Now that I know Perth is going to be a good place to invest, I now need to narrow down on where exactly I’d like to buy. Luckily, I’ve been on this road before and I have designed a framework for myself to understand where I need to buy.

For more details on how I’ve done this in the past, please refer to PropertyPost#7 here:

https://shiftinperspective.net/2021/08/15/propertypost7-find-what-region-to-invest-in/

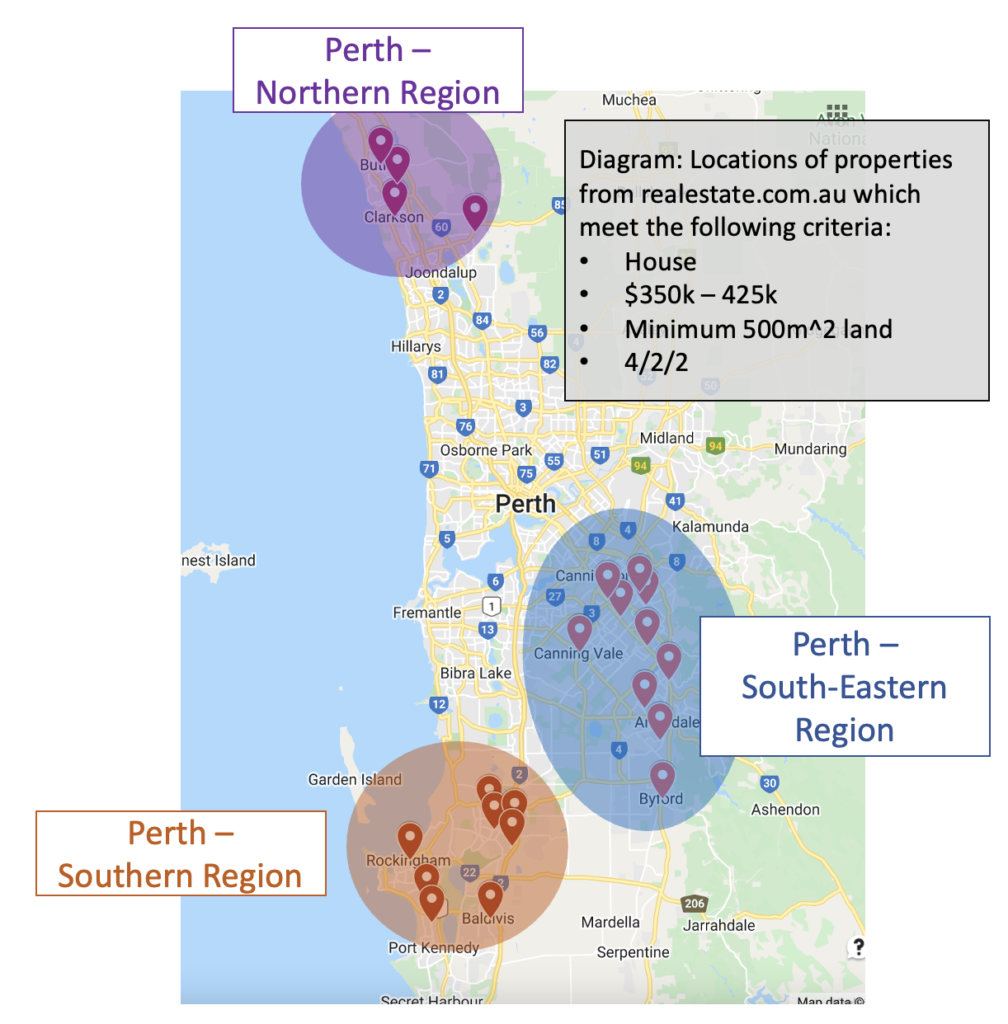

To summarise, I use the base criteria of:

· House

· $350,000 – $425,000 purchase price

· Minimum 500m^2 land

· 4/2/2

Using this criteria, I was able to come up with the map above.

Note – this is just a very broad ‘shotgun’ approach to this. These criteria isn’t the ‘end all be all’ of my search criteria. I acknowledge that going 3 bedroom and <500m^2 is a possibility too, and I should not be so strict on what is written above. This approach is just to get a general feel of where I can afford (and root out all the things outside of my general budget/criteria) and then go from there and move forward in my analysis. Also as a side note, I was listening to a podcast with PK (aussie real estate youtuber) and a PM and the PM was saying that local ground knowledge would be good for understanding which types of properties will perform well, because maybe 3/2/1’s perform well in some suburbs but not in others.

