Hello everyone and welcome to my 13th blog post! Here we will be covering some of the steps I am taking to understand the area which I am investing in and to be able to confidently pull the trigger once my finances get approved and a good deal pops up!

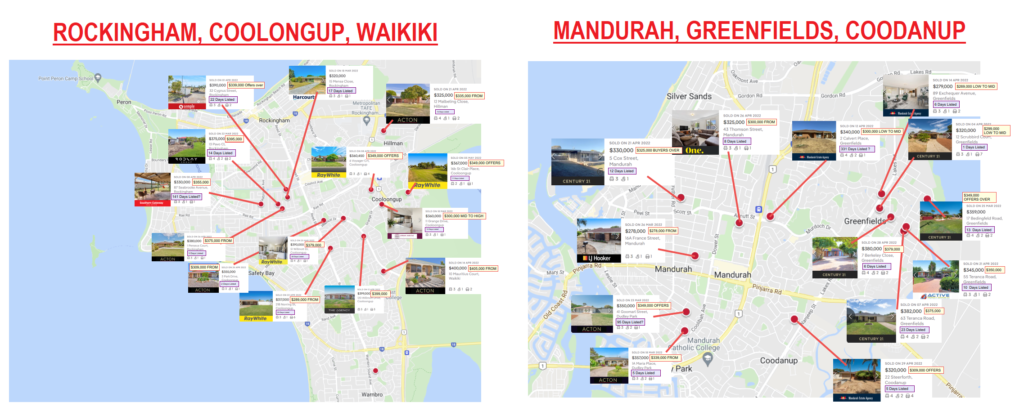

Recently Sold

I’m starting off with analysing what has been recently sold in the past couple weeks (1-6 weeks). Looking at any later data will be of no use in this hot market as prices can move quite rapidly.

I am looking at two things in particular:

· Listing price vs. Sold price

· No. of days on market

An interesting observation is that time on market in March vs. April shows that listings were a bit slower in March but a lot quicker in April, indicating that the market is getting quite hot. Also it isn’t uncommon to see offers above the asking price too in the past couple weeks.

What does this mean for me?

This means I need to:

· Be able to ‘see’ a good deal when it pops up

· Know how much I would be willing to pay for it

· Be able to pull the trigger and make an offer quickly once I am decided on it

Competence breeds confidence as people would say and I don’t think I would be able to pull the trigger if I didn’t have an adequate level of understanding of what I was doing, so undertaking the investigation of reading the data, particularly the recent listing vs sold prices & no. of days on the market should be able to give me an adequate idea of how to play in the current market for these areas.

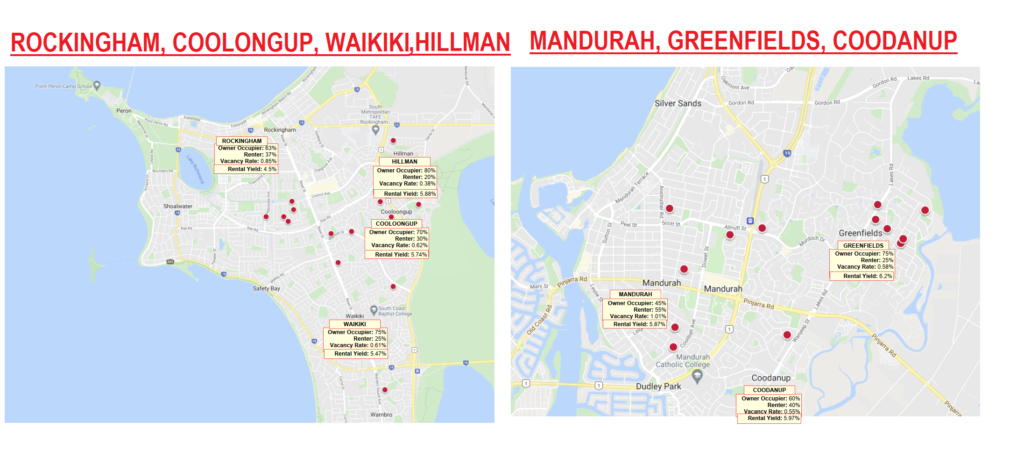

Owner Occupiers vs Renters + Rental Yield

Another interesting stat which I wanted to have a look at is the ratio of owner occupiers to renters in each particular suburb. It’s best to try purchase a predominantly owner occupier suburb for many reasons.

