Introduction

In this blog post I will cover some of my learnings on how to navigate through the finance world of property investing, and I will go over my potential stepping stones as well as some options my mortgage broker has given me.

One extremely insightful book I have read about Australian property is ‘Australian Property Finance Made Simple’ by Konrad Bobilak. In his book, there was one topic which stood out to me, which was: ‘Property Investing is all about Debt Structuring’

There are some extremely useful insights here from the truly successful property investors. Here are some main take-aways I got from the chapter:

· It’s your understanding and ability to access and structure your finances which will ultimately lead to determining your long-term wealth – not your skill in property selection (however that still does play a big part).

· Investing is not about the property itself, it’s all about structuring finance (good debt) correctly.

· From Konrad’s years of observing property investors, 80% of their focus is on creative deal structuring and debt accumulation, while simultaneously maximising their usage of OPM (Other People’s Money) via LVRs, and only spending 20% of the time on due-diligence on the suburb/actual property itself.

Since I am not a successful property investor {yet}, my mindset and understanding is quite limited and these new ideas seem foreign to me. I’ve always thought of property investing to be 80% about the property and 20% about the financing, and not the other way around.

It might take me a while to wrap my head around this idea. Nevertheless, I will still try my best to do the right amount of due diligence on both the property and the finance side of things before my first purchase regardless.

From one property to the next

I’ve mentioned in previous blog posts that an important mindset of the successful property investors is to have a long term view of structuring their finances’ in particular, asking the question of ‘how will this property I buy be financed in a way which will allow me to purchase the next?’.

I like to think of the analogy of playing chess. Each chess piece has its own unique move and ability it can do to play the role of leading the player to win the game. Currently, I need to figure out which pieces I am able to move, and understand the future implications of my decision now.

So ultimately what I need to do is to create a road map for myself, to the best of my ability. I’ll run through some of the financing structures my mortgage broker has given me, then move forward from there.

Things to keep in mind

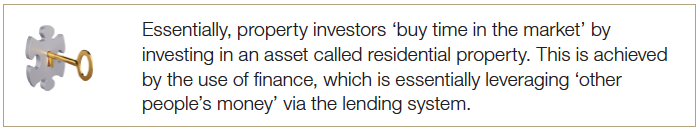

One thing to keep in mind with your strategy is the investment tiers. Ideally I would like to start with the lenders which have the strictest lending criteria. The logic behind this is that you start with the most difficult first, and as your serviceability decreases then you will step down a level in the lending tier. This will depend on my plan and my unique circumstance at the time.

My Options

These are the three main categories of options provided to me by the broker:

· Option 1: Investment Loan – Interest Only (x2)

· Option 2: Investment Loan – Principal + Interest (x1)

· Option 3: Home Loan – Principal + Interest (x2)