Additionally, one important note in doing this is to use the ‘sold’ search function instead of the ‘buy’. This was my mistake when doing this method before. The reason being is that:

1. It’s a hot market – sometimes the list price is not really indicative of the current market value of the house, as some. Crazy FHB might drop an extra 50-100k to secure the property. I have seen this first hand when I’ve really been watching a suburb and knowing the properties asking price then finding out later its actual sale price. It’s not uncommon for it to sell for well over $50k more.

2. Agents may list the property at a lower value to lure people – again, not a good indication of actual price. This was something my previous BA said is a common practice.

Anyway, with that being said, I’ve narrowed it down to three locations:

· Perth – Northern Region

· Perth – South-Eastern Region

· Perth – South Region

Before I begin covering my findings, perspectives and speculations in each of these regions, I would like to first write about some interesting things which I have learnt about Perth though my fellow PropertyChatters in the forums, which has given me quite some new perspectives on Perth, which is summarised below:

· As a Sydney-sider, I know how valuable it is to be situated near public transport. Especially during pre-covid, as. The CBD and other larger cities like Parramatta are areas where people would need to commute to for work, during pre-covid times. However on the contrary, it seems that Perth may not be so similar in this characteristic. In PropertyChat, I read that:

o Perth is a far-less city-centric workforce, so properties near PT may not be that much of an impactful characteristic

o o Everyone apparently has a car in Perth – not one per household – but one per person. Therefore, a double-lock-up-garage would be a premium characteristic.

o CBD is far less exciting than Syd/Melb.

o Roads are much clearer when compared to Syd/Melb – much easier commute to city.

It’s quite interesting to come across these ideas, as these new perspectives will alter but improve my pre-existing beliefs and approach. I know there are still plenty of things I will need to fine-tune regarding my execution, and I will try my best to improve as I go along.

Anyway, let’s get started with the analysis of these three different regions. The analysis below, again, is similar to the way I’ve completed it in the past. To summarise – I used the search criteria to delve into each of the three regions and then list the suburbs and their Avg (10 yr), 3 yr and 12mth median capital gains %. The aim of this exercise is to paint a picture, so to speak, of the area being studied. For example, the gains of a suburb, if significantly less or more than its adjacent counterparts will prompt for further investigation and reasoning as to why this is the case – e.g. perhaps one suburb is considered premium and the suburb over has housing commission and lower socio?? Etc….

With that being said, let’s get started on the analysis, beginning with the northern region of Perth…

Perth - Northern Region

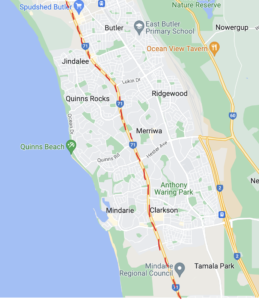

Generally, as with anywhere else in the world, the closer to the beach the better. This means aiming to get suburbs which are east of Marmion Avenue, which I’ve drawn in the red dotted line below.

This, however, may be challenging at this point in time since i believe that most of the properties west of this highway are already past my price point and that the only ones that are available now are the ‘cheapies’ which are east of the highway and much further away from the beach.

I have looked though that a house on the outer edge of the eastern suburbs still has a drive of around 10 minutes or less to get to the west coast (approximately speaking). This doesn’t sound like much to me, but maybe it does to fellow Perthians.

Also, I’ll need to check but it looks like there is a lot of potential room in the east for development and additional supply of properties.

Some other things to note about the North which I’ve gathered so far:

· The North area has newer builds and is still under further development of newer builds (e.g. North of Butler)

· This particular area up North has been said by a fellow PropertyChatter that “Quinns Rocks has long been unfashionable as Perth people see it as being somewhere past the end of the earth. Last boom, it was very popular with British expats chasing the “Summer Bay” lifestyle on the cheap.”

· Also, from my research, there doesn’t seem to be much industry going on around here (as opposed to the south)

· One propertychatter also said that at some point you need to ‘draw a line’ and say how far north is too north.

· Some eastern suburbs have pockets of housing commission.