From my investigation I’ve found that Mandurah had a rental population of 55%! This was followed by Rockingham at around 37%. Now it’s not that I should immediately mark these suburbs as a no-go zone because of what the data tells me. People always say ‘markets within markets’ which means that there are always some areas which may perform well even if its greater region is considered unfavourable. A good example is the suburb I live in – Mount Druitt. There is a large rental population but I also know the good quiet streets/pockets which are mainly owner occupiers which are desirable.

So if I were to get something in these high rental suburbs I need to tread carefully and ensure I have some good ground knowledge to direct me away from the bad pockets/areas.

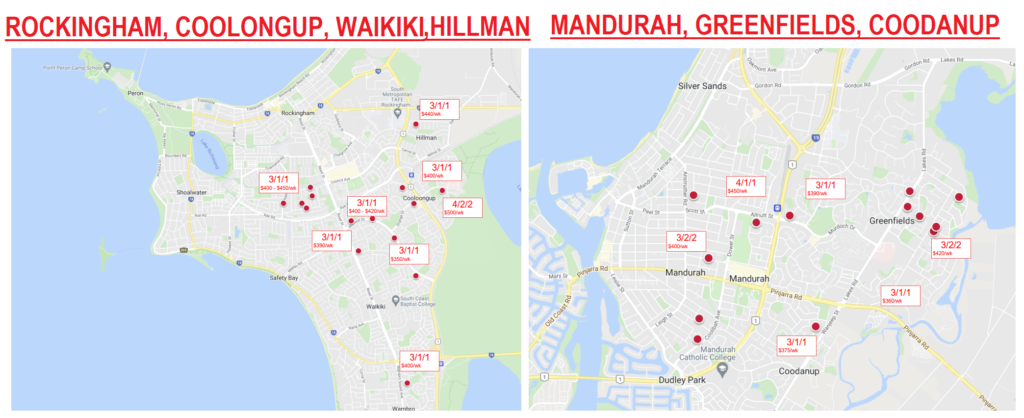

Recently Rented

I made this map to show the properties recently put up for rent as well as the building configuration (bed/bath/garage). This is to give me an indication of what I am to expect in each area.

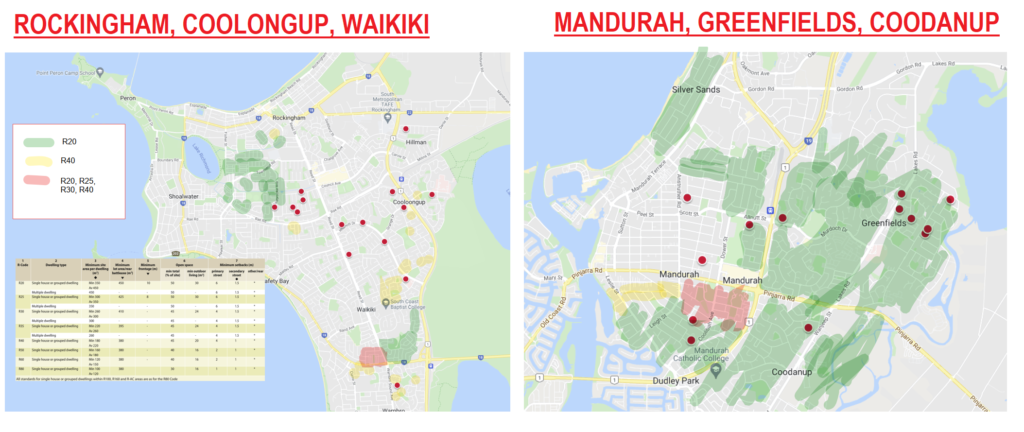

Zoning

Zoning is an interesting one and understanding this is crucial to helping me with coming to a decision of what I would like to purchase.

