In the whole world of passive investing with index funds and ETFs, Vanguard has been one of the main talks of the town with their low cost index funds. Then the next question became: How can I obtain Vanguard ETFs?

Vanguard ETFs are available for purchase on the ASX which means that you can get them through any brokerage firm.

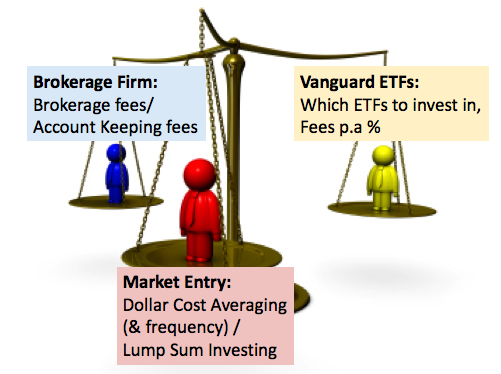

So I thought cool! Yep – let’s go with the Vanguard brokerage firm to get Vanguard ETFs– that seems to make sense to ‘buy from the source’ right? haha. But unfortunately there’s a lot of factors that goes into this plan. When delving more into detail on how to execute this strategy, I found that it seemed to ultimately lead to the following balancing act between:

· Brokerage firm

· Availability of Vanguard ETFs

· Market entry strategy

In the end, I had the decision to choose between Vanguard’s brokerage firm and SelfWealth.

I’ve summarised the interdependence of these factors in the following table:

| Brokerage: Vanguard | Brokerage: SelfWealth |

Vanguard ETFs | – Availability of Vanguard ETFs limited to only Australian domiciled ETFs. So disadvantages are is that you are missing out on the other very popular LOW COST Vanguard ETFs such as VTS (Vanguard Total US Market Share) with Annual management fee/Management Expanse Ratio (MER) of 0.03%. | – All Vanguard ETFs are available |

Market Entry Style | – Either Dollar Cost Averaging (DCA) or Lump Sum Investing (LSI) is suitable since $0 brokerage fee. Advantage is you can do very frequent DCA with no trading fee. | – Cannot do frequent DCA as there are trading fees. |

My previous investment strategy:

· Brokerage: Vanguard

Logic: No brokerage fee per trade so I’ll stick with this platform.

· Market Entry Style: DCA

Logic: Spreads risk over time

· Vanguard ETFs: Only those available through Vanguard’s brokerage firm

My new investment strategy:

· Brokerage: SelfWealth

Logic: Access to all other Vanguard ETFs. SelfWealth’s $0 account keeping fee w/ $9.95 per trade will be better than Vanguard’s 0.2% account keeping fee w/ $0 per trade. I will punch in the numbers to show how I arrived to this conclusion.

· Market Entry Style: LSI (Lump Sum Investing)

Logic: Article by Vanguard; “Dollar Cost Averaging just means taking risk later”. Mention also my current situation, not much to invest, probably only a year’s worth of savings. Also, what I think of frequency of investments to maximise returns and minimise fees.

· Vanguard ETFs: As mentioned, going with SelfWealth will give me access to ALL Vanguard ETFs. Two in particular I would live to invest in which aren’t available through Vanguard’s brokerage but available in SelfWealth are: VTS and VEU.

Market Entry Style (cont.)

So one of my initial dilemmas was around the topic of how to enter the market initially when you have decent amount of money saved up, and this lead to the two concepts: Dollar Cost Averaging (DCA) and Lump Sum Investing (LSI).

I realised that this dilemma is usually a lot more applicable to people who have a significant amount of cash (100k+) saved and are only just getting into investing. I only have around one year’s worth of savings (~20k) which I’m willing to invest so far, so it isn’t too much of a big deal for me – but it still is an important question.

Vanguard completed an exhaustive research paper on the performance of DCA vs LSI, which can be seen here in the link below.

A part of the executive summary is as follows:

“In this paper, we compare the historical performance of dollar-cost averaging (DCA) with lump-sum investing (LSI) across three markets: the United States, the United Kingdom, and Australia. On average, we find that an LSI approach has outperformed a DCA approach approximately two-thirds of the time, even when results are adjusted for the higher volatility of a stock/bond portfolio versus cash investments. This finding is consistent with the fact that the returns of stocks and bonds exceeded that of cash over our study period in each of these markets.

We conclude that if an investor expects such trends to continue, is satisfied with his or her target asset allocation, and is comfortable with the risk/return characteristics of each strategy, the prudent action is investing the lump sum immediately to gain exposure to the markets as soon as possible. But if the investor is primarily concerned with minimizing downside risk and potential feelings of regret (resulting from lump-sum investing immediately before a market downturn), then DCA may be of use. Of course, any emotionally based concerns should be weighed carefully against both (1) the lower expected long-run returns of cash compared with stocks and bonds, and (2) the fact that delaying investment is itself a form of market-timing, something few investors succeed at.”

