Hi everyone and welcome to another one of my property posts! It’s been a minute haha. In this blog we will aim to explore the investing prospects in Perth.

The study of the Perth market is something very new to me. As ignorant as it sounds I had very little clue of what was been happening in Perth in the last decade – all I knew before were from bits and pieces I’d hear about the mining booms and busts. So in this blog I will aim to explore many different aspects of the Perth economy and housing market, including the history and past performance as well as where I think Perth may be heading in the future.

There are a lot of resources I have used for the creation of this blog post. However I would like to make some honourable mentions for the sources in particular which gave the most value:

https://www.youtube.com/watch?v=T6f_Z1b94Uk

https://www.youtube.com/watch?v=XnstL6xXhYM

History of the Perth market

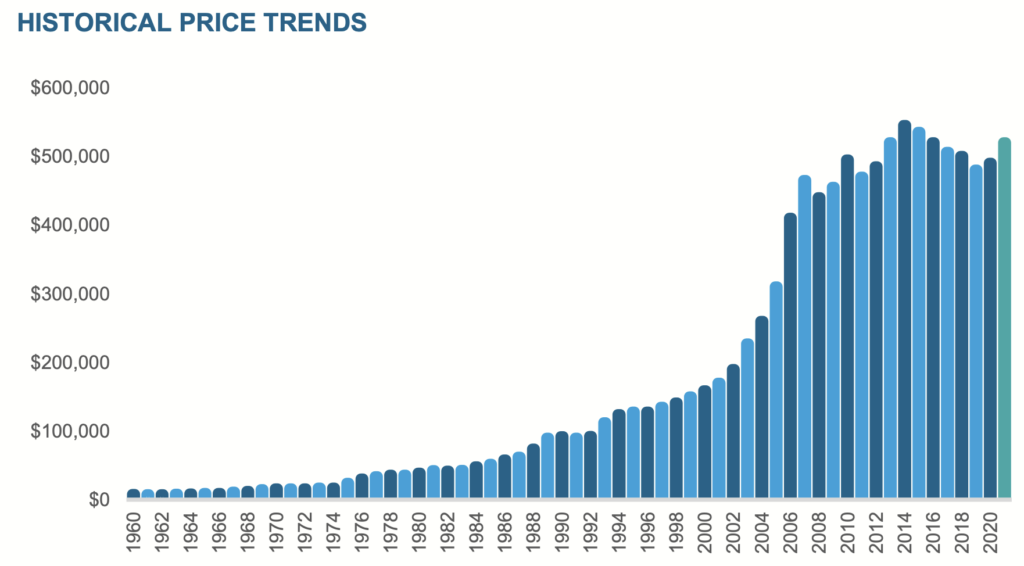

Perth experienced a mining book from 2001-2007, which contributed heavily towards its rise in the property prices. By the same token, a slow down in the mining industry directly lead to a slow in the property prices. So its undeniable there is a correlation between the mining sector and the general health of the WA economy.

Perth Economy (past)

As we know, Perth experienced a mining book from 2001-2007, which contributed heavily towards its rise in the property prices. By the same token, a slow down in the mining industry directly lead to a slow in the property prices:

“According to research by Savills, house price growth has correlated directly with increases in employment directly related to mining. Between 2003 and 2013, direct mining employment in Perth rose from 44,491 people to 101,698, an increase of 128 per cent. During that same period, median property prices rose 113 per cent to an average A$535,000. By comparison, property prices in Sydney grew 30.2 per cent during this same period, rising to a median of $651,000.”

– Source: https://www.ft.com/content/0fe89674-bb1b-11e3-948c-00144feabdc0

So it looks as though a big factor of the economy of Perth is very uncertain as it relies on the mining sector which is influenced by a variety of factors. E.g., growth of China, scaling of projects by engineering firms, etc.

Currently, the mining industry sector makes the greatest contribution to economic output in the region, which accounts for 42.5% of the total output.

