Introduction

Hi everyone, Mrs Shift here. This post is looking specifically into the regions of Adelaide that have good potential for investment. Related posts:

Property Post #7 – Find what region to invest (written based on Brisbane, where he made his first IP purchase)

Property Post #10 – Perth – a potential investment prospect

PropertyPost#11 – Understanding the different regions in Perth

As you may be aware from Property Post #10; after a bit of consideration of the Brisbane market being quite hot at the moment, we are considering looking at both Adelaide and Perth for the next IP purchase. In Property Post #11, Mr Shift has already shared about the Perth market. Moving forward though, we do want to ensure we have a good grasp of all the markets available to us to ensure we are aware of all potential areas to look for good deals, as well as diversify our portfolio. So Mr Shift’s next purchase is likely to be in Perth, but my next purchase might be in Adelaide.

First, we’ll start with why Adelaide? And then where to buy in Adelaide.

Why Adelaide?

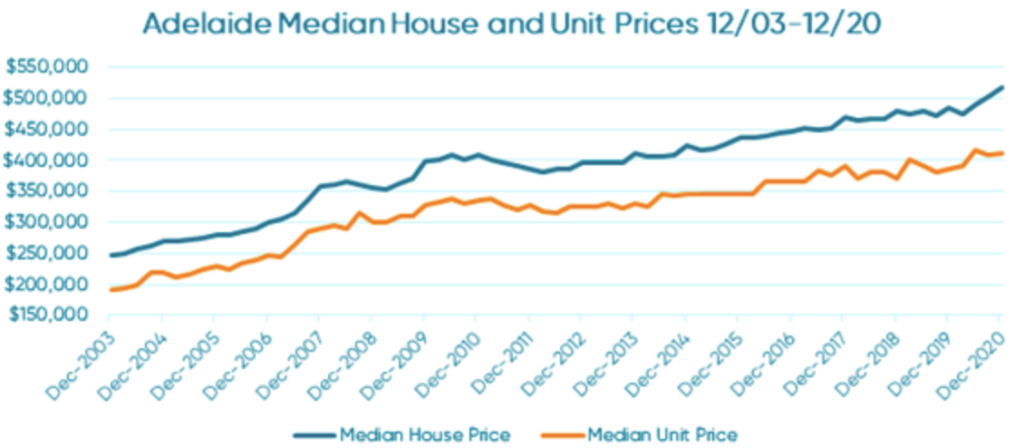

Historical Price Trends and Change in Median House Prices

Unfortunately, I couldn’t find the most up to date graph including 2021. But I will update this post if and when I do find it.

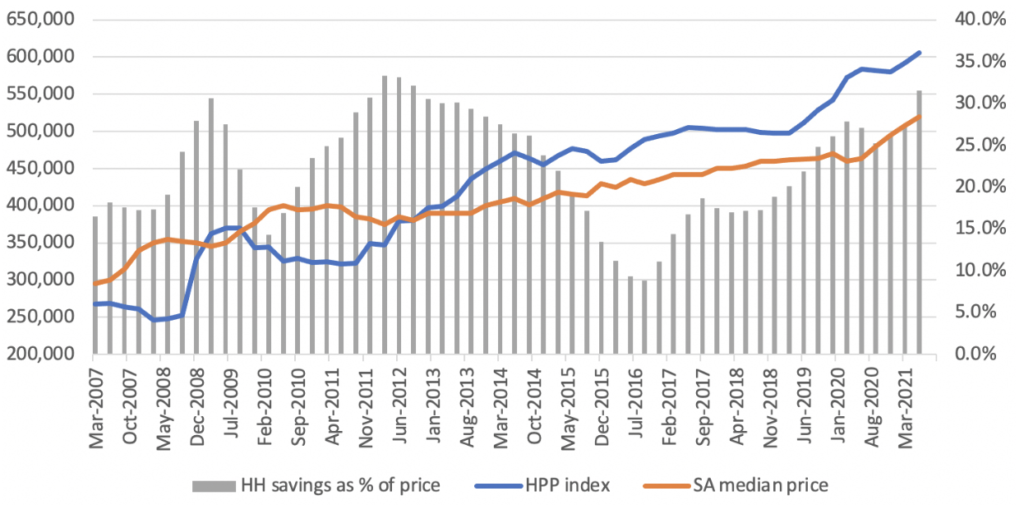

I was able to find this graph which looks at overall median price (both apartments and houses included). It shows that as household savings increase, house pricing shows greater jumps in increases