Investment loan

Stepping Stones

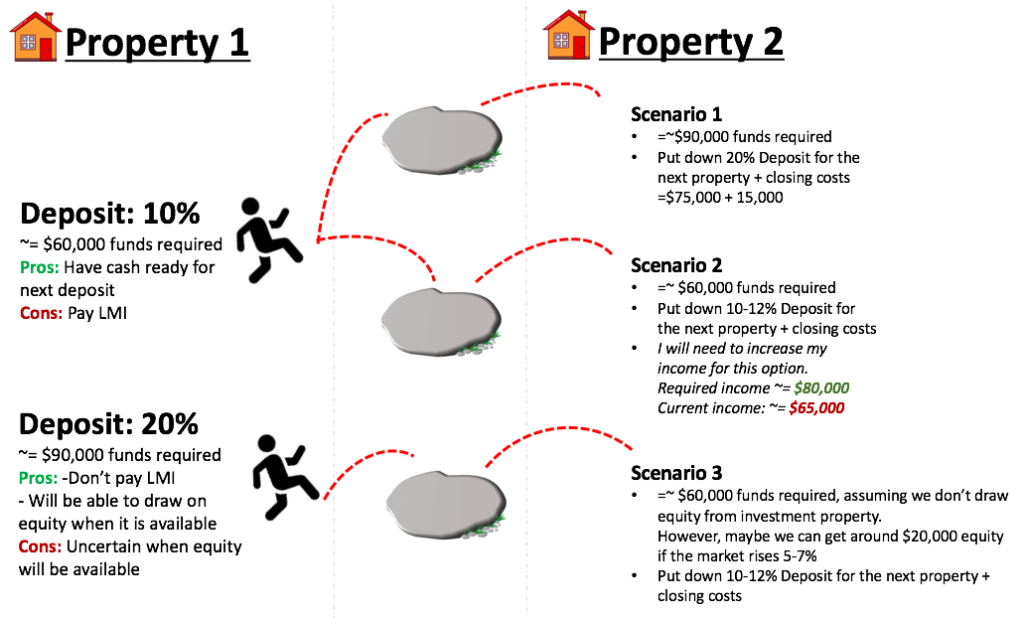

I’ve created a draft below to highlight my understanding of my potential moves to get the second property if I were to do a deposit of ~10% vs a deposit of around 20% on my first.

I am also assuming IO loan in both these cases. I will need to confirm this with my mortgage broker to see if my understanding makes sense and if my serviceability meets these potential stepping stone scenarios I have sketched out.

I am speculating between paying a smaller deposit and LMI (12% deposit) vs. a larger deposit and not paying LMI (20%).

Note: 12% was the number given to me by my mortgage broker and they said it’s the most optimal % of LMI to pay which optimises the LMI fee.

Why pay LMI?

Property investors may be turned off by LMI but it can serve also serve as your friend in two ways:

· Gets you in the market sooner. A useful philosophy I learnt in stock investing is ‘timing in the market beats timing the market.’ Or in other words, get in the market as soon as you can. Of course there can be crashes, however no one has a crystal ball and getting in when you is the best option. I’ve referenced a study of lump sum investing vs dollar cost averaging when investing (regarding stocks) over here ______, which I believe may be relevant to this topic. Paying $5,000 for LMI may seem like a lot of money, but say if it gets you in the property a year earlier than if you saved a 20% deposit, and the market goes up by 7%, then for a $500,000 property then you would have realised $35,000 in capital gains!

· Can view it as a premium you pay to have liquidity – Paying LMI doesn’t always mean you’re doing so because you don’t have enough money. People who can afford 20% may still decide to pay LMI to have their money liquid and ready to buy other investments if they do pop up. This is the financing option we decided to go ahead with for Mrs.Shift upon her first purchase.

Why pay the full 20% down payment?

· Ability to draw on equity after CG – After your property experiences Capital Gains (CG), then if you have 20% down then you would be able to draw on the equity from appreciation.

· No LMI – I guess this is one upside to it, but in my opinion I do not think avoiding LMI should be your sole reason for putting down 20%. I think this should be the cherry on top.

My 12% vs 20% argument

I am debating on whether I should go with the 12% or 20%, and here are my two main conclusions.This is assuming I sell $30k worth of ETFs to get to the $90k mark to fund the 20% deposit.

| 12% Deposit | 20% Deposit |

Finances | -~ $60,000 cash up front

+$30,000 extra in liquid cash | -~ $90,000 cash up front

-$30,000 in liquid cash |

Speculation to justify going down this route | I think my property will not appreciate more than $30,000 (8%), therefore it will be better to go this route so I have liquid cash for a down payment for my next property. | I think my property will appreciate more than $30,000 (8%), therefore it will be better to go this route so I have liquid cash for a down payment for my next property.

Therefore, I’ll go down this route and can draw equity to help as a down payment for the next property. |

Note: I will need to validate my logic with my mortgage brokers since there may be a lot of things I may be missing out on, since this is my first time doing things J. One potential pitfall I may come across is: how easy will it actually be for me to draw on equity from the property even if I’ve paid 20%? How does that work? Do I need some fancy refinancing or whatever and pay a premium for me to have access to these funds? I have no clue – I need to look into it more haha. But if these factors are in play then it will make a significant impact on my decision moving forward.