– Source: https://app.remplan.com.au/perth/economy/summary?state=41DpcOPRjIkymxmsr8PmJLCYh5hAya

We’ve seen how with historically this state’s strong reliance on mining that it has become a ‘boom and bust’ town susceptible to what’s happening in the mining industry, making it quite a ‘risky’ place to invest which goes against a lot of the property investing fundamentals (such as looking for places with strong and reliable industries such as hospitals). And historically, we’ve seen that a reliance on one industry is a terrible way to go.

So with this being said, why the quokka am I thinking about investing in Perth!? There are two main reasons:

1. Perth on the property cycle – Perth has been quite stagnant for the past 10 years or so. There are some potential factors which I’ll cover below which tell me that Perth may be at the beginning of the boom phase (with data to support that this is not going to be driven entirely by mining).

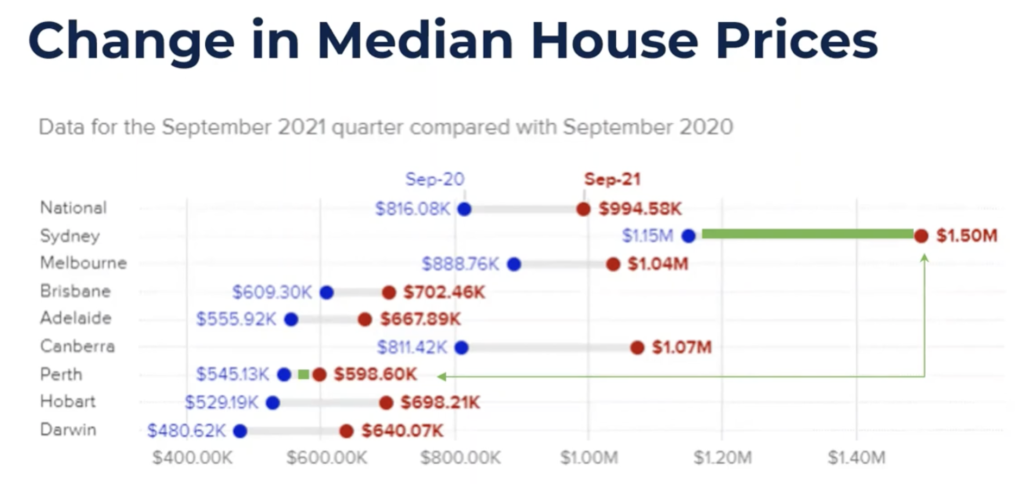

2. Affordability – Prices are still extremely low. You can still buy a place in Perth at 2014 prices! Also right now, Perth has the cheapest median house prices out of all of the capital cities. Tie this in with point number 1 and it really does put it on the radar for potential place to invest. This low price point also means for positive cash flow, which is the perfect ingredient we need for building a property portfolio!

Perth industry

As mentioned above, the mining industry sector makes the greatest contribution to economic output in the region, which accounts for 42.5% of the total output.

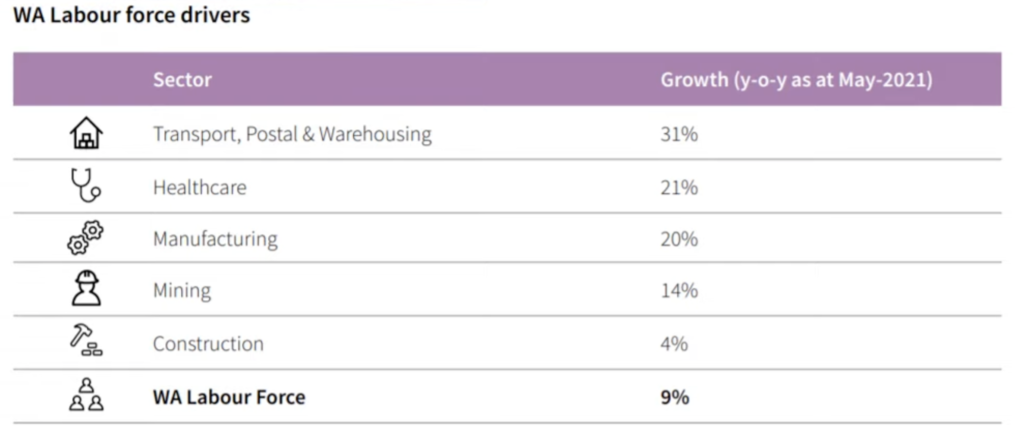

The government now is trying to diversify the economy and make it less reliant on mining to try to ‘future-proof’ the economy and make it not so susceptible to the fluctuations happening in the mining sector.