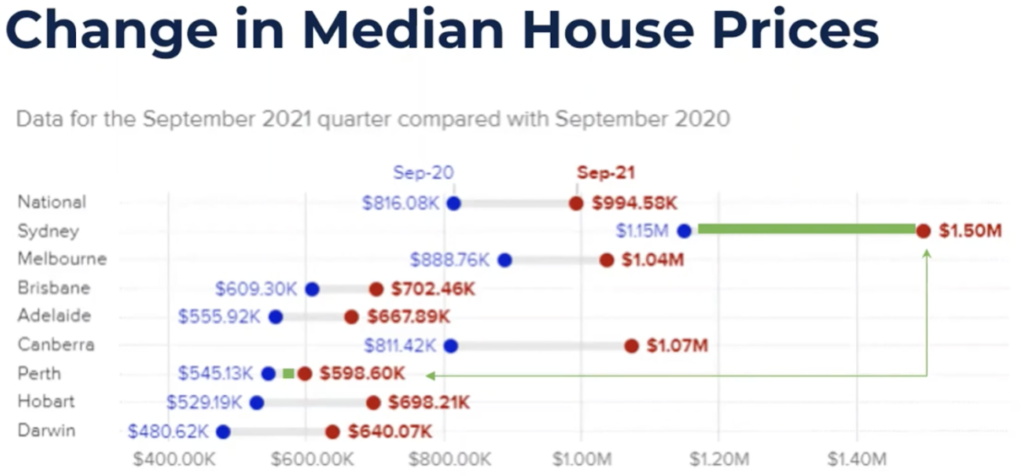

Zooming in to September 2020 – September 2021, I can use the same graph below that Mr Shift shared in his Perth post:

From both these graphs we can see that Adelaide is continuously growing like all other Australian capital cities. Although the latter graph is mainly highlighting that Perth had the lowest growth compared to all other capital cities and now also has the lowest median house price across all capital cities; meanwhile, we can see that Adelaide’s growth over this period resulted in it going from 4th lowest median house price to 3rd lowest median house price as Hobart overtook it’s spot for 4th. Lower house prices generally result in better rental yields which is a good thing.

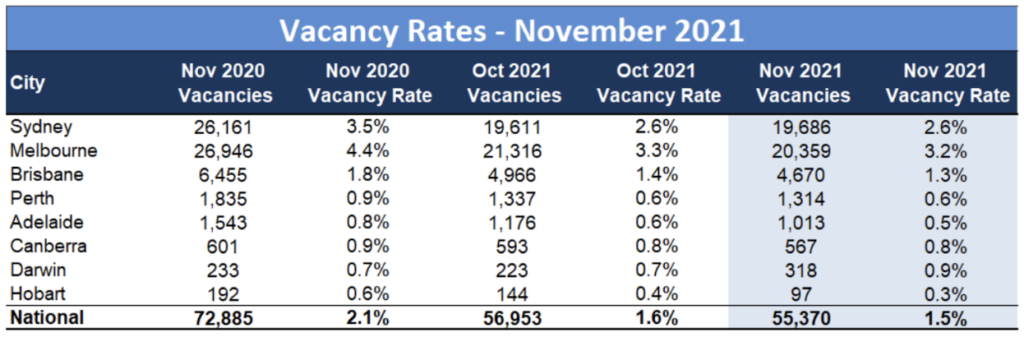

Rental Demand

We can see here that Adelaide has low vacancy rates; and as of Oct 2021, it became the second lowest of all the capital cities, with Hobart having the lowest overall.

Reiterating from the Perth posts – low vacancy rates means that there is a shortage of places available for rent. This causes rent to go up due to low supply, but also because people are willing to offer more just to secure a place to rent. So how does this affect property prices? When rent is expensive, it is not uncommon for people to deliberate upon themselves whether it might be cheaper in the long run to just purchase a property instead of renting, so a lot of people will start to seek buying a place instead, creating demand in the property market. Additionally, it also does mean that a property purchase in Adelaide is less likely to sit too long on the market without tenants, resulting in better positive cashflow.