Investment loan options from my mortgage broker

When I made an inquiry to my mortgage broker, I told them I had approximately $60k down payment to work with, and received options based off that. I haven’t yet explored the financing options assuming a 20% down payment – so I’ll just go over the 10-12% down payment options.

Here are two of the three options my mortgage broker has given me for the investment loan:

| Investment Loan | |

| Interest Only (IO) | Principal + Interest (P&I) |

Purchase Price (& Rent) | Purchase price: $375,000 | Purchase price: $375,000 |

Loan Split | 88% LVR = $330,000

$4,800 LMI (to be capitalised on the loan)

Split 1 – Investment: $304,800 IO (5 Years IO, 25 Years P&I) Split 2 – Investment: $30,000 IO (5 Years IO, 25 Years P&I)

| 90% LVR = $337,500

$7,800 LMI (to be capitalised on the loan)

Split 1 – Investment: $307,800 P&I Split 2 – Investment: $37,500 P&I

|

Interest Rate & Repayments | Total = $735/mth

Split 1: 2.49%, IO 2 Years Fixed, $633 per month Split 2: 4.07%, IO Variable, $102 per month

| Total = $1,351/mth

Split 1: 2.30%, P&I 2 years Fixed, $1,185 per month Split 2: 3.36%, P&I Variable, $166 per month

|

Funds Required | Total Funds Required = $60,200

Deposit 12% = $45,000 Stamp Duty = $12,700 Solicitor = $2,500

| Total Funds Required = $52,700

Deposit 10% = $37,500 Stamp Duty = $12,700 Solicitor = $2,500

|

When I made an inquiry to my mortgage broker, I told them I had approximately $60k down payment to work with, and received options based off that. I haven’t yet explored the financing options assuming a 20% down payment – so I’ll just go over the 10-12% down payment below.

Principal + Interest (P&I)

With this option I will be paying $1,351 per month.

Interest Only (IO)

With this option I will be paying $735 per month.

P&I versus IO

I am leaning more towards the IO for the following reasons:

· If I do go down the route of borrowing money from my parents to use as a down payment, then I’ll need to pay them monthly too. If I were to add a principal payment on top of that as well, that would be quite a lot of money gone each month.

· P&I is giving me less money to spend on my next property, unless of course I make it to the 20% mark and get the ability to release equity.

· If I don’t aim for 20% to release equity, then P&I doesn’t make sense since I’m just servicing a tax-deductible debt. Might as well put the money to work elsewhere.

Home loan

If I go down the PPOR route, here are some of the advantages I would experience:

· I would get a stamp duty concession waiver courtesy of the first home buyers scheme (~$18,000 savings) [woohoo!]

o Side note: In all states (except QLD), you are can even buy your investment property first and STILL be able to be eligible for the stamp duty concession for your first PPOR.

· I’d have a lot more borrowing power (looks like +~$100k judging from the options given to me by my mortgage broker)

· I may be eligible from capital gains exemption for up to six years after purchasing the property. So for example, if I buy a Primary Place of Residence (PPOR) in Mount Druitt and move in for 6 months, then decide to move to the CBD for work and rent a place to live in, then rent my place out WITHOUT changing its status as a PPOR, then within the 6 year window upon first purchasing the place I would be exempt from capital gains tax IF I decide to sell the property.

I’m pretty sure with my initial ‘strategy chat’ with my mortgage broker, they did seem to suggest that there were tax benefits with buying as a PPOR, and I think the six-year rule is what they meant. I cannot seem to think of any arguments against this option and it does seem like a really good way to go.

What are my worries?

· I am currently thinking of investing in QLD but unfortunately with the pandemic, I’m unsure of moving interstate as border closures seem to be able to pop up at any random time, and then that means I can’t visit NSW.