“The economy’s concentration in primary production exposes the state to extreme volatility, especially given the pronounced fluctuations that typify commodity price cycles,” explains Dr Bond-Smith.

By strengthening its other industries, WA can better counter-balance mining’s peaks and troughs, and ensure the state isn’t left behind as the world moves towards new technologies and a knowledge-based economy.

Source: https://news.curtin.edu.au/stories/moving-beyond-mining/

There are also some indicators which show that the economy may be changing

There has been significant growth in sectors other than mining:

· Transport, Postal & Warehousing

· Healthcare

· Manufacturing

I believe that the contribution of these other industries will continue to rise for Perth, especially with the $1.5 billion Perth City Deal, summarised below:

“This City Deal partnership between the three governments will focus on the Central Business District and support Perth’s recovery and positioning as the best of Australia’s west, through:

· creating jobs and supporting private investment in the CBD, particularly in areas that will support future economic growth;

· enabling an energised and vibrant city centre that attracts residents and visitors and demonstrates the best in inner-city living; and

· building a strong community that is inclusive, safe, sustainable and liveable.

The City Deal will invest in projects that deliver economic stimulus catalysing over $1.5 billion of investment in CBD projects and creating in excess of 7,500 construction jobs in the city, with projects kicking off in earnest.”

Perth employment

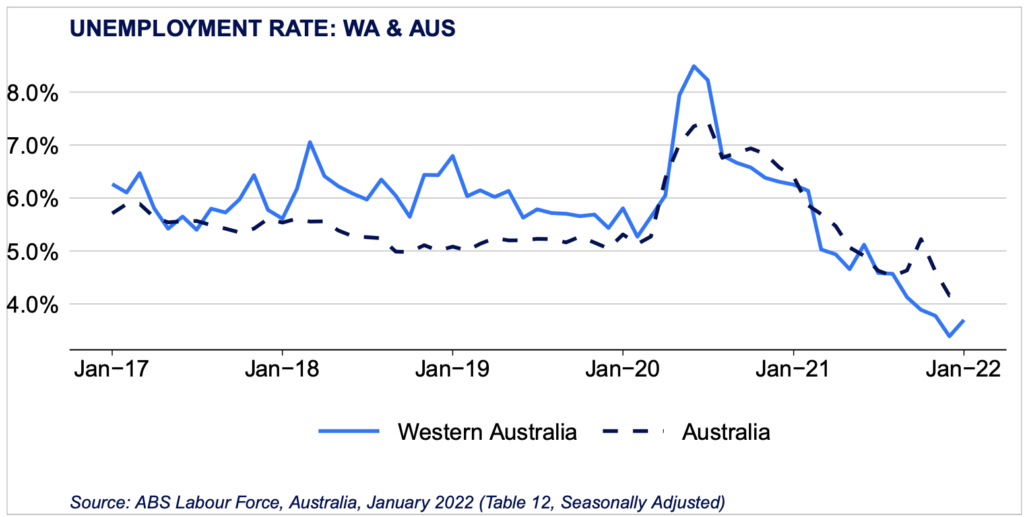

As i mentioned, there was a long period of time after 2011ish where unemployment rates were high and it was a struggle for people, particularly ex-miners, to find employment. The graph below shows the unemployment rate for WA and Australia the past 5 years.

So over the past 5 years we can see that WA has generally had a higher unemployment rate than the rest of Australia. However, post-pandemic and from January 21 onwards, the WA has had a lower unemployment rate than the Australian average!