This post here has a good high level analysis of each suburb:

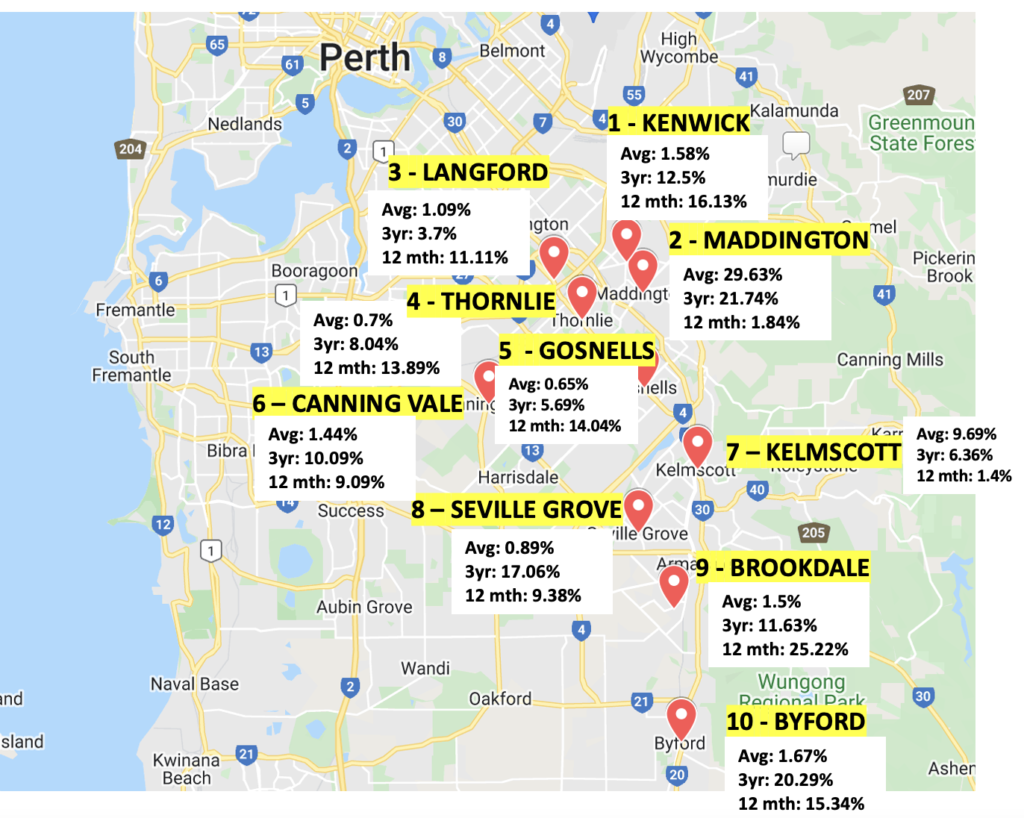

Perth - South-Eastern Region

Out of the three regions, this is the closest to the CBD.

Notes (my thoughts are sort of all over the shop for now lol):

· Avoid suburbs such as Byford which has potential for new development

· Like many other areas, there can be a big demographic difference between neighbouring suburbs. E.g. – Thornlie considered middle-class to lower-middle class and its adjacent suburb Canning Vale is upper middle-class (this is what a PropertyChatter has speculated).

· But on the contrary, I do read some stuff saying Thornlie is going nuts. Maybe it’s because of its proximity to the city? This makes me recall the statement “a rising tide raises all ships”. And sure, everywhere is going crazy and some more than others. But I’d need to also remember to approach with caution and make sure I buy in a good pocket and do my DD regardless of anywhere I purchase

· It was said that Perth, as opposed to Syd/Melb, has generally had less of a city-centric workforce. However, I believe that with the $1.5 billion Perth City Deal, and with the potential $750 million Perth cancer hospital, that Perth CBD will experience an enormous influx of jobs and that perhaps proximity to the city will become even more of a premium characteristic of Perth properties.

· The unfortunate thing about this region is that it’s furthest from the beaches, which is a bit of a downside since I think Perthians love their beaches. I did read that close to the river is good also, so I guess generally, closer to the city is better as with anywhere else.

