***July 5th Update***: I have done some further research and have realised that I think I have found an alternative route I would like to follow with regards to passive investing with Vanguard. I will make a post on it soon once I have it sorted. I will keep this blog post up though, as my train of thought with this method can still serve to give a useful insight. I will also make an attempt to elaborate on my decision to deviate from this plan and move on with the new.

My passive investing aim

My aim with investing with Vanguard is to set in place a passive investment plan to commit to. There are some good reasons for using Vanguard for passive investing such as:

· Vanguard offers index funds/ETFs which gives wide exposure to the different markets

· No brokerage fees with transactions – only fee is 0.2% account fee annually. The no brokerage fee for transactions is particularly handy since I plan to invest in multiple ETFs and plan to dollar cost average – which can be expensive with brokerage transaction fees. Also, this is of little effect to me currently as my portfolio size is relatively small still.

The Ideal Investing Plan

The investing plan I plan to mimic is called the “three-fund portfolio”, which is popularised for US investors, which is a basic asset allocation including:

· Domestic stock ‘total market’ index fund

· International stock ‘total market’ index fund

· Bond ‘total market’ index fund

What’s attractive about this investment plan is that it is very simple to implement, and quite versatile in adjusting for your risk tolerance – e.g. controlling your bond/stock ratio. I plan to mimic this portfolio using Vanguard ETFs.

Simple Investing for Aussie Investors

Listed above is the simplified portfolio consisting of 3 ETFs. For us Aussie investors, we can implement the below 5 ETFs to mimic the simple portfolio:

Domestic Stock:

· VAS – Vanguard Australian Shares Index ETF – This ETF tracks the return of the ASX 300. This index provides exposure to Australia’s large, mid and small-cap equities.

International Stock:

· VGS –Vanguard MSCI International Index Shares ETF – This tracks the return of the world international shares market (excluding Australia). This ETF provides exposure to many of the world’s largest companies in the major developed countries, such as the US, Japan, UK, etc.

· VGAD – Vanguard MSCI International Index Shares ETF (hedged) – This is the exact same index tracked by VGS, however it is hedged to AUD. A hedged investment is good because it will offset the effect of currency fluctuations, which is achieved by the fund manager, theoretically. An example of where this would be beneficial is where the you purchase some American investments, and then the AUD appreciates – this means selling your American stocks would result in a smaller return since the Australian dollar went up. It is good to have a mix of both VGS and VGAD to in a sense ‘diversify’ and spread out your risk of the effects of currency fluctuations.

· VGE – Emerging Markets – These are beneficial to add into your portfolio because the performance of emerging markets generally have low correlation with the market performance with the rest of the world, thus making it a good choice to add diversification into your portfolio.

Bonds:

· VGB – Australian Government Bond Index ETF – Bonds are always added to the portfolio for safety. My investment amount in bonds would ultimately reflect my risk tolerance – For instance”

o 90% Stock, 10% Bonds – High Growth, High Risk

o 70% Stock, 30% Bonds – Medium Growth, Medium RISK

o 50% Stock, 50% Bonds – ‘Balanced Portfolio’

o 30% Stock, 70% Bonds – Small Growth, Small Risk

Since I am quite young and will be investing in the long term, I will be choosing the more aggressive investment style of 90% stocks/ 10% bonds, since I have years ahead of me to recover if the market decides to crash.

Allocations

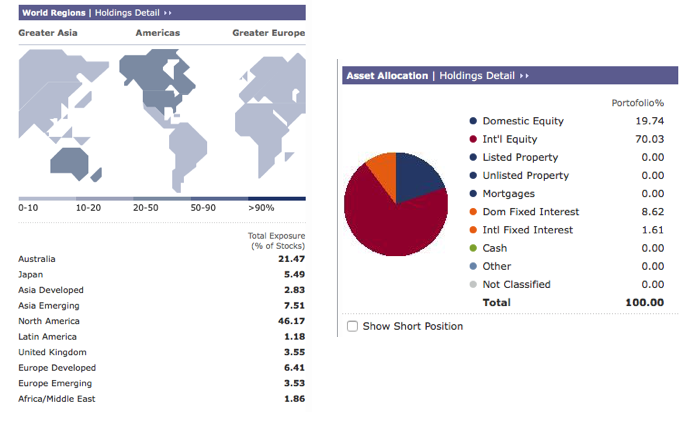

I found the following allocation implemented by another fellow investor who similarly is in a position to adopt an aggressive investing position. The allocation is as follows:

· VGS – 40%

· VGAD – 20%

· VGE – 10%

· VAS – 20%

· VAF – 10%

I made a Morningstar trial account and mimicked the above asset allocation, then checked out the data analysis the service provided:

Allocation – Au vs World:

I’m happy with the equity allocation 20(Au)/80(World) of this portfolio. A pitfall which investors may fall into is “home-bias” where investors may tend to invest too much in their home country although it may only make up a small part of the global market. (This may not be too applicable to US investors since their domestic market has a strong global influence).

VGS and VGAD:

Having more unhedged international indexes (VGS – 40%) as opposed to hedged international indexes (VGAD – 20%) places less emphasis on the success of the Aussie market to make a profit, which sort of ties in with the idea of reducing ‘home-bias’. As mentioned, if AUD currency isn’t doing so well, then VGS will capture the profitable benefits from this. However, it’s still healthy to have some form of safety and diversification, which is why still having some VGAD is good.

Execution

So when I began my Vanguard investing I had no particular goal in mind, and I didn’t really know what I was doing. I just bought a tonne of VAS – 43 units to be exact.

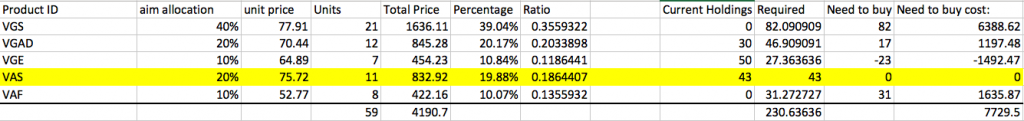

So what I’ve done is calculate how much of all the other ETFs I would need to purchase to balance out my portfolio to my desired asset allocation.

So I would need around $7.8k to get to the portfolio allocation I would like, which is ok – I can just slowly purchase/dollar cost average my way to the portfolio balance I’m aiming for, which may take a couple months, depending on how much I decide to invest, which is something I would need to decide.

My excel sheet isn’t the prettiest, it was just something I quickly made up to get an idea of where I stand.

Conclusion

It’s basically smooth sailing from here since I now have a passive investing plan. Once I reach my goal of a balanced portfolio, I can just come up with a simple plan on how I will move forward with dollar cost averaging into my portfolio. What I would need to consider and determine are:

– How often I will decide to invest

– How much I will invest

Additionally, I will use a spreadsheet to do portfolio rebalancing maybe every 6 months-a year. I don’t know too much about how often I should do this, but it should be relatively simple to do.

Ultimately it does seem like a bit of work doing my investments this way. However I think with time and research, the initial time spent to understand and come up with a plan outweighs putting your money into a mutual fund where you’ll be hit with much larger fees with the active management, and also not have too much of a benefit or guarantee of better future returns over index funds – (For more information on this idea, a good source I would recommend is Tony Robins – Unshakeable and Tony Robins – MONEY – Master the game).

Thanks for reading!