Introduction

Hello everyone and welcome to my seventh Property Post which is how to find a suburb! I think this should have come before my previous post of what to look for in a suburb haha, but that’s ok. I am doing these posts as I go along and things won’t always happen in the sequence I’d expect it to as I gain a better understanding of how to move forward. Here’s how I think the sequence of action should be:

I feel like I am just bush bashing without a road map, and that analogy isn’t far from truth when describing my journey so far in real estate. I have no clue of the most ‘efficient’ or optimal way to move forward. Maybe if a property pro reading this might be thinking I’m an absolute spastic and there’s a much better way of going about it, I just wouldn’t know hahaha. But nevertheless, I will try my best to narrow down on a path to follow. Let’s get to it!

Previous thoughts on how to move forward

Before coming up with this ‘method’ I did have a lot of other things in mind –

· I have my suburb analysis ‘blueprint’ that I just came up with in my last post – so should I just pick out random suburbs and just start analysing them lol? What do I do?

· I was thinking hmm, maybe I should try to find the suburbs with the highest capital gains so far.

· Or maybe I should try find the highest yielding suburbs… Are there possible resources which show a heat map for those? I did find a heat map, but only for NSW haha.

· My next thought was, hmm even with the best growth suburbs being shown on a map, can I even afford it?

Moving forward with a plan

I then went back to the drawing board and came back to my philosophy of ‘beginning with the end in mind’ and asking myself about what my plan is. Ideally, I was thinking about a property in the $300k – $400k range, with my main reason being:

· Rental yield – would be ideal to get something with positive or neutral-ish cash flow so it pays for itself

· Cheap – so my serviceability won’t be cooked for my next potential purchase (e.g., for instance if I buy an $800k property in Sydney, I’ll be cooked and won’t be able to purchase another one for a while haha).

Soo, with that in mind, I thought alright, I’ma set my criteria and see in which areas my following criteria is met:

· House

· $300k – $400k range

· Minimum 500m^2 land

My options for this budget were either:

· NSW – however, will be in regional towns

· Interstate – Can be near the capital cities but cheaper

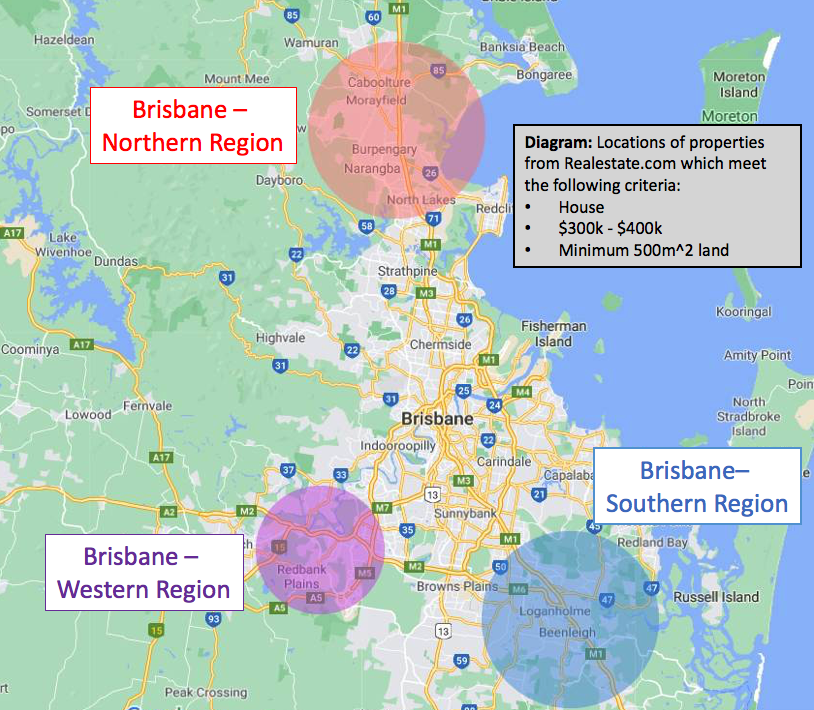

I’ve decided to go with Brisbane for my potential area to invest in. This is because I believe a lot of Sydneysiders and Melbournians might consider making the move up north post-pandemic with the increase of WFH and less need for office people to be near a CBD.

On Real Estate.com, there are three main regions for Brisbane which I can look at

· Brisbane Northern Region

· Brisbane Western Region

· Brisbane Southern Region

I won’t even bother mentioning the eastern region (which is near the coast), given my budget… LOL.