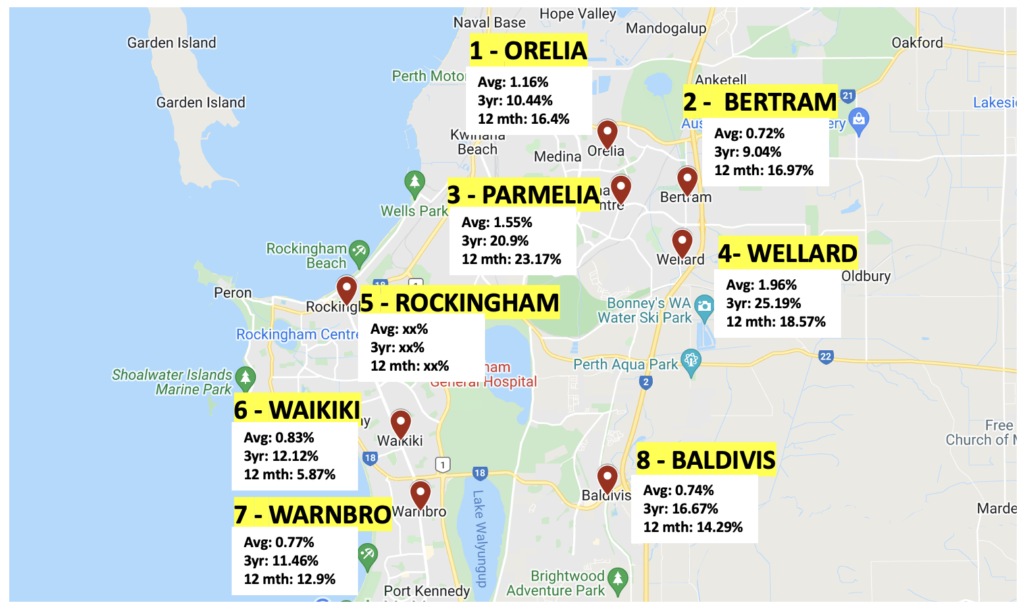

Perth - Southern Region

Now for the south… The south of Perth, the Rockingham LGA in particular, has been quite the popular ‘talk of the town’ amongst Propertychatters on the forum it seems…

Just to list a few reasons for this:

· You’d still get some properties on the cheap around this area which is close to the beach. Don’t think you’d be able to do that anywhere else in Perth

· Cashflow positive + high rental yields + great potential growth prospects = investor hotspot

After looking into the city of Rockingham and reading the forums it’s easy to see why this is such an attractive investment prospect.

With that being said’ let’s take a deeper dive into what’s going on here:

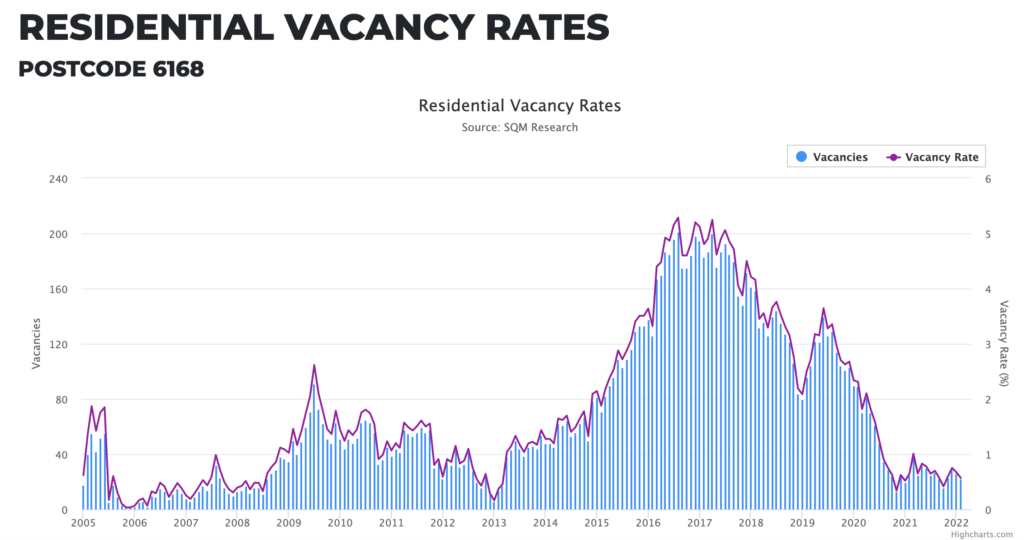

· Rental demand – A fellow Propertychatter who is a PM in Rockingham says the vacancy rates are virtually zero and the rental market is insane.

· Another PCer said that they had 15 applications for $450/wk for their $400k property and narrowed down to one tenant willing to pay $550/wk, which are insaaaaaneee yields.

