess what moves I can make, then I think about the investment vehicle (property) which will be best for me at this current point in time. Currently, I am targeting the high yielding investment properties which have strong capital growth potential for the cash flow + capital gains. This is so i can draw equity quickly with capital appreciation + maintain a decent positive cashflow to have better serviceability to leapfrog from one property to the next.

Anyway, this blog is getting a bit long so I’ll end the blog here – thanks for reading!