Before we begin I’d like to elaborate on what zoning is. Zoning determines how many dwellings can be present on a particular piece of land. Older suburbs typically have larger blocks for single family dwellings. So for example some small 3/1/1 houses can be situated on a 1000m^2+ block… which is huge – you can fit like 5 townhouses there! With population growth now and limited land there’s a push and need for higher density living… and here’s where zoning comes in. The gov may ‘rezone’ areas to be allowed to have several dwellings on a piece of land depending on the land size, as you can see on the map I’ve provided.

There are different types of zonings types per area which is quite a bit to explain so I won’t go into in this blog post. But it is important to understand as I need to be aware of this option when looking at properties.

I always like to draw similarities between the game of property with a game of chess. You need to understand your next couple moves ahead before making the move in the present moment.

My initial impressions were to make it a priority to purchase a property zoned for subdivision potential as it will give me plenty of options in the future. However there are some caveats to this:

· I think, from what I’ve seen, that the areas that are rezoned for subdivision potential are typically the older ugly 3/1/1 houses, and maybe in the uglier areas too. There is also a bit of a premium I believe due to the subdivision potential feature the land holds.

· If a place is nice and subdividable, (e.g. I saw a nice 4/2/2 corner block with subdivision potential). then it’s out of my budget.

So ultimately if ive concluded that if I were to go down the subdivision route, then this ‘chess move’ means that:

· I will get lower rental yields with such properties

· However I will get better yields in the future should I decide to subdivide and develop

As of now, the direction I would like to go is to go down the conventional route I was thinking of before which is just to get a decent yielding place in a high growth potential suburb and to maintain a decent cash flow for future purchase.

However, I won’t entirely close the door on a subdividable property – if a good deal pops up, I would still put some honest thought and consideration into it.

Members of my team

Property manager

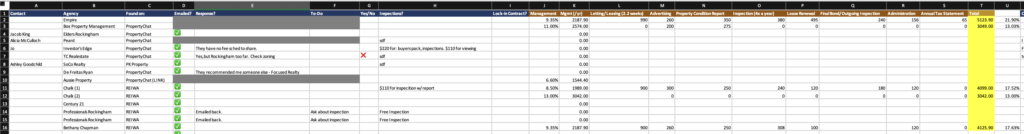

I’ve tried to speak to as many property managers as I can to see who would be a good fit for me. Also I wanted to understand how the fees operate, as WA seems to be quite different as the fees are a lot higher over there for PM’s.

Anyway, what I wanted to try to accomplish with speaking to the agents was to gauge their level of service and how can they can assist me with my property purchase. PMs are if not the most important member of your team as they:

· Understand the market – prices of houses, prices of rent

· Are your ‘boots on the ground’

· Can give you valuable local knowledge

I think I have found the right PM for me who services the areas I am targeting.

Solicitor

My choice for the solicitor was a unanimous decision as everyone on the PropertyChat forums seemed to all recommend this one solicitor.

The solicitor is also another important member of my team because they can help you understand the ins and outs of the legalities of the buying process in the particular state. This is crucial because different states operate in different ways and the buying process has its own different set of rules in WA, as opposed to say QLD… and I’ve heard WA to be called a ‘buyer’s beware’ state as it operates primarily in favour of the seller.

So one example of this would be in WA (as opposed to QLD), you cannot terminate a contract using the B&P clause unless there are structural issues. In QLD however, you can terminate without cost to yourself if there is anything which for some reason you do not like.

Getting a solicitor who can help you understand the legalities and the process is crucial, especially when conducting an interstate purchase.

What makes it a lot more difficult to add on top of purchasing interstate unseen is you need to be able to act quickly in a hot market. So having a good solicitor able to assist you ASAP when the trigger is being pulled is crucial.

Pulling the trigger

Currently my plan to pull the trigger are:

1. Shortlist 5-10 properties which I like

2. Send to PM

3. Ask PM to give me top 1-3

4. Get REA to do video walkthrough of place and send a lot of pics

5. Send to PM for opinion

6. If I like it, ask REA for contract

7. Get solicitor to review contract and if all good, make an offer

a. Once offer is made, no turning back unless B&P show for structural damage