· Houses are selling quick, very hot market

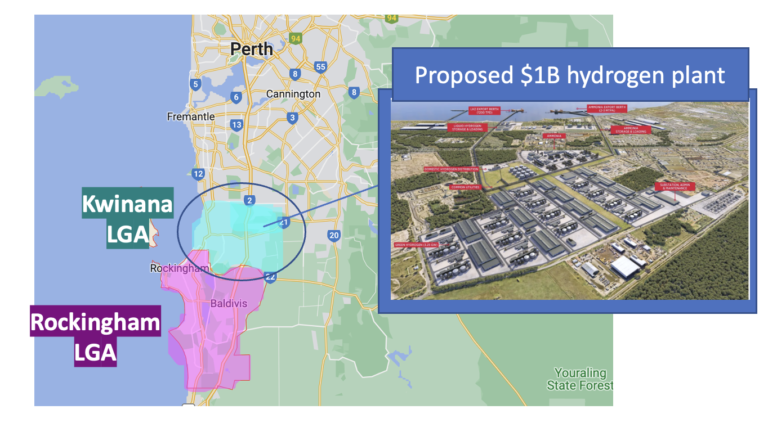

· The city of Kwinana, which is the LGA north and adjacent of Rockingham, will potentially be getting a $1 billion hydrogen plant. This means jobs jobs jobs.

In PropertyPost#10 we saw that the vacancy rates for Perth was among one of the lowest in Australia (second lowest trying with Adelaide at 0.6%). I wanted to check to see if Rockingham LGA was just potentially an outlier in this statistic since it is quite far off from the CBD and it seems to be its own thing. Let’s see what the numbers say below.

We can see that there has been quite a dip since near the start of the pandemic and that the vacancy rates have remained at quite a steady low., which is a good sign.

I’ve also stumbled across this ancient post from 10 years ago (2012) which is helpful for explaining the demographics in the Rockingham LGA:

I’ve picked out some interesting and useful points which I’ll just copy and paste cos ceebz:

· Geographically the place is awesome if you’re into water sports and deserted beaches. For a metroish(thanks to the trainline) location with access to awesome water\beaches it has to be one of the best spots.

· Things start going pear shaped when you look at the behaviour of the locals. It really is a lottery as to who you end up living near. Yes housing is affordable and you get loads of space compared to closer to the city but that all means nothing if you have some retarded **ckwits living next door to you.

· Definitely Cooloongup, East Waikiki, Hillman, Woodbridge have a bulk percentage of government housing. Even a percentage in Port Kennedy. If you can find a good house with a pool and big shed for a good price it shouldn’t deter you. I guess it depends on what you’re looking for.

· Warnbro on the east side of Read St… I think there are a few gov houses in there as well.

· Warnbro\Shoalwater is nice, but even still parts of that have some pretty rough characters. Alot of retirees.

· You also have Baldivis\Settlers nice big houses, pretty condensed, families, cashed up bogans. A bit of a way from the city centre of rocko. But now does have its own woolies.

· People live here for the coastal lifestyle and dont really give a **** about the bogan percentage.

· The bogan activity in the rocko area is on a street by street basis, I have a house in a quiet little cul de sac in Cooloongup and could not be happier 5 minutes to Safety Bay and 15 to work, only 1 rental house on the whole street

Hmmm, so what I gather from this is that Rockingham seems to be a bogan hotspot, with pockets of housing commission here and there. This seems very unusual to me and difficult to conceptualise as someone from Sydney, as it seems that all the housing commission has been pushed away from the coast and that the demographics are usually better near the coast. These Rockingham bogans and housos have it good living next to the beach I’ll tell you that… haha.

I think the biggest point from this whole I’ll need to take into account is:

“ The bogan activity in the rocko area is on a street by street basis”

It’s no different to where I live, Mt Druitt, where it has been plastered on the news as the ghetto. But my street and pocket in where I live is absolutely fantastic and have had no problems while living here over the past 26 years.

Also, Mt Druitt has seen a significant amount of gentrification and growth despite its past population.

I think we are seeing a similar thing in Brisbane, Logan region (where I’ve purchased). From reading PC I’ve seen that they’ve even alluded to Logan as the “Mount Druitt with palm trees”. But now it’s booming and areas are gentrifying.

Maybe Rockingham will do the same. I’m sure it will… I don’t think you can go wrong with purchasing near the coast in the long term, especially when there are signs of growth happening all around.

Anyway, I seem to be babbling on. I think I’ll just need to call it a day with this blog post as I feel I’ve done a decent amount of high level study of understanding each of these regions, so now it’s time to get my hands dirty and start the actual search and networking for this property purchase.

Till next time, peace!