Adelaide Industry

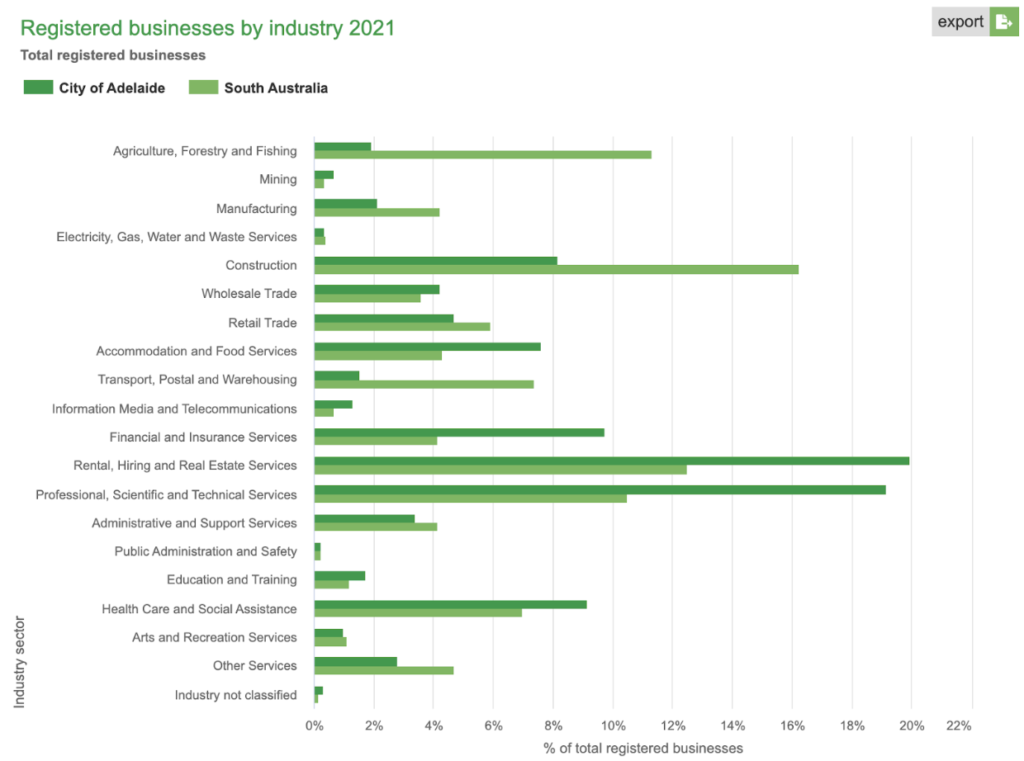

Here is a graph of the percentage of registered business by industry in South Australia and Adelaide

This shows that South Australia and Adelaide have quite a diverse range of industries supporting their economy. Diversity in industries ensures that dips in certain industries doesn’t affect the economy as a whole, like in the example of Perth / WA in the past which was heavily reliant on mining.

