We use these monthly updates as a tool to keep us accountable on our journey.

Hello and welcome to our September monthly update!

Mr. Shift

Month | ETFs | Cash |

July | $57,107 | $3,457 |

August | $59,215 (+3.69%) | $7,362 (+$3,905) |

September | $58,845(-0.62%) | $3,000 (-$4,362) |

October | $57,860(-1.67%) | $6,461.44 (+$3,461.44) |

Quest items completed (from last month)

During October I completed the following quest items:

· Begun engagement with a buyer’s agent

· Got my pre-approval

· Started looking for potential property managers – I will need to get a recommendation for one in a particular area for this.

Monthly Summary

· I’ve paid my initial retainer fee for the buyer’s agent, which means they will begin to search on properties on my behalf. I am yet to create a blog post exploring my quest for finding a buyer’s agent and my research before finding one I was happy with.

· I’ve finally got my pre-approval! Here are my pre-approval details:

o Commonwealth Bank

o IO investment loan

o Pre-approved for $433,900.00

o Conditional pre-approval until 21 April 2022

My current trajectory

Unfortunately, I fell into a bit of a rut since I didn’t set too many goals for myself after pre-approval an engaging with a buyer’s agent, which was early on in the month. I think I need to set out new goals in the meantime while I’m waiting for other third parties to do their thing. I need to remind myself that at any given moment there is opportunity for me to do something which will help me drive forward to a better future.

Also, in my blog post detailing my Financial Roadmap I was in a bit of a conundrum and was unsure whether I would go for 20% deposit or 12% deposit. I guess I will just have to decide based on the property which is offered to me!

Next month’s quests

· Create a blog post about finding a buyer’s agent, what to expect, etc.

· Create a draft skeleton of my mega-post which will detail my whole property investing journey from A->Z. Hopefully other people can refer to this when they are starting their own property investing journey :-).

· And of course, most importantly, secure my first property!

Mrs. Shift

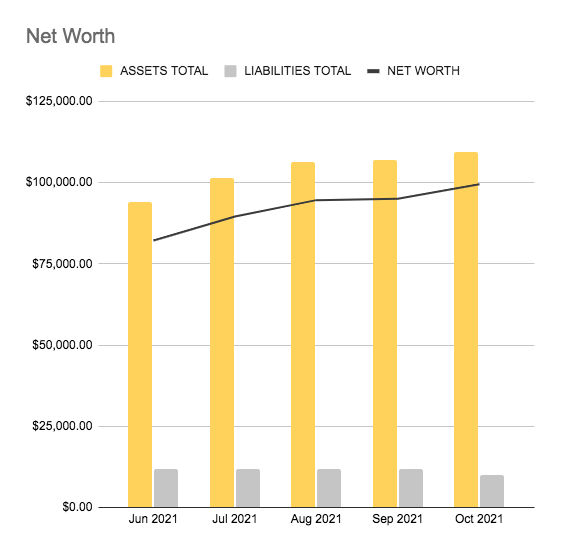

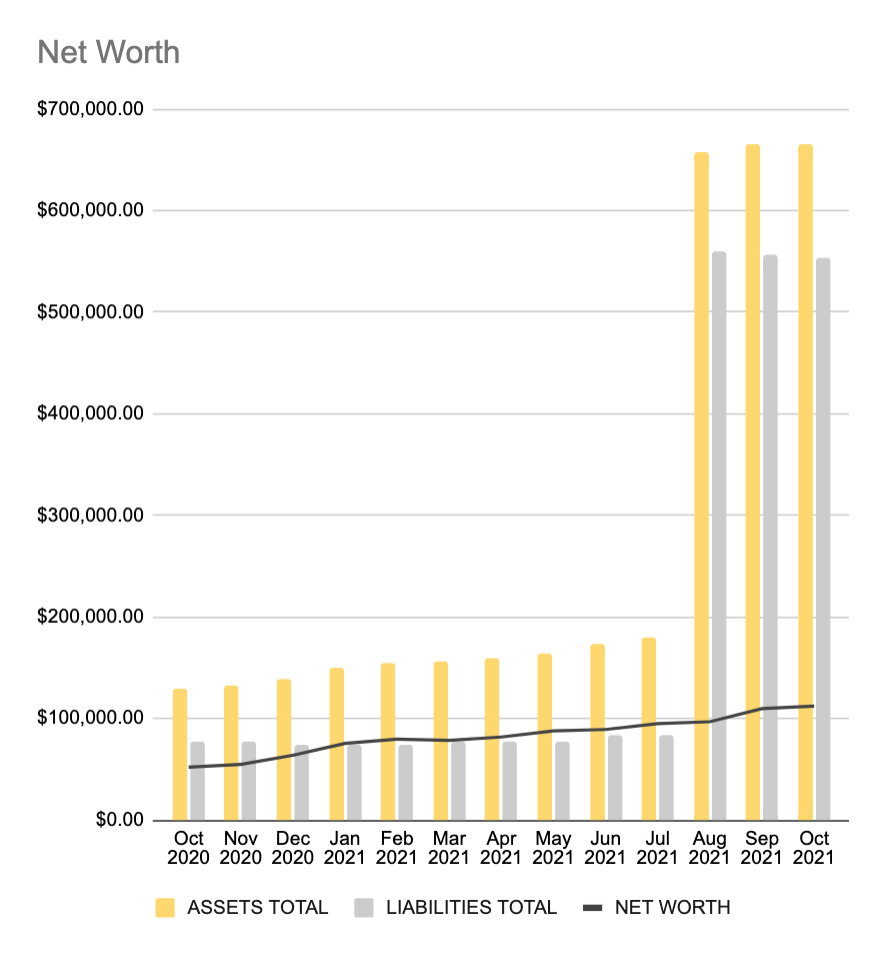

Networth Update

Portfolio/Cash update

Month | Stocks | Property | Cash |

July | $22,258.85 |

| $65,466.94 |

August | $23,365.76 (+ 4.97%) | $530,000 | $25,940.71 (- $39,526.23 ; for deposit) |

September | $19,619.56 (- 16.03% ; sold shares) | $535,000 (+ 0.09%) | $30,830.07 (+ $4899.36)

|

October | $19,967.57 (+ 1.77%)

| $535,000 | $29,982.25 (- $847.82)

|

Lockdown finally ended in Sydney. It also meant that I bought quite a few things I didn’t buy whilst in lockdown. The main expensive thing I bought was a couch, but all the small things still added up to be quite a bit. My first quarterly Strata, water and council rates bills also came around this month, and as such each quarter will have a similar hit to my cash savings.

As Christmas approaches, I can already anticipate that I’ll be spending a lot on presents over the next two months. Furthermore, I’m graduating in Melbourne next month, and this means that I know I’ll have to spend quite a bit on the ceremony, the memorabilia, and the flights to and from Melbourne. Hopefully early next year I’ll have more capability to save more in cash.