I’ve made some dot point on some of the main ideas Robert has explored in the first couple chapters in the book, and will elaborate on my perspective on some of the quotes.

- “The poor and the middle class work for money. The rich have money work for them”.

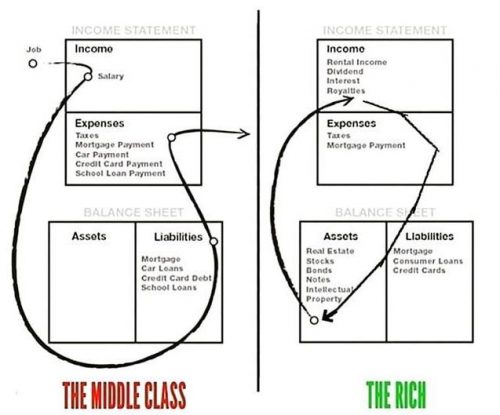

This is an idea which i’ve explored in my “BEGINNER’S GUIDE #2” blog post in the finance section. The following image is an income statement difference between the poor and the rich:

In the blog post I demonstrate how having an investment of $1,000,000 growing at 4% p.a. is enough to allow you to retire comfortably with $40,000 a year (from the interest gained from this investment) and maintain your nest egg of approx. $1million. This is a prime example of having money work for you.

- “The house is not an asset” – This was a bit difficult to understand at first. If I were to put myself in the shoes of Robert Kiyosaki, and say he and a middle class person had 100k, and they both had the goal to get a house. How do we both go about doing that? Robert would use that money to buy income producing assets to generate enough money from those assets to then buy the house. A middle class person such as me would most likely think to get into a mortgage and in doing so potentially lose the leverage of using money for buying income producing assets.

However, I think that depending on the housing market and the property you are able to purchase, then perhaps the long term capital gains of this house may be a better investment in the long run. I don’t know too much about this yet, and I would like to thoroughly explore all the factors involved in buying a property, since the only perspective I have now is Robert’s.

Mastering your emotions

- The FI plan of index investing will see a lot of turbulent times in the stock market – for instance 08 GFC, I know a lot of people would’ve panicked and sold but truth is if you had a solid understanding of the market, had your emotions and psychology in place, you would have been able to ride it out. Now of course, I don’t know what it’s actually like to be in that situation and I am just basing this off what I have read, but I can learn from this and apply this knowledge in my financial journey.

- An example person I watched a video of even had a letter to himself of a plan to follow if the market does [temporarily] crash; a letter to himself of what to do, what to think, and stuff like that to calm himself down. This solid frame of mind, a ruleset call it, this self-imposed rigidity in state of mind and thought, has been echoed in all investment book (Intelligent Investor by Benjamin Graham & Tony Robbins MONEY – Master the Game)

- I’ve been burnt before with allowing my emotions run my decisions. An example would be ‘hopping on the bandwagon’ and purchasing ‘hot stocks’ when things are rising, instead of having a system in place for properly analysing the stock worth and my understanding of the company.

· Seeing what others miss

o Keep using your brain, work for free, and soon your mind will show you ways of making money far beyond what I could ever pay you. You will see things that other people never see. Most people never get to see these opportunities because they’re looking for money and security, and that’s all they get. The moment you see one opportunity, you’ll see them for the rest of your life

o I think this quote really resonates with me because when I have been broke and jobless during uni, I would think of new ways to look for money – such as buying and selling cars. I think that maintaining this level of thinking, to constantly cultivate the mind to search for new ideas, is what Robert is alluding to here. I feel like I, in a sense, have an adequate level of competence to “see what others miss” when browsing cars on gumtree to resell – However, I need to develop to competence also to “see what others miss” perhaps in other markets such as the property market.