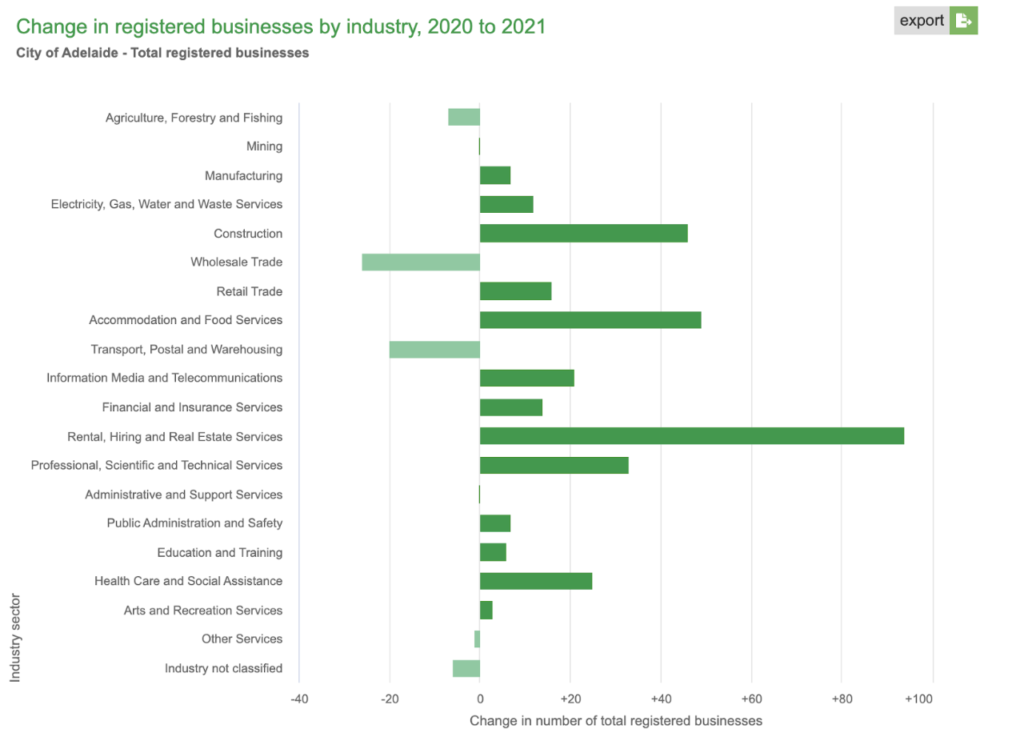

Further, here is a graph showing the change in registered businesses by industry within Adelaide:

This graph showcases the changing nature of registered businesses in Adelaide as a response to the changes the pandemic had. Although some industries had reduced numbers of registered businesses, most other industries boomed; outweighing the negative deltas heavily. When economies are active, generally house pricing continues to follow suit by increasing.

Unemployment Rate

Unfortunately we see here that as of January 2021, South Australia has the highest rate of unemployment. This is quite a contrast from Western Australia having the second lowest after the ACT. A higher unemployment rate increases the difficulty of selling a house, which then reduces the ability of the housing market to increase.

Where to buy in Adelaide?