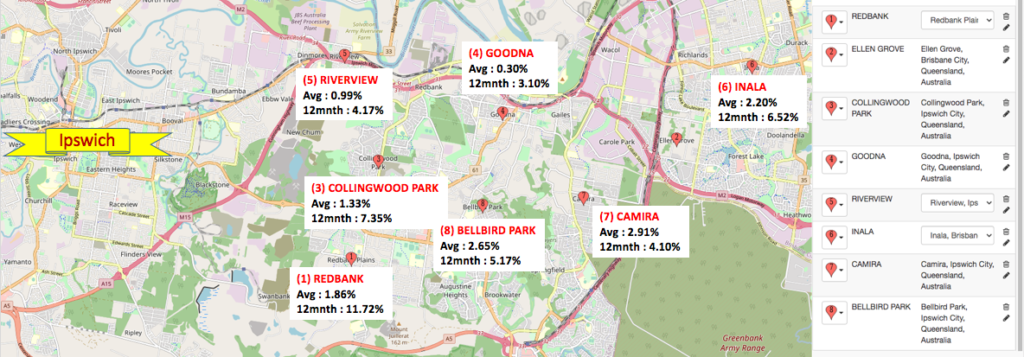

Then with these three regions, I hopped on RealEstate.com and used my search criteria for each region. I then mapped out the suburbs which matched these for each region, and I came up with this map:

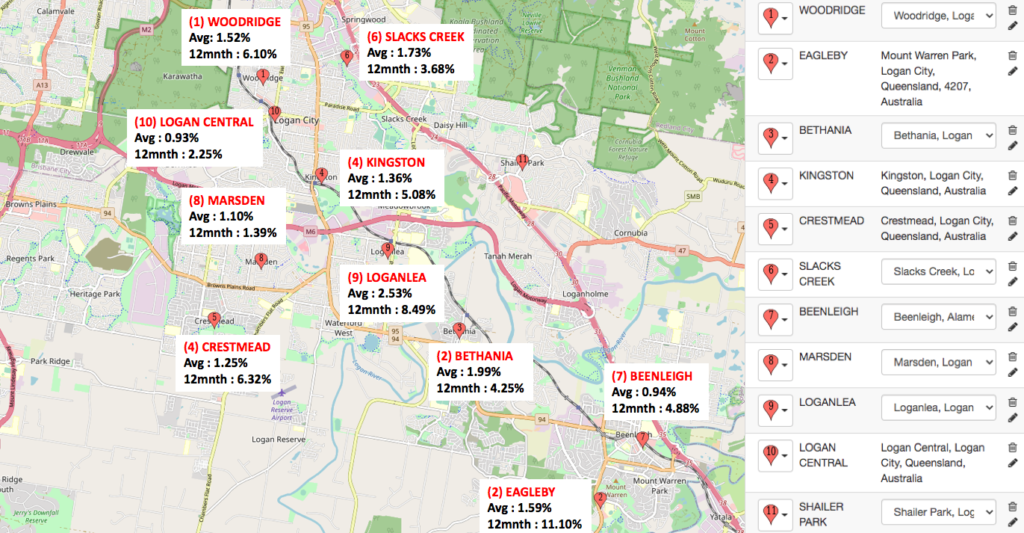

Let’s start with the one with the most properties, which is the Brisbane southern region.

Brisbane Southern Region

General overview/context of the suburb:

· From my research it sounds like Logan area suffers from a negative stigma of having low socioeconomic areas. It has been likened to being the ‘Mount Druitt’ of Brisbane in the past, and even saw some posts saying its ‘Mount Druitt with palm trees” haha.

· I’ve got a mixed bag of different opinions about this area from reading online and from talking to other investors.

The good :

o Brisbane is speculated to yet experience capital growth like Syd/Mel.

o Higher yields – might be the correct investment based on your strategy.

o Land – Can purchase much more land for a lot cheaper as opposed to Sydney.

The bad:

o Lower socio area.

o Negative stigma attached to Logan.

o May take a while to see some decent CG & gentrification.

o Poorer tenant quality.

o May have higher rent arrears/vacancies.

o Maybe most the people investing in Logan come from interstate investors/BAs (Buyers Agents) who don’t know much about the area.

Factors to consider:

· Proximity to linear transport – How close is the suburb/property to the M1 motorway or the train station?

· Understanding the train line/train stations – Knowing which stations have express trains to the city (such as Beenleigh) is useful.

· Understanding certain streets – Not all streets are created equal. Maybe there are some streets that have a bad reputation. An example is trying to find a place near the train station – I’ve read that closer to the station, there may be more derros and shitter quality people so you’d need to take that into consideration and include that in your decision. ‘Boots on the ground’ knowledge/insight from a local (may be local investor, REA, property manager, BA, etc.) will come into play here as they will have a lower level understanding of certain streets and no-go zones, etc.

· Schools – I think this is a big factor too. I read on some posts saying that there are some schools that people won’t even send the kids of their worst enemies to haha. Yikes.

· Gentrification – I think there are big plans for gentrification in Logan. I’d need to figure out where they are.