In the graph above, we can see that WA has the second lowest unemployment rate in Australia.

Change in median house prices

From the graph above, we see that Perth:

· Had the poorest performance in price growth from September 2021 – September 2022

· Is now the cheapest capital city to invest in. It has now been overtaken by Darwin & Hobart.

Rental Demand

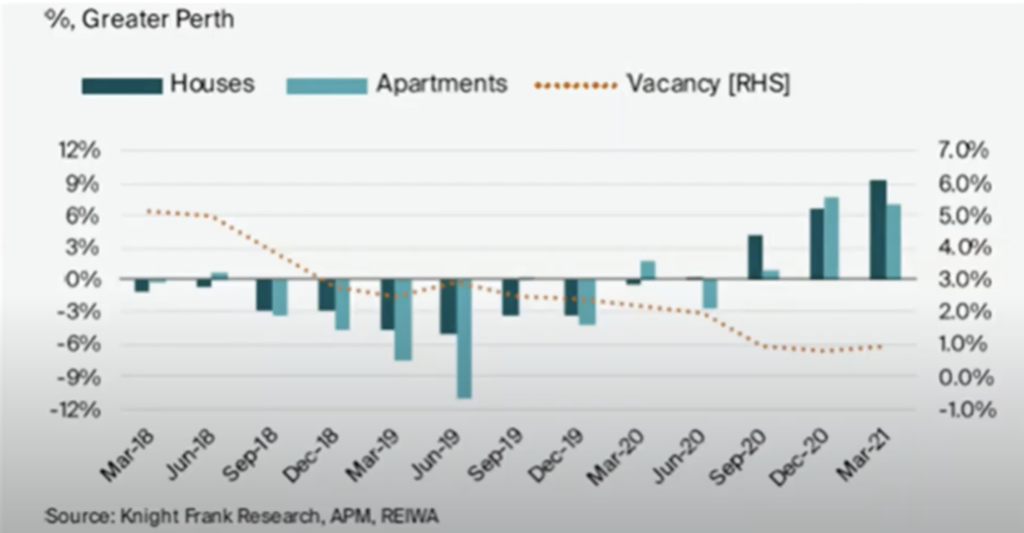

Perth and Adelaide have some of the best rental demands in Australia.

There is a relationship between rental demand and the price of houses. Low vacancy rates means that there is a shortage of places available for rent. This causes rent to go up cos of the low supply, but also because people are willing to offer more just to secure a place to rent. So how does this affect property prices? When rent is expensive, it is not uncommon for people to deliberate upon themselves whether it might be cheaper in the long run to just purchase a property instead of renting, so a lot of people will start to seek buying a place instead, creating demand in the property market.

“Typically, a vacancy rate between 2.5% and 3.5% represents a balanced market.” – riewa.com

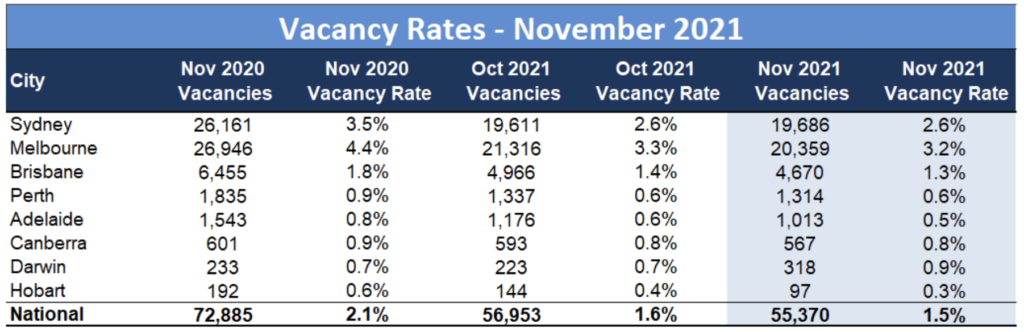

Now let’s look at what the vacancy rates are for the capital cities of Australia right now:

Note: this is just a generalised statistic for the capital city as a whole. We’ll need to do some further research and deep dive into the particular suburbs we will be targeting. So for e.g. the ideal scenario would be purchasing in a nice suburb which is already established and where there is no extra room for additional supply to be added.