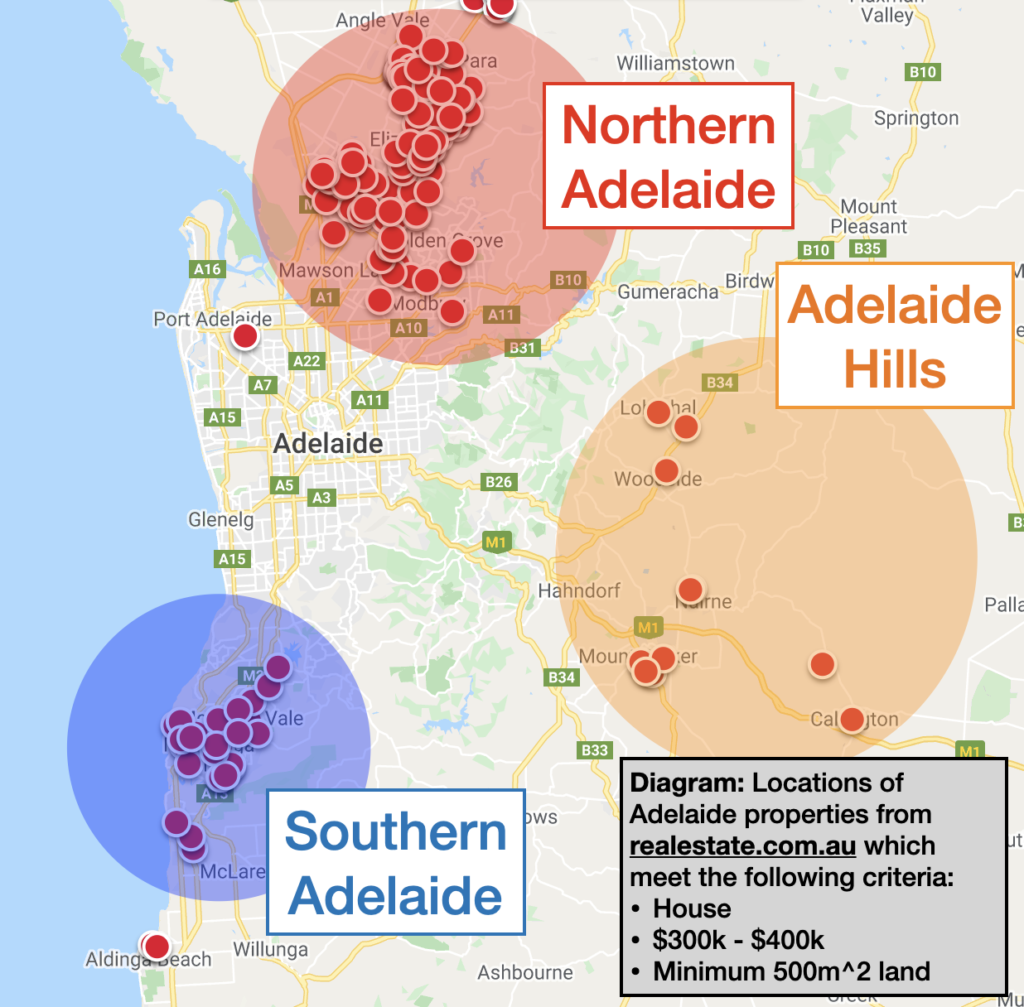

Using a similar method to Mr Shift’s research into Brisbane and Perth, the following search was conducted on Adelaide:

Houses sold

$300k – $400k range

Minimum 500m^2 land

In Adelaide, there are 3 regions of Adelaide (out of 5) for which meet the criteria:

• Northern Adelaide

• Southern Adelaide

• Adelaide Hills

To further narrow the search, noting that some of it may be anecdotal, I sought advice from a friend who’s lived in Adelaide all of his life and is also well-travelled around Sydney / Melbourne. I also utilised advice from PropertyChat.

– Adelaide Hills may have increased premiums due to being more bushfire prone. Depending where you buy, it may not be close to the train line.

– Northern Adelaide is a potential as it has plenty of stock in the budget, as well as a train line.

– South West Adelaide has a beachside appeal with a train line, and has begun to boom late after COVID.

From these findings, I’ve decided to narrow down my search to Southern and Northern Adelaide, with a preference towards Southern Adelaide. And so with that in mind, I used the search criteria above to identify the suburbs which matched:

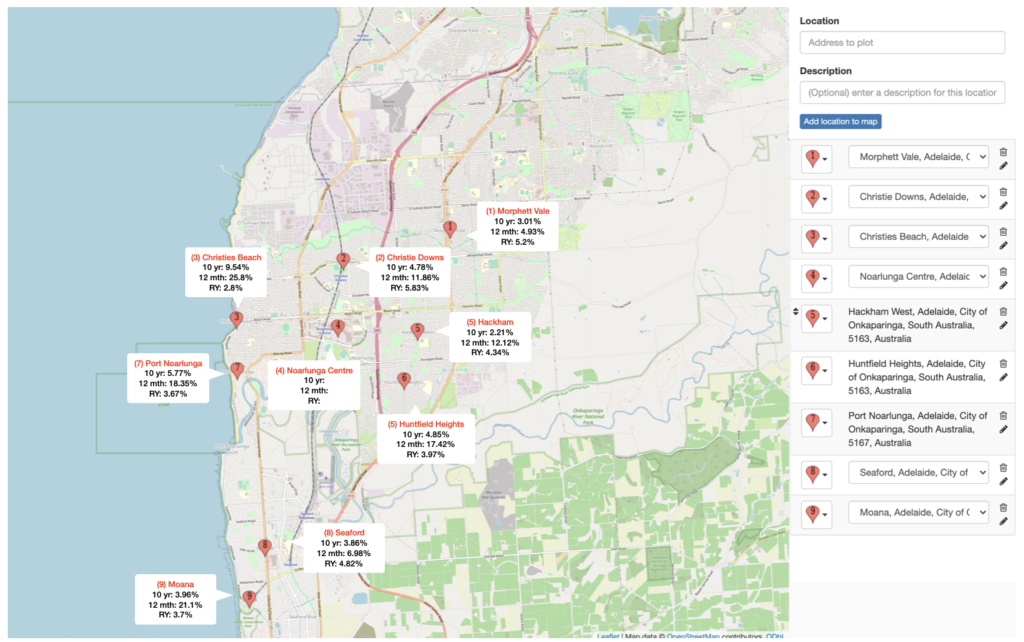

Southern Adelaide (higher preference)

