This post aims to explore some of my personal perspective changes with regards to finance, and how the ‘FIRE’ movement has influenced my plan to achieve financial independence.

Old perspectives

Throughout my life I’ve generally been somewhat ok with having a plan with regards to my exercise, diet, and my studies. However, one area where I have always lacked and shied heavily away from is my personal finances, and also my financial literacy.

I think this is because I’ve bought into the mainstream story of what the typical life would look like, which is finding a career path in your early 20s, and working for the next 45 years of your life until you are retired.

I had a perception that this was the life blueprint, and accepted that this was inevitably the way things were. This narrowed my mindset and outlook on finances – it made me think that this way of life is out of my control, and there’s nothing I can do about it, then why even bother with personal finances/financial literacy if I’d still have to work till I’m 65?

A shift in perspective

It can be quite inspirational getting to view life through an angle you haven’t seen before. For me, reading ‘Rich Dad Poor Dad’ was my first step in opening my mind to the idea of financial freedom – it made me realise that the narrow-minded perspective I had previously had on finance was all due to my own limiting beliefs of what I thought possible. I learnt that everyone actually has control of their own financial future through financial literacy.

Goals

With this new perspective, I want to set a financial goal to strive for. I’ll just set my goal to financial independence. Financial Independence when you have enough money/income from your assets (such as capital gains and dividend income from investments) to live the rest of your life without having to work the 9-5.

The FIRE movement

FIRE stands for Financial Independence Retire Early. FIRE is a lifestyle movement where people orient their financial goals in a way which leads to Financial Independence as soon as they can, with the goal of having the option to retire early. So how can FIRE be accomplished? A popular avenue through which people adopt to achieve FIRE is through index investing. (Please refer to my blog post: “BEGINNER’S GUIDE #1 – Getting started with Investing for some more information on index investing.)

The 4% Rule

The 4% Rule is one of the most popular ‘rules of thumb’ in the science to retirement. The 4% Rule is basically the safe withdrawal amount you can take out of your savings/investments each year without really affecting your capital gains/dividends on your investments. So what does that mean?

As you may have recalled in my ‘BEGINNER’S GUIDE #1’ post, the US stock market returns have historically been 7% p.a. Let’s say inflation runs at a rate of 3% per year, so your real returns are actually 4%.

So how much money would you need to have save up to retire? You will first need a rough idea of your yearly expenses. For example, let’s say your yearly expenses were $40,000 per year. To retire:

Money req. to retire = Yearly expenses / 4%

Money req. to retire = 40,000 / 4%

Money invested req. to retire = $1,000,000

To clarify, if you were to retire living off $40,000 per year, you will be able to take that out of your investments, and over the year your money would reach almost the same amount.

So with $1 million invested, with a 4% growth rate:

$1,000,000 * 1.04% = $1,040,000

Taking out the $40,000 to use as your living expenses you end up with

$1,040,000 – $40,000 = $1,000,000

Then the subsequent year your million would’ve grown by $40,000 again, and so on and so on.

This is an oversimplified version of course, as there are many other factors to be included such as dividend payments and fluctuations of stock market return (which can be good or bad). But what this example serves to show is the power of having your money work for you.

“The rich don’t work for money – they have money work for them” – Robert Kiyosaki

What if the market crashes?

Nothing is certain, and this is most likely a possibility. The FIRE movement isn’t as straightforward as punching in the numbers, saving and investing enough money, then you’re 100% set to retire. It will definitely require some adjustments and compromise to when the markets aren’t performing so well. But that is just a little roadbump. You can decrease your spending amount, or worst that could happen is that you temporarily pick up work (perhaps even part time) for that additional cash during periods of poor stock market returns.

Why do I like FIRE?

I like how people in the FIRE movement are taking action and control over their own financial future. I do acknowledge that a lot of variables to take into consideration, and a lot of external factors will shake the trajectory towards this goal.

However, I think it is good to set a goal to aim for, because without a goal and a clear idea of what to aim for, then I then I would be oblivious about which direction I’m heading towards for my financial future.

Creating a game plan

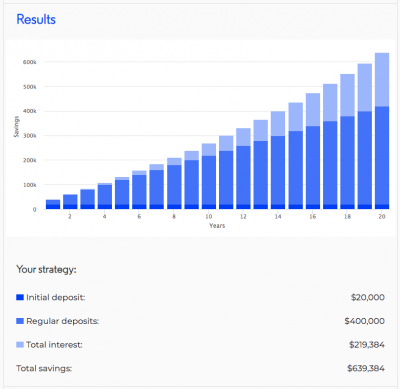

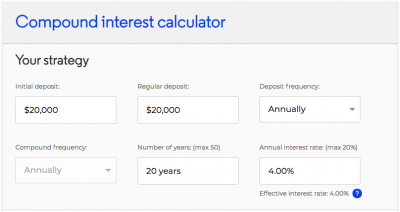

To create a game plan, I will need to work from the bottom-up. I need to figure out what a magic number is I’ll need for retirement and try to figure out how much I need to save from my paycheck each month. I will set a hypotherical scenario of living frugally off $25,000 per year.

Yearly expenses = $25,000

Money req. to retire = Yearly expenses / 4%

Money req. to retire = $25,000 / 4%

Money req. to retire = $625,000

If I am able to save $20,000 per year, then I will be able to retire at age 45. That’s 20 years off the original retirement age!

Of course as I have already mentioned there are a lot of factors which can change, and there will definitely be a lot of adjusting needed to achieve a goal such as this. However I think it’s good to always keep the end in mind, and familiarise myself with the money numbers related to my long term plan.

How the lessons taught in Rich Dad Poor Dad tie into this

· “Pay yourself first”

I think this ties in with how success books always talk about beginning with the end in mind; clarifying your end goal then breaking it down enough until you know a rough idea of the steps needed to reach your goal.

We all have taxes, bills and other financial obligations in our life. Coming up with a defined number of how much I need to save each year helps me pay myself first and invest, then pay for my other financial obligations, then the remaining can be my spending money.

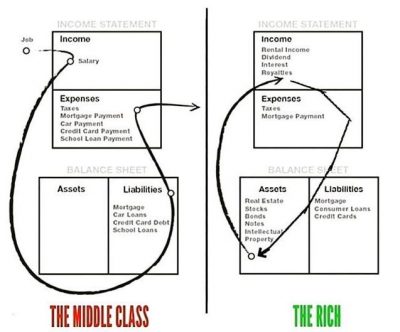

· Aiming to achieve the income statement of the rich

This is why the rich are getting richer. As you can see from the above example, if you build your asset column enough, you will reach a stage where the ‘money is working for you’ to the point where it will be sustainable to live off the income generated from your assets (in this case, capital gains + dividends from the index funds).

The middle class do not build their asset column and only rely on employment to pay the bills. The mindset of the rich is to build your asset column and to make your money work for you.

Conclusion

I’ve always dreamt of a way of how cool it would be to retire early and get to more time travelling, exploring and doing stuff I love. But it always seemed quite out of reach, and taking steps forward towards this goal would often ‘paralyse me’. I wouldn’t know where to begin, so I would take no action.

But defining an actual number, and working backwards to see what is actually required for this to be achieved makes the big, almost seemingly impossible goal seem like it is well within reach.

For my next blog topic in this series I am hoping to get into the details of creating a Vanguard account, and which Vanguard ETFs I will be choosing to invest in for the long run.

Happy investing!