Hello and welcome to the second part of my financial roadmap! This is pt.2 as this is for investment property #2 so I would like to cover how I am drawing on equity from property #1 for the second purchase.

I thought this blog would be useful because I had no idea prior to this how a refinance would work and how drawing equity works.

Refinance

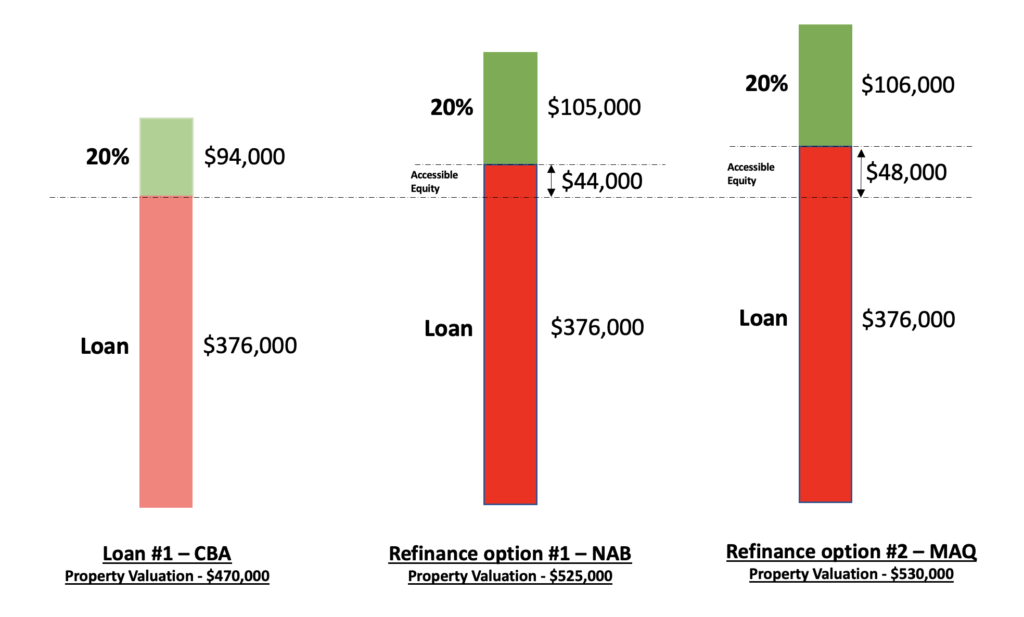

The purpose of a refinance is to be able to ‘draw equity’ from your property, where the equity comes from the appreciation in value. In a refinance, your house is revaluated at its current market value. The accessible equity will come from the difference between your new loan and your old loan. This accessible equity is what I’ll use for the downpayment for my next property purchase.

Here is a table of the valuations which I received from three different lenders at 80%LVR:

|

Lender |

Valuation Type |

Assessed Value |

|

AMP |

Full |

$490,000 |

|

NAB |

Kerbside |

$525,000 |

|

MAQ |

Full |

$530,000 |

Unfortunately the valuation for AMP was unfavourable, so we will consider only NAB & MAQ. Here’s a visual of what the refinance of my first property will look like:

After the refinance, there will be the ‘accessible equity’ which I can use as part of my downpayment for the next property.

Here is a small summary of the features of each of the loans:

NAB | MAQ |

❌ Less equity❌ Slightly bigger interest rate✅ $2,000 Refinance Rebate (refund) ❌ Poor serviceability & many conditions to meet for loan including: · $440/wk rent · HECS fully paid off · $1000 credit card limit

| ✅ More equity ✅ Slightly lower interest rate ❌ $0 Refinance Rebate (refund)✅ Better serviceability/more borrowing – rent-free/living at home letter accepted

|

It looks like MAQ is the better option here so I will most likely go with them. NAB sounds too difficult and I don’t want to pay off my HECS + I feel that the $440/wk rent criteria may be difficult to meet and may cause potential problems during final approval maybe – so I’d prefer MAQ since my chances of loan approval will also be a lot better with them.

Regarding the loan for my next purchase, we’ll need to go with a lower tier lender – this is because I am quite limited in serviceability with my income.

Calculating Funds

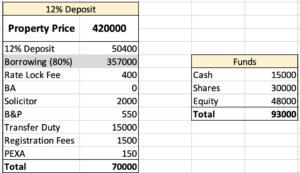

For the next property I am intending to have a lower budget of max $420k. Ideally I’d like to be purchasing around the $400k mark however I’ve put $420k just in case for conservative calculations.

I am estimating approx. 70k in upfront funds required to make the transaction. If I have $48k in equity then I’ll just need to fork out $22k out of pocket, through my savings + some shares to be able to fund the deal. Going no BA also definitely saves a of money! Also, I’d feel comfortable having some cash reserves going down this 12% deposit route (I don’t think I could have done 20% even if I tried, and if I got close then I’d have $0 in savings which would not be ideal).