The graph above supports the idea that there is an inverse relationship between vacancy rates and property prices.

To BA or not to BA... that is the question

The time has come again where I have to ask myself… to BA or not to BA, that is the question…

This is a something I had really asked myself last year and I had originally thought to do it without a BA, however I ended up changing my mind and going with a BA for a variety of reasons. The main reasons being:

· Overcoming fear – purchasing my first investment property was the biggest financial commitment I had made in my life thus far, so pulling the trigger wasn’t going to be a walk in the park.

· Overcoming analysis paralysis – this was my first purchase so there were a lot of variables and other factors I was unsure about.

Currently, I seem to have come across quite a few resources which point towards going down the route of doing everything yourself and not going with a BA.

Maybe I should give it a bit of a go first and tell myself I can try do it without one.

Conclusion

To conclude, I would say that overall, I am bullish on Perth.

There are a lot of things which make Perth a really attractive investment prospect, including:

· Capital city with the lowest median house prices in Australia – As we can see, the ship has sailed for all the other capital cities, and Perth hasn’t (or is at the beginning of) leaving shore to set sail to the moon. (hopefully…).

· Hasn’t had a boom yet – I do believe there are a lot of indicators hinting that Perth may begin its boom, which I have covered in this blog. The common traits about savvy and experienced investors is that they buy into the market before the wave/boom, so I believe that what Perth offers is that opportunity to purchase cheap before the boom.

· Higher yields – Lower purchase price means higher yields, meaning positive cash flow! This will allow us to hold onto the asset without being out of pocket… the opposite actually, we’ll also be getting money from it. Although it won’t be much (~1k a year or so I’m guessing), the good thing is that your serviceability won’t be so cooked as opposed to you purchasing a negatively geared property.

· Government incentive to make Perth stronger in other industries and less reliant on mining – The Perth City Deal which was started around late September is a good indicator of this shift. I have also read about things like WAxit which is this push by WAers to make Perth its own independent state – one of the main reasons is that WAers are saying they are carrying the nation – which they are, in a way, with their mining exports. I think this may have something to do with the gov play friendly and try to help them with growing and all that other stuff.

Steps Forward

I have a decent amount of background knowledge about Perth now and am confident in possibly investing here. Now the next steps I’ll need to take is to do some high level research, just like I did for Brisbane, to get a better understanding of:

· Create a map of the suburbs I can afford in the north & south. Criteria will be 4/2/2 with 500m^2 for ~420k.

· Blast through tonnes of PropertyChat forums to get an understanding of the areas. Which areas are full of yobbos and low socioeconomic folk? Which areas are nicer and have more of a family feel? Etc. Like Brisbane, there is a north and south of the river – is there a preference for one over the other?

After all this research stage I’ll have a better understanding of specific areas I’ll want to target, and that’s when the game begins. I’ll need to start forming relationships with the relevant parties (REAs, PMs) to put myself on the radar of a keen and eager buyer who knows wtf they’re looking for so if a distressed or off-market property does pop up, they’ll know who to call.

In the beginning of May I’ll likely begin sorting out my finances – as my mortgage broker has said to wait 90 days post settlement to then get a revaluation on the property. I am estimating at least 50 – 80k equity in the property.

From the top of my head, I think there is one thing which I need to really understand, and this is to learn if there is anything I can do to make me more attractive to the seller. So I read things about people saying buyers would want to go with them if they know they are going to be able to quickly settle, or like the ‘cash offers’ things? I think being able to know my flexibility in the loan settlement and being able to cater it to the particular seller’s unique needs may be an element which will ultimately help me in securing a fair priced, or even below market value property.

The road ahead may be long, and there’s lots to do, but it will be worth it in the end! Till next time, cya in the next blog .