Hackham West

Christie Downs

Seaford

Happy Valley

Huntfield Heights

Christies Beach

Port Noarlunga

Noarlunga Centre

Moana

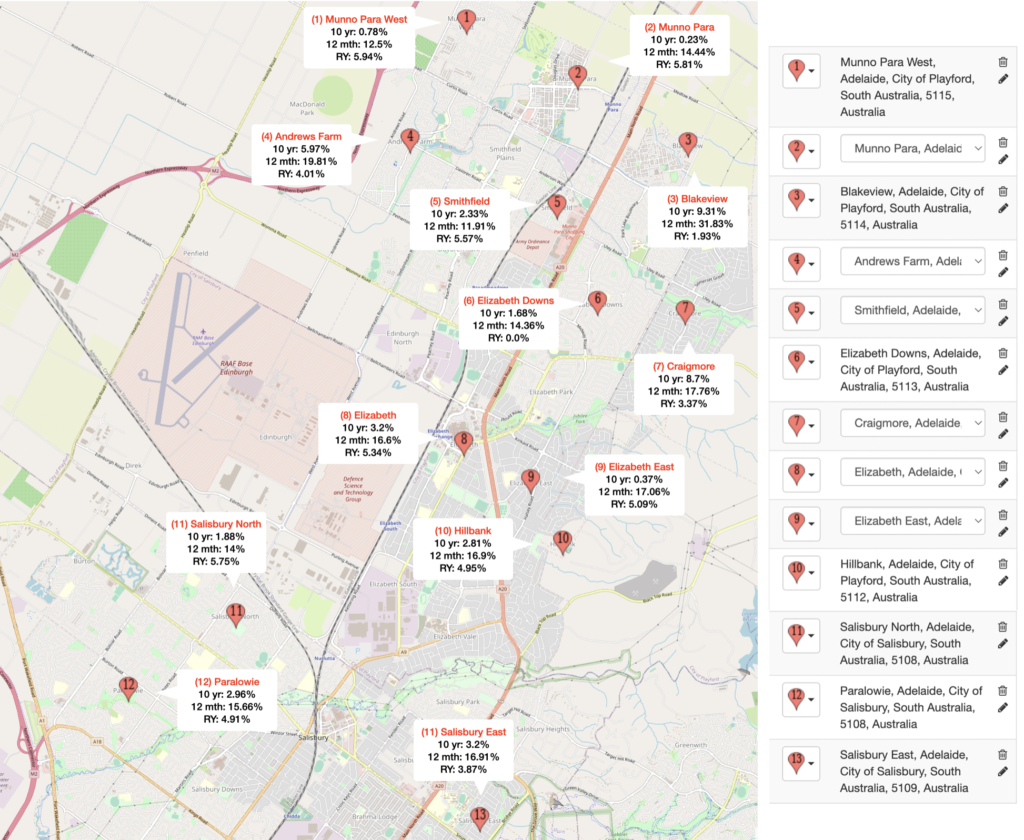

Northern Adelaide (lower preference)

Craigmore

Munno Para

Munno Para West

Paralowie

Salisbury East

Andrews Farm

Salisbury North

Elizabeth Downs

Blakeview

Elizabeth East

Smithfield

Hillbank

Elizabeth

The BuyersBuyers’ Property Investor Special Report says that landlocked suburbs close to the city, as well as some suburbs close to the coast, performed best in 2021. More specifically the Central and Hills areas of Adelaide came out clearly on top, followed by South, West, and trailing far behind, North. This further qualifies my desire to purchase in Southern Adelaide as compared to Northern Adelaide.

In terms of projects, both the City of Marion and the City of Onkaparinga have several developments going on within their Councils, but most are quite minor as compared to the Hydrogen Plant in south Perth. So what I’m trying to say here is that most are not really the job-creating type of major projects.

However, the Australian and South Australian Governments are working collaboratively to build a dedicated non-stop North-South Corridor.

This project applies to both the northern and southern regions of Adelaide. Significant transport projects such as this makes cities ‘smaller,’ in that it allows for people to live far away, but not be too far away from major areas of interest e.g. CBD, hospitals, airport, etc.

A major comparison of north and south is the amount of land developments currently available:

There are more areas of development in the north than in the south. Large amounts of supply deter capital growth as the supply may outstrip the demand. The opposite creates desirability.

Conclusion

From here, I now have a decent high-level overview of Adelaide. Re-iterating what Mr Shift said, but I don’t think you can go wrong with purchasing near the coast in the long term, especially when there are signs of growth happening all around. As such, I am leaning more towards the Southern region, but I will not yet close the door on a potential investment in the North.