· There may potentially be some difficulty in me moving states – will see if work allows. I’ve looked it up and my company does have an office in Brisbane, so I think if I put forward a good case, then they may let me move up there for the time being.

· From what the mortgage broker has told me, an interest only loan is not available for a primary place of residence. I need to understand why this is the case – is it for all first home owners? Or is it maybe because my down payment is only 10%? Is it possible to get an interest only on an owner occupier home loan? I will need to clarify these things with my mortgage broker.

Home loan options from my mortgage broker

| Owner Occupier Home Loan | |

| Principal + Interest (P&I) | Principal + Interest (P&I) |

Purchase Price (& Rent) | Purchase price: $480,000 | Purchase price: $445,000 |

Loan Split | 90% LVR = $432,000 $9,400 LMI (to be capitalised on the loan) Split 1 – Owner Occupied: $379,400 P&I Split 2 – Owner Occupied: $62,000 P&I

| 86.96% LVR = $387,000

Split 2 – Owner Occupied: $37,000 P&I

|

Interest Rate & Repayments | Total = $1652/mth

Split 1: 1.99%, P&I 2 Years Fixed, $1,401 per month Split 2: 2.68%, P&I Variable, $251 per month

| Total = $1,483/mth

Split 1: 2.08%, P&I 2 Years Fixed, $1,329 per month Split 2: 2.89%, P&I Variable, $154 per month

|

Funds Required | Total Funds Required = $50,500

Deposit 10% = $48,000 Stamp Duty = $295 (Transfer fees) Solicitor = $2,500 | Total Funds Required = $60,795

Deposit 13.04% = $58,000 Stamp Duty = $295 Solicitor = $2,500 |

Stepping Stones

I’ll leave this section for now. Once I understand a bit more about owner occupier loans after speaking to my mortgage broker, then I will update this section J.

Parents repayment

On a side note, I would like to calculate how much I would need to repay my parents on a monthly basis given I were to borrow money from them for my purchase.

Let’s create the following hypothetical situations with:

Amount borrowed = $60k

Interest Rate = 3%

Payback time = 12 years

I am also assuming that since the money I am borrowing is coming from their offset acc for their investment property, they will be able claim to more tax on their investment debt, resulting in more money they can claim back, which I will deduct from what I owe them. Also note that these calculations are very rough – they are happy for me to pay no interest at all however I think the best that I can do is to pay at least 3% interest back for borrowing the money out of their offset account. Here are my rough repayment estimates:

Amount Borrowed Option #1 = $60,000 | Amount Borrowed Option #2 = $90,000 |

Gross paid (P&I) = $71,521

Gross interest paid = $11,521 Minus tax deduction = -$11,521*(0.3) Minus tax deduction = -$3456.3

Net interest paid = $8064.7

Net paid (P&I) – $68064.7

Monthly Repayments = $102,096.7/(12*12) Monthly Repayments ~=$472/mth

| Gross paid (P&I) = $107,281

Gross interest paid = $17,281 Minus tax deduction = -$17,281*(0.3) Minus tax deduction = -$5184.3

Net interest paid = $12096.7

Net paid (P&I) – $102,096.7

Monthly Repayments = $102,096.7/(12*12) Monthly Repayments ~=$710/mth

|

It definitely looks like going interest only on my loans would be most beneficial if I am having these repayments too to think about.

Next steps

When I speak to my mortgage broker next, I would like to ask them the following

· Is my understanding of financing (from diagram of my ‘stepping stones’) correct? (i.e. stuff like needing 20% deposit to have the ability to draw equity, and also 20% vs 12% deposit argument/justifications?)

· Is my understanding of the first home owners scheme and the ‘six-year rule’ correct?

· How does drawing equity from the property work?

· If I do move to QLD for PPOR purchase to take advantage of stamp duty concession and the 6-year rule, how long till I’m able to refinance to IO? Is this feasible?

· Are there any flaws with my approach/ideas?

· Are there any other factors which I am missing or should take into consideration?