I’ve also found different resources in support of preferencing LSI over DCA, which can be seen in this cool gif below:

So from the image above it can be seen that initially, DCA outperforms the lump sum investment significantly during periods of high volatility in the market/ where the market is experiencing a crash, in the short term. Take a look at the year 2000 dot com bubble crash/ 2008 GFC on the graph and you can see that the DCA performance far outweighs LSI during the early months. But remember, investing is a long-term game. As time goes on, the % outperformance of the DCA goes down over time.

So, with this information in mind, what I’ve learnt mainly from this is that it pays to get invested early. So this got me thinking: “If I LSI my first years’ worth of disposable savings into my investments, then how often should I invest after that?”

This is a not so straight forward question, because while I do want to get invested ASAP with every monthly pay, there’s a $9.95 brokerage fee associated with each investment purchase, which may potentially minimise my returns if I invest to frequently.

So, the grand question on my mind is:

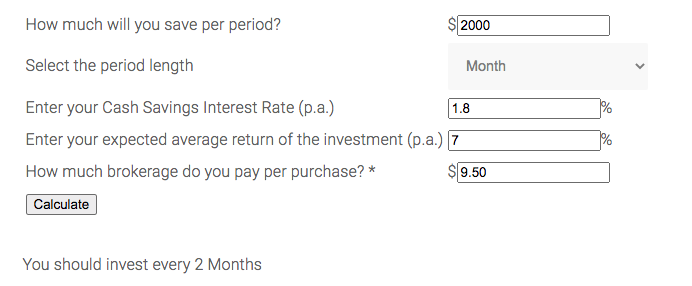

What is the OPTIMAL frequency of investments to MAXIMISE my returns, taking into consideration the following factors:

· $2,000 invested each month

· 7% return on the stock market (hypothetical)

· 1.8% return on my high interest saving account

· $9.95 per brokerage fee

Luckily, some legend online was able to make a calculator to give us this optimal investment frequency number given the above inputs. The results of the calculator shows that I should invest every 2 months.

Ok awesome, this is cool. Now one other thing I need to also consider is my asset allocation.

So I will most likely be adopting an asset allocation similar to Aussiefirebug:

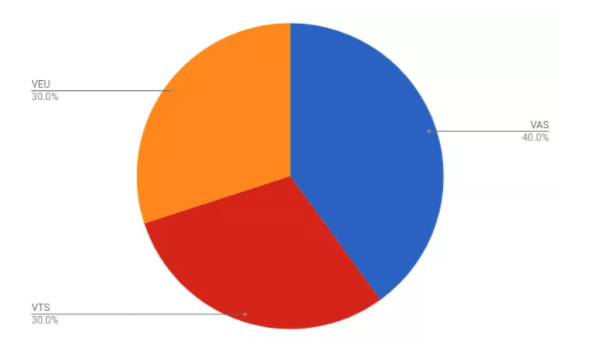

· VAS Vanguard Australian Shares Index ETF (MER 0.10%) – 40% Allocation

· VEU Vanguard All-World ex-US Shares Index ETF (MER 0.08%) – 30% Allocation

· VTS Vanguard U.S. Total Market Shares Index ETF (MER 0.03%) – 30% Allocation

This allocation shows the ideal percentages of each ETF I should be holding in my portfolio. So here’s my plan of investing. So to clarify over the span of 6 months I will be investing $10,000. This is how I will invest the money:

· $3000 into VEU

· $3000 into VTS

· $4000 into VAS

And this cycle will continue so I maintain my portfolio balance approximately at this ratio.

Conclusion

From this post we were able to explore all the factors which I came across when trying to plan out:

· Which brokerage firm I wanted to go with

· Which Vanguard ETFs I would like to purchase

· Market entry strategy I would like to adopt

These factors were all interdependent and there was a lot of things to cover and understand before making a sound decision on a plan I would like to adopt. I would always like to fully understand the plan and do my own due diligence, especially before rolling out something I am likely to follow over the long term over a lot of years.

When exploring the market entry factors I was once again met with the idea of how important it is to ‘punch in the numbers’ and actually understand what I am dealing with, and find out the optimal way of approaching things.

In my next post, I will explore AussieFirebug’s asset allocation list and try to make sense of it, try to understand it fully, and see if there are any changes I would like to make or if I will roll out the same strategy.

Thanks for reading and as always – happy investing!