Brisbane Western Region

I spent quite a bit of time on the forums just researching a bit of this stuff but didn’t end up writing much, so I’ll just do a very ugly draft summary of what I came across haha.

I think some of these areas experience the same ‘low-socio area’ stigma to them, such as Goodna.

General info:

- In Collingwood/bellbird park/Ipswich/ Redbank plains – beware of ‘black sand’/’blacksoil’ which can cause problems on the foundation

- Consider higher council rates and insurance

· There is still a considerable amount of land out west so may take a while for CG to kick in

· While it is close to Ipswich I’m not sure there’s too much going on there. I was thinking that Ipswich might be like the ‘Parramatta’ (second CBD) version to Brisbane but it looks like there’s not much going on there.

Goodna

· Close to the train line.

· Goodna looks like it is a bit closer to the CBD like than areas of Logan.

· It seems to suffer the ‘low-socio’ status though which is bad

· It’s obviously been very slow off the ground compared to all the other suburbs in the area, however I did read about an investor believing that this area will experience soon follow growth trends too.

Redbank Plains:

· Apparently has oversupply of properties

· Low socio are with bad tenants

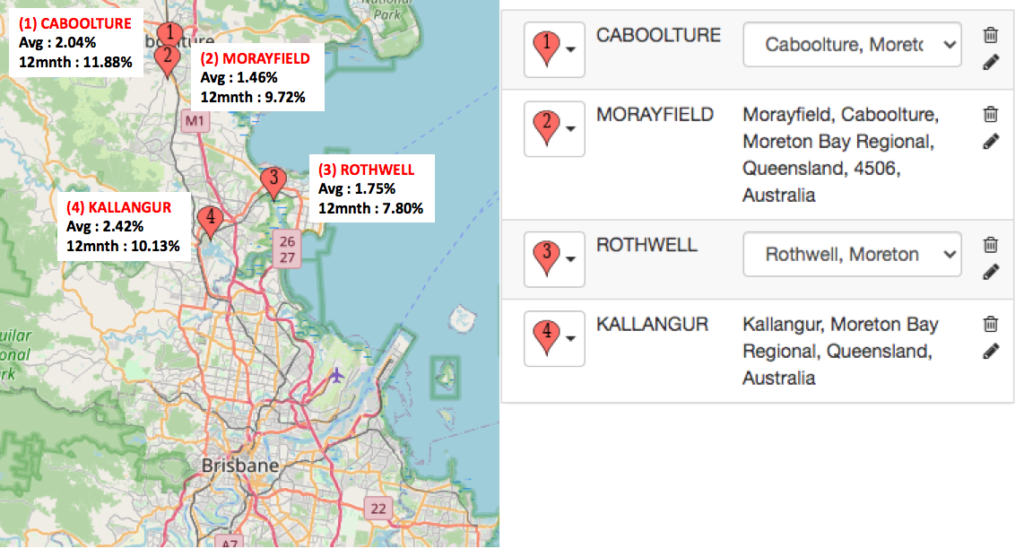

Brisbane Northern Region

I came across even less stuff about this area. Caboolture is the main one while (3) and (4) are outliers and would unlikely have properties in my price range.

If I really wanted to try to invest here I may need to speak to a true Brisbanian and understand the demographic or the reasoning people will choose to go so fat north – can it be so they’re closer to the sunshine coast? or maybe just closer to the east coast?

Anyway, here are some of the things I found about Caboolture:

• Too far out

• Low socio area

• A lot of land in and around Caboolture and will stay that way

It does look really far from Brisbane which may be a turn off. However, I have seen some posts about people purchasing there, and it also does look like it’s had a pretty good run for the past 12 months too.

Conclusion

I know some of my analysis isn’t so great. I just decided to read a bunch of posts from people and try to gather what I could to try to paint a draft rough overall picture for myself of the different areas based on what I’ve read. I do not want to get paralysed spending too much time on this for now and will perfect it later, but I have a rough idea now and I can continue to move forward. However, I do acknowledge that this is only a sliver of what is actually happening, and it’s almost impossible to know unless you speak with people with boots on the ground and actually know the areas well.

I’ve read about suburbs which seems like no investor would touch, however there is always the one who sticks out who knows the area well and really knows how to profit there. I think this is resemblant of Robert Kiyoksaki’s saying that there are good deals everywhere, you just need to ‘have the eyes to see them. You need to either have the ‘eyes’ yourself or get help from someone who does. There may be to houses in a ‘bad suburb’ 2 blocks apart, but one may be a good investment since it is a nicer street and the other might be a bad one if the neighbour demographic is poor. It all will boil down to specialised local knowledge.

So to conclude, how will I move forward? To move forward, it would be great if I spoke to some people situated in Brisbane when trying to understand particular areas so they would be able to give me their specialised Brisbane/local insights.